#China #economy #retail #manufacturing #GDP

China: there is growth, but not the same. The Chinese economy continues to show rather modest growth. In June, retail sales increased by 0.2% mom and 3.1% YoY. In fact, nominal sales over the past 2 years have grown at a rate of 3.1% per year, in real terms, retail has grown by a modest 1.2% annually. In general, for the 2nd quarter, real sales increased by an impressive 11.1% yoy, but relative to the failed quarter of last year, when it was -8.1% yoy, because the real growth over two years was about 1% annually. So consumer demand looks weak so far.

Production looks a little better, growth by 0.7% mom and 4.4% YoY, over the past two years it has grown by an average of 4.1% per year. There is some support from exports, but the total capacity utilization is 74.5%, which is lower than the levels of last autumn, when it was about 78%. Quarterly growth of 4.5% YoY, but again relative to the low base of last year, so the two-year growth momentum is quite modest (2.5%).

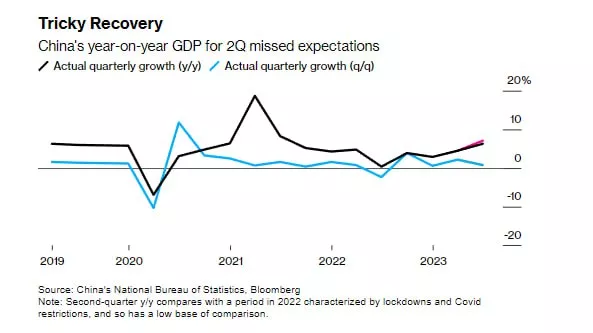

GDP growth was 4.8% YoY in nominal terms and 6.4% YoY in real terms. In quarterly terms, GDP growth was 0.8% QoQ, GDP was pulled by the services sector, which grew by 1% QoQ and 6.4% YoY. But in general, all this is a consequence of the low base of last year, when in the second quarter of 2022 the Chinese economy practically stopped (growth was 0.4% yoy). The credit momentum is slowing down a bit, although the total amount of financing has been growing quite actively, but not enough to warm up the economy.

In general, while China has not managed to accelerate the economy in any meaningful way, growth rates are closer to 3% per year than to the target 5%. In such a situation, it is worth waiting for new and new incentives, although, objectively, it is not very clear yet how to push the population out of the savings model (deposits increased by 2.7 trillion ~ $370 billion in July alone). In a good way, the recipe here is higher inflation and lower rates, a more aggressive budget, but the Chinese authorities are not ready for active steps yet. @ESG_Stock_Market