Already available! The weekly World Economic Digest (Wednesday) on 30.07.2023 presents the most significant economic events and their impact on the world economy. In this issue, we will look at the latest updates in world trade, the development of financial markets, changes in the political situation and their possible impact on international firms and investors.

In June, after mortgage rates rose to ~6.8% per annum on a thirty-year mortgage in the United States, the average mortgage payment set a new record of $2.16 thousand per month, or 51.2% of the average salary of non-management personnel.

Relative to the s/p, the payment for the first time turned out to be higher than the highs of 1989 and 2006.

USA: housing prices are rising

The S&P/Case-Shiller US house price index in May showed a third consecutive month of growth, this time by 0.7% mom (sa), the annual price drop was a modest 0.5% YoY, after a 44% increase since 2019, prices have so far only moderately adjusted and that is mainly due to inflation. In real terms, the dynamics of prices are worse, but here, too, price growth has been outpacing inflation for three months in a row. In the 20 largest cities, prices increased by 1% mom, although they decreased by 1.7% YoY.

Moreover, according to Zillow, prices continued to rise in June, and nominal prices were able to rise above the highs of 2022. Although after the rise in mortgage rates, the demand for houses shrank, but the supply also decreased. Rent, although it has slowed down growth, has reached new highs and is adding further.

U.S. consumer confidence rose in July. An interesting point is that although more than 70% of American households believe a recession is likely, most of them personally expect the situation to improve.

PS: The Fed will raise the rate by 25 bp today, and the signal may be tougher than the market expects.

The Fed, as expected, raised the rate by 25 bps to 5.25-5.50%, the market was fully laying this decision, so there are no surprises here.

Recently, the belief in the markets that this is the last increase has started to decline a little, although it dominated. The Fed practically repeated the June statement, leaving itself the opportunity to raise the rate in the fall, but still the general tone is expected to be a little more cautious.

QT will continue at the same volumes, Powell may try to add some rigidity… but the market doesn’t really believe him.

US GDP – on government incentives and services

US GDP growth in the second quarter was 2.4% QoQ in annual terms (0.6% QoQ), annual growth was 2.6% YoY (but it should be taken into account that in the first half of 2022, GDP was declining, i.e. relatively low base). In fact, the entire growth of 2.4% is:

✔️ Consumption of services with a contribution of 0.9 pp (the one that supports inflation);

Growth of investments of companies with a contribution of 1.1 percentage points (mainly subsidized under state programs);

✔️ Growth of government spending with a contribution of 0.4 pp.;

On the one hand, the growth is certainly higher than expected, on the other hand, its structure is still largely launched state stimulus programs with a huge budget deficit and record interest costs, as well as the inflationary service sector with a fairly strong labor shortage – the number of new applications for benefits is again declining.

All this will complicate the situation for the Fed, especially if some price increases from the resource markets are added…

#USA #economy #GDP #mortgage #real estate #rate #fed #rates #inflation #crisis

China continues to convert its foreign economic activity into yuan

The total volume of China’s external payments on the current and financial account increased by $268 billion, while in dollars it decreased to $226 billion. Payments in yuan for the last 4 months have consistently exceeded payments in dollars and in general exceeded dollar payments for the first half of the year.

The total volume of receipts from foreign economic activity to China in June rose to $264 billion in yuan and amounted to $255 billion in dollars. Although here the yuan has surpassed the dollar only in the last 2 months and for half a year so far the dollar has not caught up.

The net balance of income from foreign economic activity in dollars is positive, i.e. more dollars come to China than go (in June + $28 billion). On the contrary, the balance of receipts in yuan is slightly negative (in June – $ 4 billion), i.e. gradually the number of yuan in the foreign market is growing, although extremely slowly.

Last time, the active process of internationalization of the yuan was brought down on the fly and actually stopped for 4-5 years by the crisis in the stock market, which provoked a powerful outflow of capital and the loss of $1 trillion in reserves. After that, conclusions were drawn and the Chinese are promoting the yuan through trade with strict moderation of capital flows.

