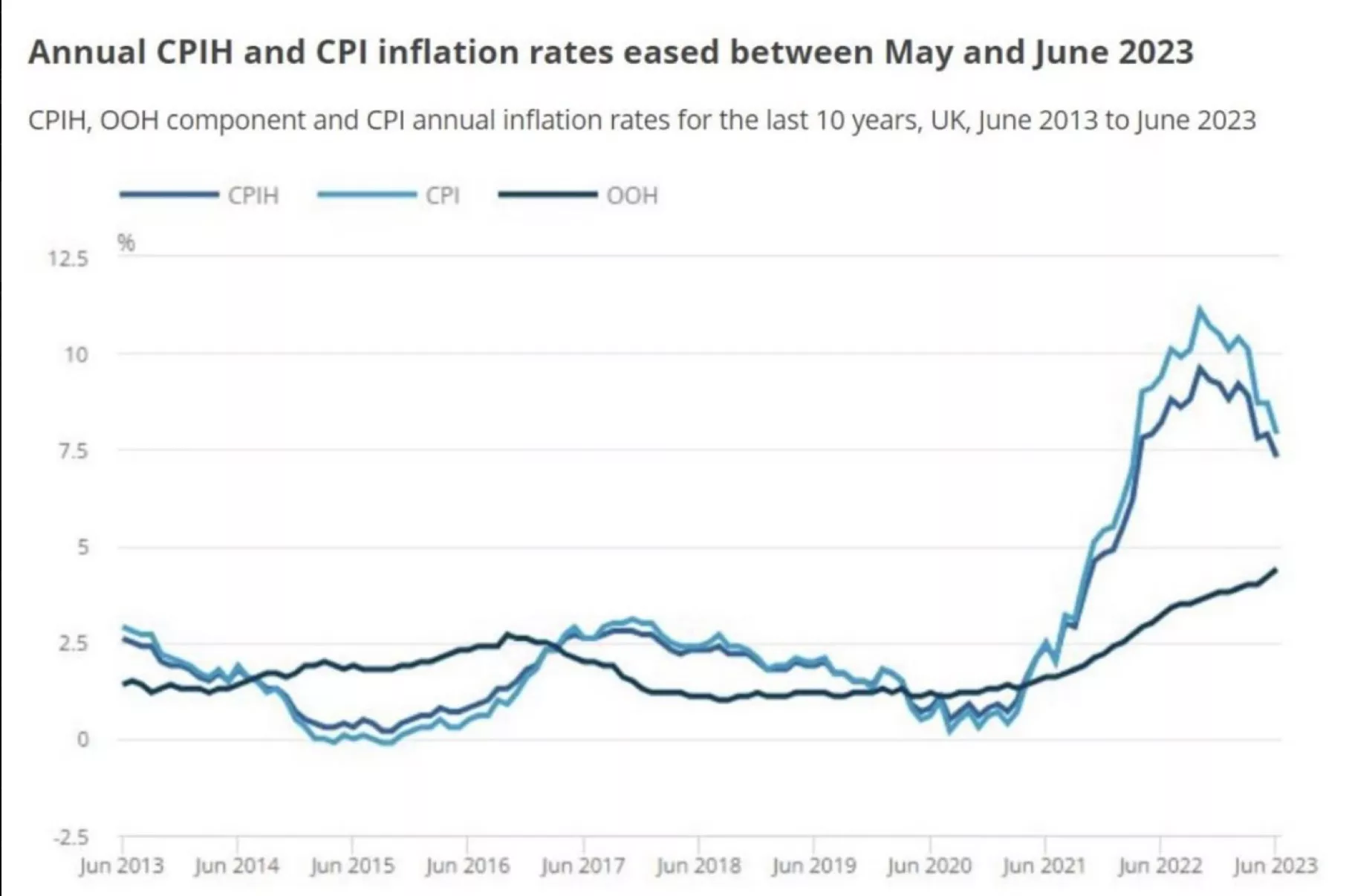

UK inflation has finally slowed down

In June, consumer price growth in the UK finally slowed by 0.1% mom and 7.9% YoY. Lower fuel prices helped (-2.7% mom and -22.7% YoY), which contributed to a general decrease in commodity prices in June by 0.2% mom, annual growth slowed to 8.5% YoY. The growth of food prices also slowed down somewhat to 0.4% mom, but the annual growth rate here remained high and amounted to 17.4% YoY. The strengthening of the pound also played a role here against the background of expectations of a rate hike by the Bank of England, since a significant part of commodity consumption is tied to imports.

With services, the current price dynamics turned out to be the same as in May +0.5% mom, although the annual growth slowed slightly to 7.2% YoY. The dynamics of salaries play an important role here, which continue to grow quite intensively so far. As a result, core inflation slowed down slightly to 0.2% mom and 6.9% YoY. Retail price growth also slowed to 0.3% mom and 10.7% YoY, but still remains extremely high.

In July, the marginal tariffs for gas and electricity should decrease, which will lead to a decrease in overall inflation, but the trend of core inflation is likely to form around ~ 6% per year. Given the significant dependence of prices on the pound exchange rate (i.e. the position of the Bank of England) and services (salaries), if the Central Bank backs up, as it likes, it can get an additional boost through the exchange rate, but the Bank of England is prone to a “twitchy” policy, therefore it is possible that it will try to soften the position.

#UK #inflation #rate #BOE

@ESG_Stock_Market