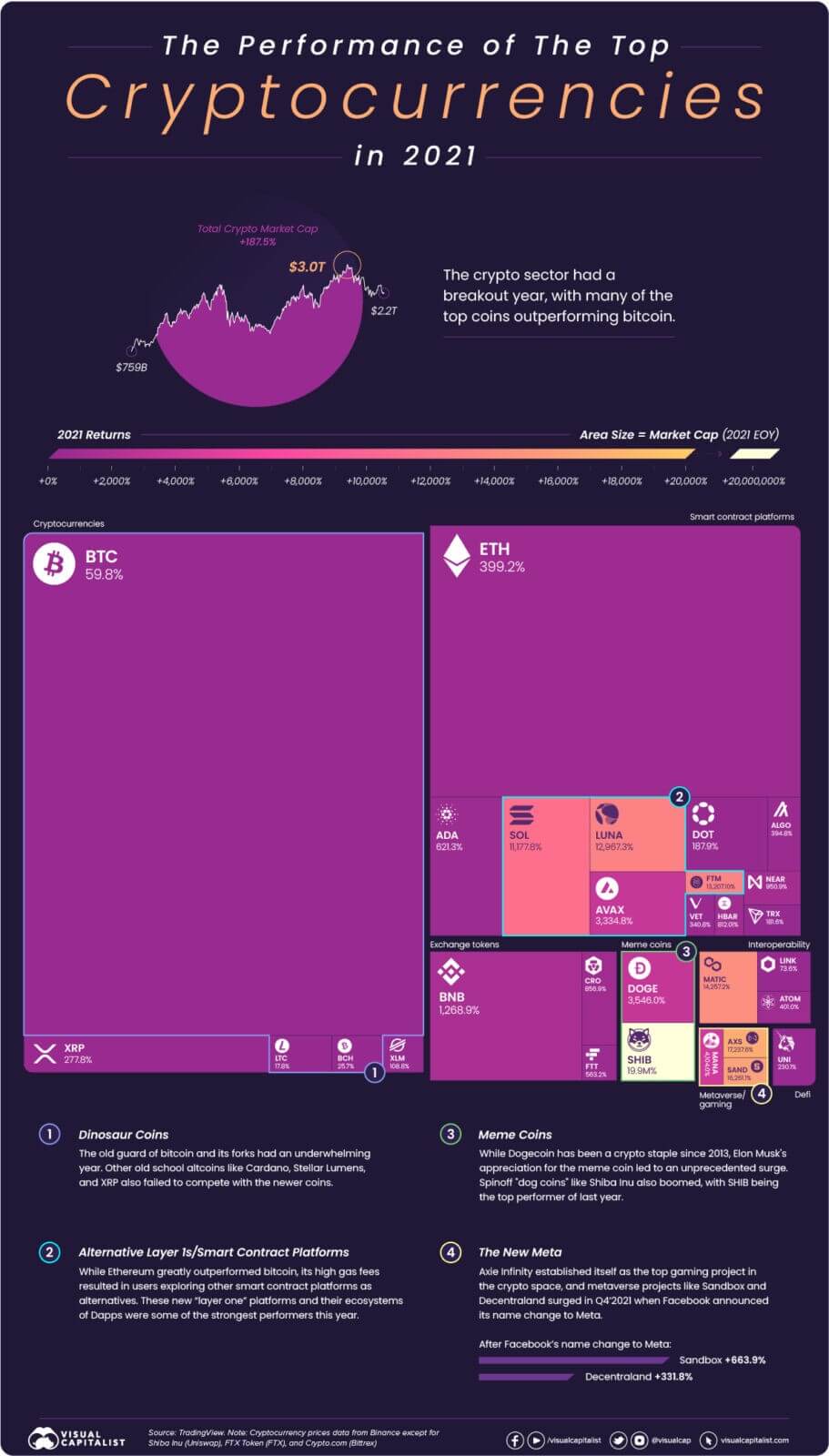

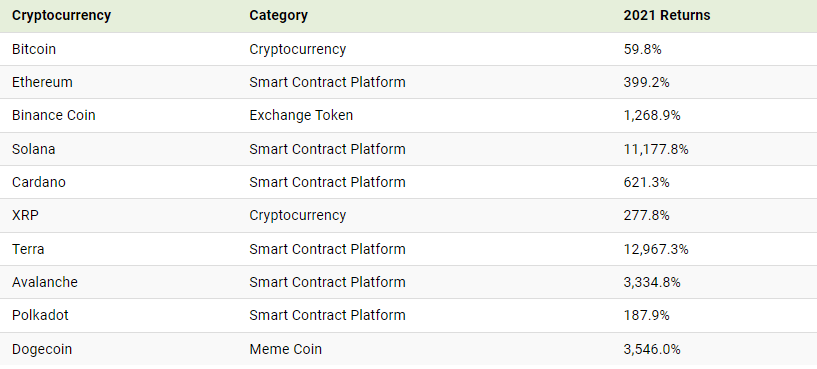

In 2021, cryptocurrency markets were booming and growing, with various sectors flourishing and largely outperforming the market leader, bitcoin.

Cryptocurrency yields. Yields of the best cryptocurrencies in 2021