#CNY #China #export #economy #fx

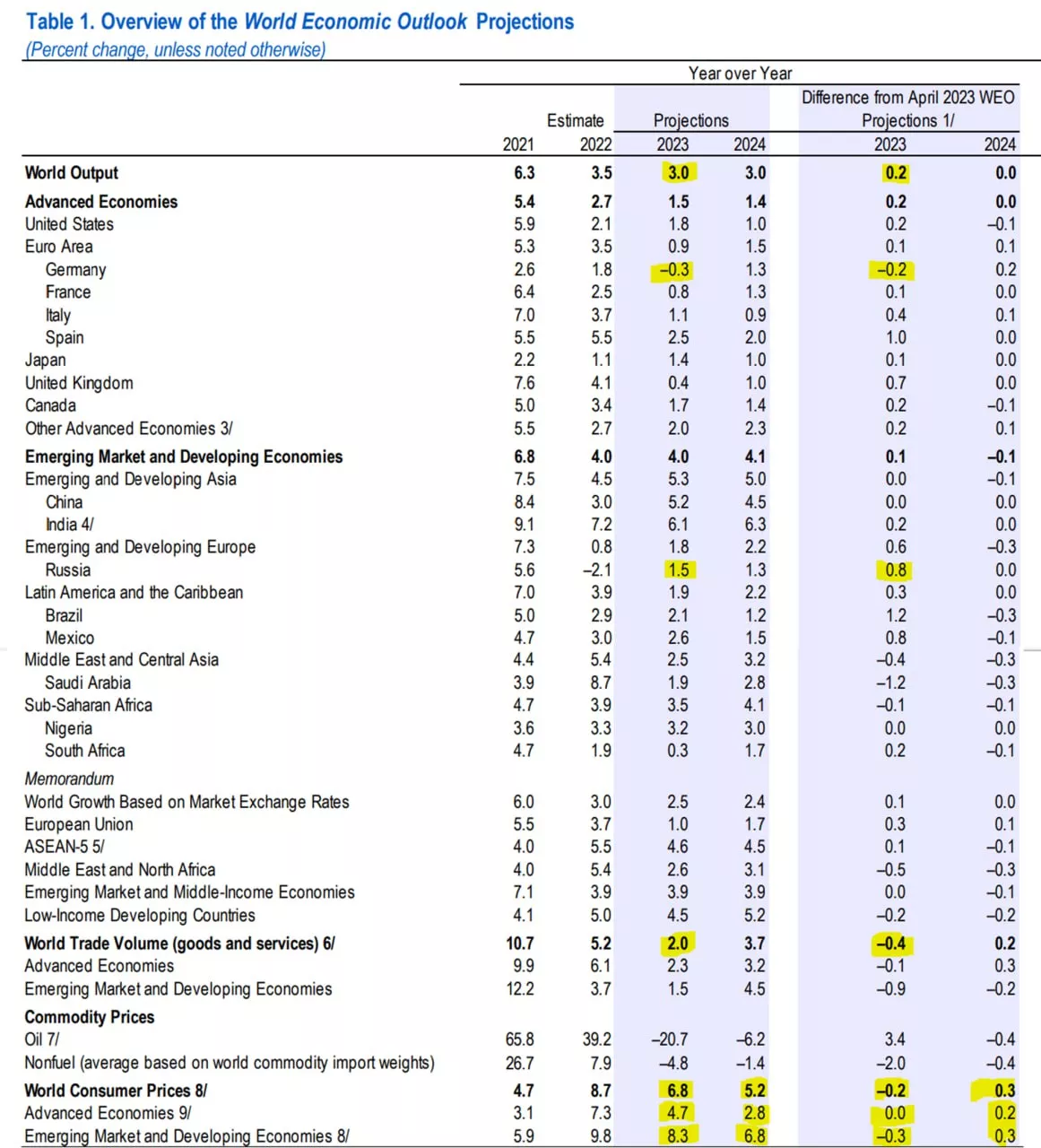

The IMF, as usual, is quite optimistic about the situation in the economy, the growth of the world economy will be 3% in 2023 and 3% in 2024, too

The only major economy that will face a recession according to the IMF is the German economy: -0.3% in 2023, but it will grow by 1.3% in 2024. But in Britain, the IMF did not find a recession. But the forecast for world trade has been lowered. There is every chance in the autumn forecast to see a downward revision.

But the forecast for inflation is 6.8%, for developed countries 4.7% for 2023 – unchanged, but it will not be possible to return to the goal in 2024 (2.8%), for developing countries 8.3% in 2023 and 6.8% in 2024.

#world #IMF #economy

The Bank of Japan has finally decided … while the truth is only on signals

The Bank of Japan left its short-term negative interest rate unchanged at -0.1%. The Central Bank kept the target yield of 10-year bonds at about 0%, but said that its ceiling of 0.5% is a guideline, not a hard limit in an attempt to make its easing program more flexible.

Although formally all the goals have remained the same, the Bank of Japan, trying to find a way out and abandon the control of the yield curve, no longer guarantees a tight retention of the yield of ten-year government bonds below 0.5%. In general, this is the first step in giving up control of the curve, Japan’s government bonds, of course, tried to sell off and the yield jumped to 0.56, the yen strengthened slightly, but the Central Bank will continue active interventions… but the market will try to attack by getting rid of JGB and trying to break the Bank of Japan.

Yesterday, the ECB predictably raised the rate by 25 bps to 4.25%, but it signals the imminent completion of this process, it is obvious that it is becoming increasingly difficult to raise, the economy is close to recession, although inflation is still significantly higher than the target. In September, an increase is still likely, but the ECB no longer gives any clear signals “everything will be determined by data”, just like the Fed.

#Japan #rates #inflation #BOJ #JPY

The IMF has improved India’s economic outlook while China’s recovery is on the wane

The International Monetary Fund on Tuesday raised its economic forecast for India this year amid a slight improvement in global growth prospects, but said China’s recovery from the pandemic has weakened.

According to the IMF’s World Economic Outlook bulletin for July, India remains the fastest-growing major economy in the world with growth of 6.1% this year, 0.2 percentage points higher than the IMF’s April forecast. The IMF expects India to account for about a sixth of total global growth this year.

The IMF said China will be the second-fastest growing major economy with a 5.2% growth rate this year, but its recovery from the COVID-19 pandemic is slowing, so the fund left its forecast unchanged.

The IMF currently forecasts that global growth will reach 3% this year, which is 0.2 percentage points higher than in April, but still below the 3.5% growth recorded in 2022.

The exchange rate of the US dollar to the Indian Rupee. Thoughts.

Perhaps for me, as an investor, the main problem of investing in India is the regular fall of the Indian rupee against the US dollar. Although from October 2022 to the present, the rupee to the dollar have been in the same place, moreover, technical indicators speak for a correction, but if you look at history, the rupee is falling all the time. When investing in India in rupees, be sure to keep in mind that with a high probability of 10-15% per year there may be a depreciation of the local currency.

@ESG_Stock_Market