China’s GDP: the economy grew by 2.9% in Q4, by 3% in 2022 — the second lowest since 1976.

Let’s see how Chinese companies are trading in the Asian session. Top 20 stocks:

1. Alibaba +0,09%

2. JDcom -3,53%

3. EDU -1,18%

4. Li Auto -0,99%

5. XPeng -2,73%

6. NIO -1,18%

7. BYD -2,47%

8. Baidu -3,05%

9. Tencent -0,92%

10. Bilibili -1,7%

11. NetEase -1,94%

12. Autohome -0,79%

13. SMIC +2,42%

14. Xiaomi -2,02%

15. PetroChina -0,52%

16. China Life -3,49%

17. Baozun -2,4%

18. China Petroleum & Chemical 0%

19. Meituan -1,27%

20. Lenovo -0,99%

Compared with the closing of trading in the US session on Friday, Chinese shares in Hong Kong are falling by 2-4%, and compared with yesterday’s trading, a drop of 1-3%. Indices and ETFs for China in the range from -0.16 to -1.31%.

🇺🇸 🇨🇳 This week, Chinese Vice Premier Liu will meet with US Treasury Secretary Yellen. Washington says the goal is to “deepen communication,” while Beijing called the meeting “policy coordination.”

Chinese Deputy Foreign Minister Xie Feng urges the United States not to use technology as a weapon. Xie, who is widely considered China’s next ambassador to the United States, calls for cooperation, not confrontation.

📊 China’s GDP: the economy grew by 2.9% in Q4, by 3% in 2022 — the second lowest since 1976.

Due to the negative statistics released, Chinese stocks are falling today.

CHINA’S GDP: GROWTH RATES IN 2022m ARE AMONG THE SLOWEST IN RECENT YEARS

The Chinese economy grew by 2.9% YoY in 4Q22, down from 3.9% YoY growth in 3Q22, but above market estimates of 1.8% growth. Quarterly dynamics: 0% kvq vs 3.9% kvq. For the whole of 2022, the economy increased by 3.0% YoY (8.1% in 2021), noticeably falling short of the official target of 5.5%. This is one of the slowest annual rates in recent decades, the worst was in 2020, when China’s GDP added only 2.2%.

The Chinese State Bureau notes that “… the economic recovery is not sustainable, since the global situation is still difficult and difficult, and internal pressure in the form of a reduction in demand, supply shock and weakening expectations still persists …”. The Chinese authorities plan to announce the GDP growth target for 2023 in March

The Netherlands will not accept new US restrictions on the export of chip manufacturing technologies to China and is consulting with European and Asian allies. “We have been talking to the Americans for a long time, but in October they came up with new rules. It cannot be said that we have been under pressure for two years and now we have to sign along the dotted line. And we won’t,” said Dutch Trade Minister Lije Schreinemacher.

The escalation of the US-China conflict “poses a great danger” for the whole world, said Stephen Roach, former chairman of Morgan Stanley Asia. The US and China should restore trust and establish a secretariat in a neutral country such as Switzerland to manage their relations, because their five-year conflict is escalating and “poses a great danger” for them themselves and the world, Roach said.

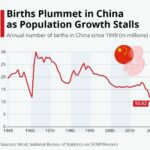

In China, the first population decline in 60 years is observed in 2022. The total population of mainland China last year was 1.4118 billion people, a decrease of 850,000 people.

CHINA’S ECONOMY IN DECEMBER: THE FIGURES ARE BETTER THAN FORECAST, BUT THE MARKET SITUATION IS STILL QUITE RESTRAINED

The Chinese State Bureau presented relatively good figures for the results of December

• Industry: 1.3% YoY vs 2.2% YoY in November; 0.2% YoY expected. All of 2022: 3.6% yy vs 3.8 yy a year earlier

• Retail sales: -1.8% yy vs -5.9% yy, expected -8.6% yy. All of 2022: -0.25% yy vs -0.09 yy a year earlier

• Investments in fixed assets: 5.1% for 11M22 (forecast 5.0%)

All three indicators came out above consensus. On January 8 of this year, China announced the lifting of anti-bullying restrictions, which hit many segments of the Chinese economy quite sensitively. Previously published statistics on foreign trade indicate a rather weak state of Chinese exports.

Volkswagen expects China’s car market to grow by 5% to 23 million units in 2023.

They say that Evergrande will offer two options for restructuring an offshore company. In one of the options, some debts will be extended to 12 years.

China Evergrande said that its auditor, PricewaterhouseCoopers (PwC), resigned due to disagreements over issues related to the audit of its financial statements for 2021.

Ryan Cohen has acquired a stake in Alibaba worth hundreds of millions of dollars and is pushing the e-commerce giant to increase and accelerate share buybacks. Previously, Cohen earned money by investing in meme shares of GameStop. Today we will translate the details.

✅ Online retail sales in China increased by 4% in 2022, the National Bureau of Statistics of China reported.

Most Chinese provinces are planning GDP growth of 5-6% in 2023. The highest figure was set in the southern Chinese province of Hainan. 4 out of 31 provinces and regions are aiming to achieve annual GDP growth above 7%, and 20 have set goals of about 6%.

Hong Kong stocks are weaker as traders leave the overheated market and China reports a slowdown in growth, while Fosun shows a downtrend.

📌 Hong Kong stocks fell from a six-month high after a government report showed that China’s economic growth slowed last quarter, giving investors an excuse to reduce their assets in an overheated market.

📌 The Hang Seng index declined 1 percent to 21,527.39 during a break in trading at noon local time. The Tech Index lost 0.6% and the Shanghai Composite Index fell 0.3%.

📌 E-commerce platform owner JD.com It lost 3% to HK$ 236.60, and search engine operator Baidu lost 2.7% to HK$ 130.70. Tencent fell 0.8% to HK$ 367.20. Shares of Macau casino operator Sands China fell 3% to HK$ 27.90, while shares of WuXi Biologics fell 5.4% to HK$ 69.90.

📌 China’s economy grew by 2.9% in the fourth quarter of last year, compared with 3.9% in the previous three months, the statistics bureau said. The agency added that the annual growth was 3% compared to 8.1% in 2021.

📌 Other government reports today showed that retail sales fell by 1.8% compared to last year after a 5.9% decline in November. Industrial production increased by 1.3% compared with an increase of 2.2% in November.

📌 Against this trend, Fosun International shares gained 2.8% to HK$ 7.34. The inland onshore division of a diversified Chinese conglomerate has received a syndicated loan of 12 billion yuan (US$1.8 billion) from eight Chinese banks, indicating that its liquidity problem has improved.

@ESG_Stock_Market