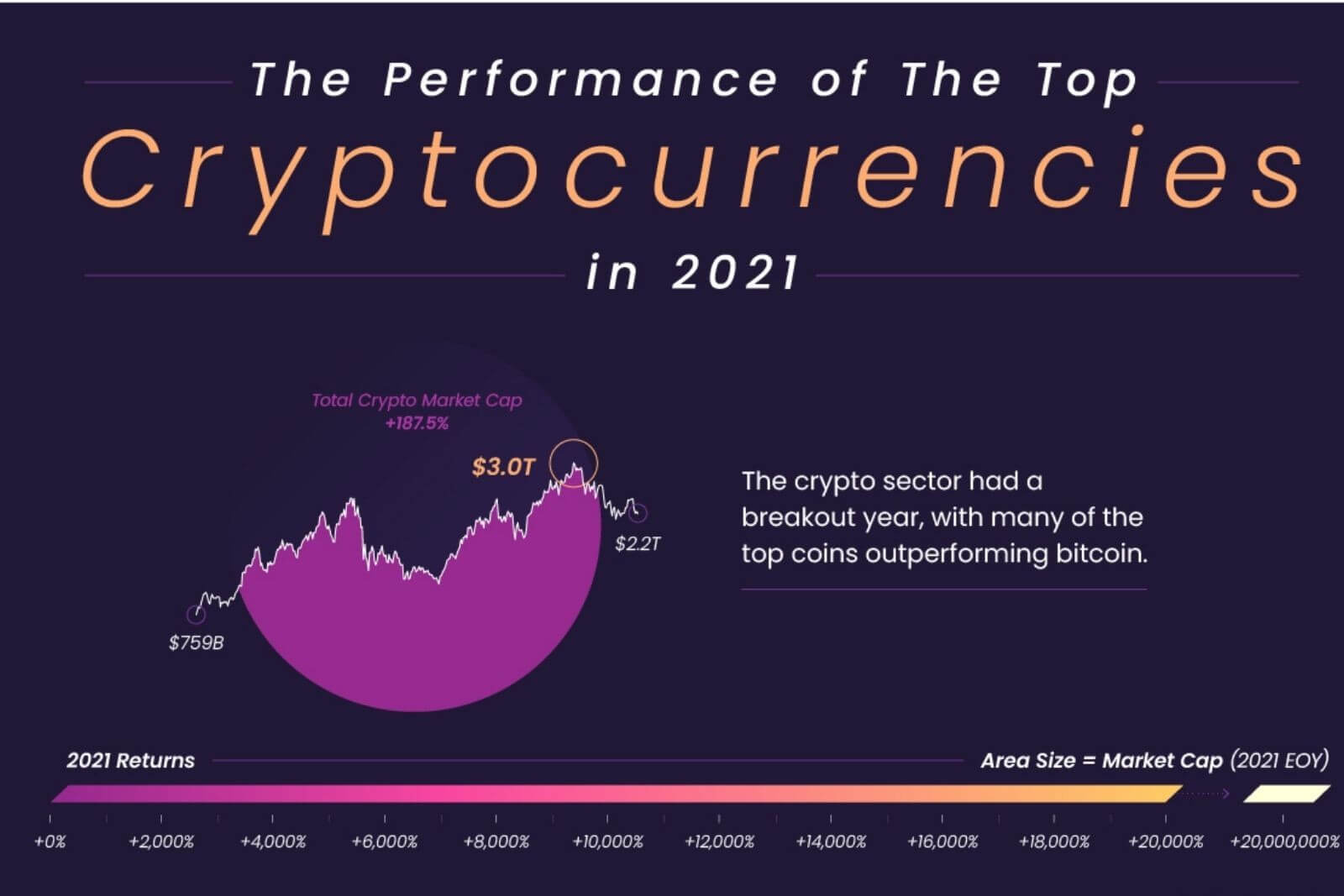

While bitcoin was only able to return 59.8% last year, the overall market capitalization of the crypto sector grew 187.5%, with many of the top coins offering four- and even five-figure return percentages.

