COLLECTION OF THE RECESSION: HERE ARE SOME OF WALL STREET’S BEST STOCKS IN CASE OF A DOWNTURN

More and more Wall Street participants are talking about the risk of a recession, with $GS Goldman Sachs, $DBK@DE Deutsche Bank and many others pointing to a higher probability of a recession.

“Since the beginning of the year, we have seen a record level of inflation… an increase in the yield of 10-year Treasury bonds by 170 basis points, a historic increase in the Fed rate by 75 basis points to combat rising inflation, consumer and business sentiment are becoming significantly more negative.”

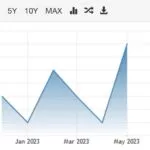

Meanwhile, the S&P 500 index has just experienced its worst first half since 1970, falling by almost 20%.

🙀 And $GS Goldman says there is more instability ahead.

🔥 👇 HERE ARE SOME OF THEIR FAVORITE WALL STREET STOCKS IF THE RECESSION BECOMES A REALITY

✅ Buy low-risk names, with a discount in utilities

✍ According to $MS Morgan Stanley, the utilities sector has already outperformed the S&P 500 by about 15% since the beginning of the year and may continue to “modestly” outperform it in the event of a weakening economy or a complete recession.

The investment bank says that in the event of a recession, low-risk stocks will outperform the market. He chose $AEP American Electric Power, $EXC Exelon and $ATO Atmos Energy as value companies with good growth potential, “low-risk characteristics” and trading at discounts.

✅ The demand for clean energy can be high

The Bank also believes that in the clean technology sector, a select group of stocks with a tailwind of profits can outperform their competitors in the near future.

🔝 It says that the highest quality names like $RUN Sunrun, $PLUG Plug Power, $AES AES and $SEDG Solaredge Technologies can continue to show strong business fundamentals during the recession.

But $MS Morgan Stanley warned that the broader clean tech sector may not outperform the market as a whole during the downturn, if history is any indication. Currently, clean technology has outperformed the S&P 500 by 12% since the beginning of the year.

✅ Pay attention to small and medium-sized capitals

📈 $BAC Bank of America says that despite the volatility in the markets, the “path to alpha” in small-cap companies remains unchanged. Alpha is a measure of investment efficiency compared to a benchmark.

In a note dated June 30, the bank named a number of shares of companies with small and medium capitalization in the $RUT Russell 2000 and Russell Midcap indices, which, according to him, historically felt best during the recession.

It took into account high—quality stocks — those that have higher profitability with stable business activity over time – and risk factors, as well as the ability of companies to return dividends to shareholders.

🔥 The “buy”-rated stocks listed on the $BAC Bank of America screen included auto parts retailer $ORLY O’Reilly Automotive, food company $HSY Hershey, medical firm SCHE Chemed Corporation and electronics and fiber optic connector manufacturer $APH Amphenol.

Industrial and technological firm $VNT Vontier, analytical firm $EXLS EXL Service and packaging company $AVY Avery Dennison were also included in the list.

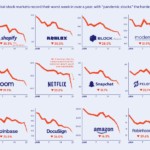

✅ Significant downside risk

🗣 $EVR Evercore ISI said that growing concerns about the economic downturn forced it to assess which stocks of technology and IT companies it covers could be best protected from the downturn.

In a note dated June 27, the consulting firm stated that, in its opinion, there remains “a significant risk of decline (on average ~ 30-40% compared to current levels) in a recession scenario.”

However, it says that stocks including $CHKP Check Point Software Technologies, $DELL Dell, $IBM IBM and $PANW Palo Alto Networks have less risk reduction potential (less than 20%).

They also noted that, looking at past results during the recession, $DELL Dell and $IBM IBM, in particular, successfully managed to protect their margins.

https://t.me/ESG_Stock_Market

@ESG_Stock_Market