Overview of the Crypto Market 2021

Last year was not only a breakthrough year for crypto in terms of revenue, but also a growing maturity of infrastructure and the resulting decorrelation of individual crypto-industries and coins.

The cryptocurrency infrastructure has evolved considerably, and people now have many more options for purchasing altcoins that do not require buying and using bitcoins in the process. As a result, the prices of many cryptocurrencies have been dictated more by the value and functionality of their protocol and applications, rather than their correlation to bitcoins.

Bitcoin was not the only cryptocurrency that failed to reach triple-digit returns in 2021. Litecoin and Bitcoin Cash also provided meager double-digit percentage returns as payment-oriented cryptocurrencies were largely ignored for projects with smart contracts capabilities.

Other older projects such as Stellar Lumens (109%) and XRP (278%) provided triple-digit returns, and Cardano (621%) was the best performer of the old guard, despite the failure to implement smart contracts functionality last year.

The rise of Ethereum’s competitors

Ethereum was well ahead of bitcoin in 2021, returning 399.2% as the boom in popularity of NFT and the creation of DeFi 2.0 protocols such as Olympus (OHM) expanded possible uses.

But with networking growth and a 50 percent increase in transfers in 2021, Ethereum’s gas fees have skyrocketed. From a low of $20 per transaction to NFT coin prices starting at around $40 and reaching into the hundreds on network congestion days, the retail cryptocurrency crowd has migrated to other smart contract platforms with lower fees.

Alternative promising smart contract platforms such as Solana (11,178%), Avalanche (3,335%) and Fantom (13,207%) all had 4-5-figure percentage returns as these protocols created their own decentralized financial ecosystems and NFT markets.

As Ethereum is set to merge with the beacon chain this year, which uses share proof instead of proof-of-work, we will see if 2022 will bring lower gas fees and a return of retail sales to Ethereum if the merger is successful.

Dog coins are their way to the top

While many new cryptocurrencies with powerful functionality and unique use cases have been rewarded with high returns, it was memes that provided the biggest returns in cryptocurrencies last year.

Dogecoin’s surge after Ilon Musk’s “adoption” led to many other dogecoin coins following, with SHIB making the biggest gain and returning an astounding 19.85 million percent.

But since Dogecoin went from $0.07 to a high of $0.74 in the second quarter of last year, the price of the original meme coin has slowly fallen 77 percent to $0.17 as of this writing. After a roller coaster ride last year, 2022 began with a positive catalyst for Dogecoin holders as Elon Musk announced that DOGE could be used to buy Tesla goods.

Gamification of the crypto industry

In 2021, the intersection of crypto, gaming, and the meta-universe has become more than just a pipe dream. Axie Infinity was the first crypto game to successfully create a “play to earn” structure combining its own token (AXS) and in-game NFT. is becoming a sensation and source of income for many in the Philippines.

Other cryptocurrency gaming projects, such as Defi Kingdoms, embed recognizable gaming interfaces into decentralized financial applications, with decentralized exchange becoming the “market” of the city and income farms becoming the “gardens” where the crops are harvested. This fantasy aesthetic is more than just a new coat of paint, as the $1.04 billion project develops a core game in which to make money.

Along with gamification, crypto and non-crypto developers in 2021 have been paying a lot of attention to digital worlds, or meta universes, in which users will inhabit. Facebook’s name change to Meta resulted in two well-known meta-village projects, The Sandbox (SAND) and Decentraland (MANA), growing another few hundred percent, ending the year with returns of 16,261% and 4104%, respectively.

With so much focus on the crypto sector after the 2021 breakout, we will see how U.S. regulatory developments and changing macroeconomic conditions will affect cryptocurrencies in 2022.

#gamification #ethereum #cryptocurrency #metacurrency

@ESG_Stock_Market