Periodic Table of Commodity Returns (2022 Edition)

For investors, 2021 was a year in which almost all asset classes ended in the plus, with commodities providing some of the highest returns.

The S&P Goldman Sachs Commodity Index (GSCI) was the third best-performing asset class in 2021, yielding 37.1% and outperforming real estate and all major equity indices.

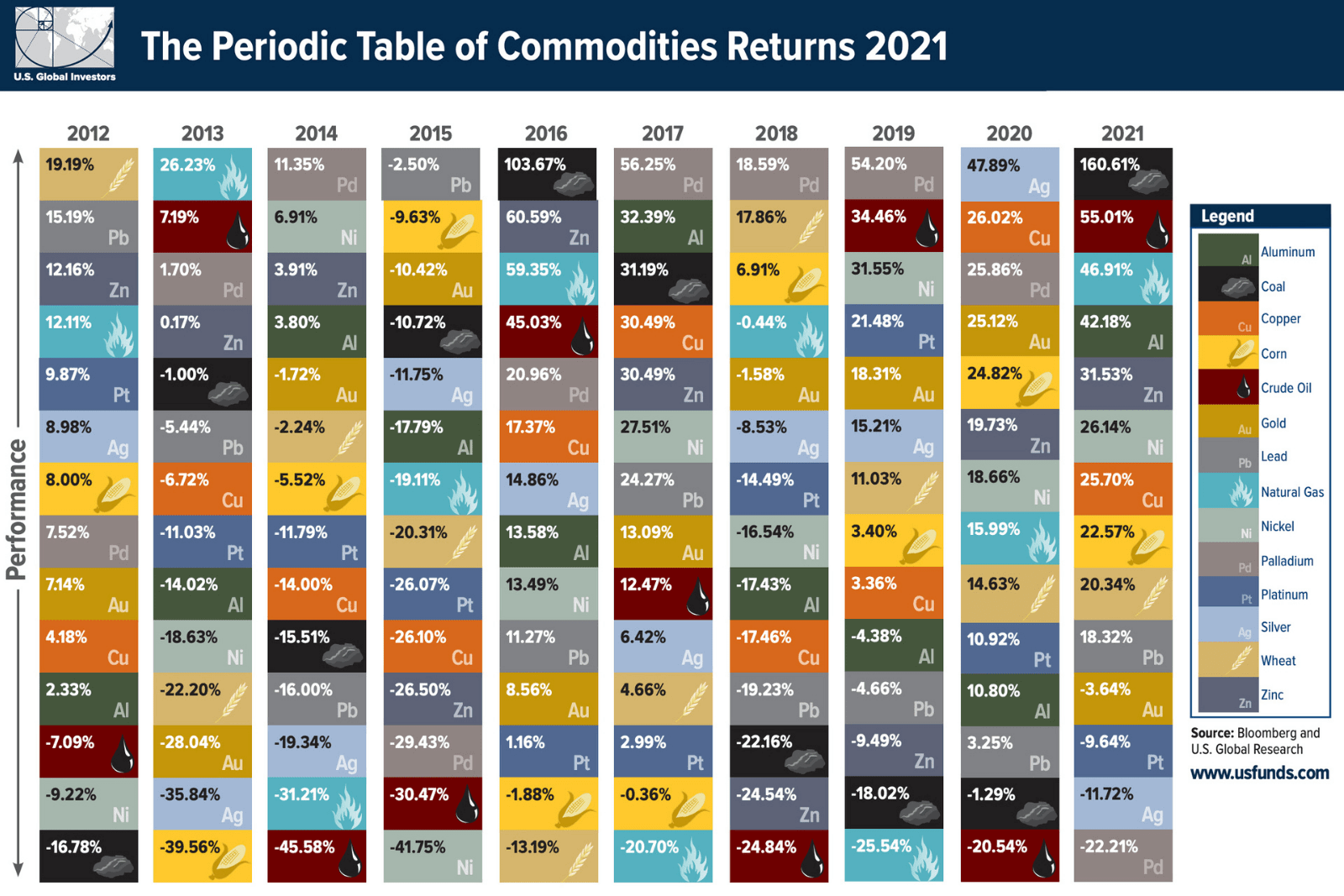

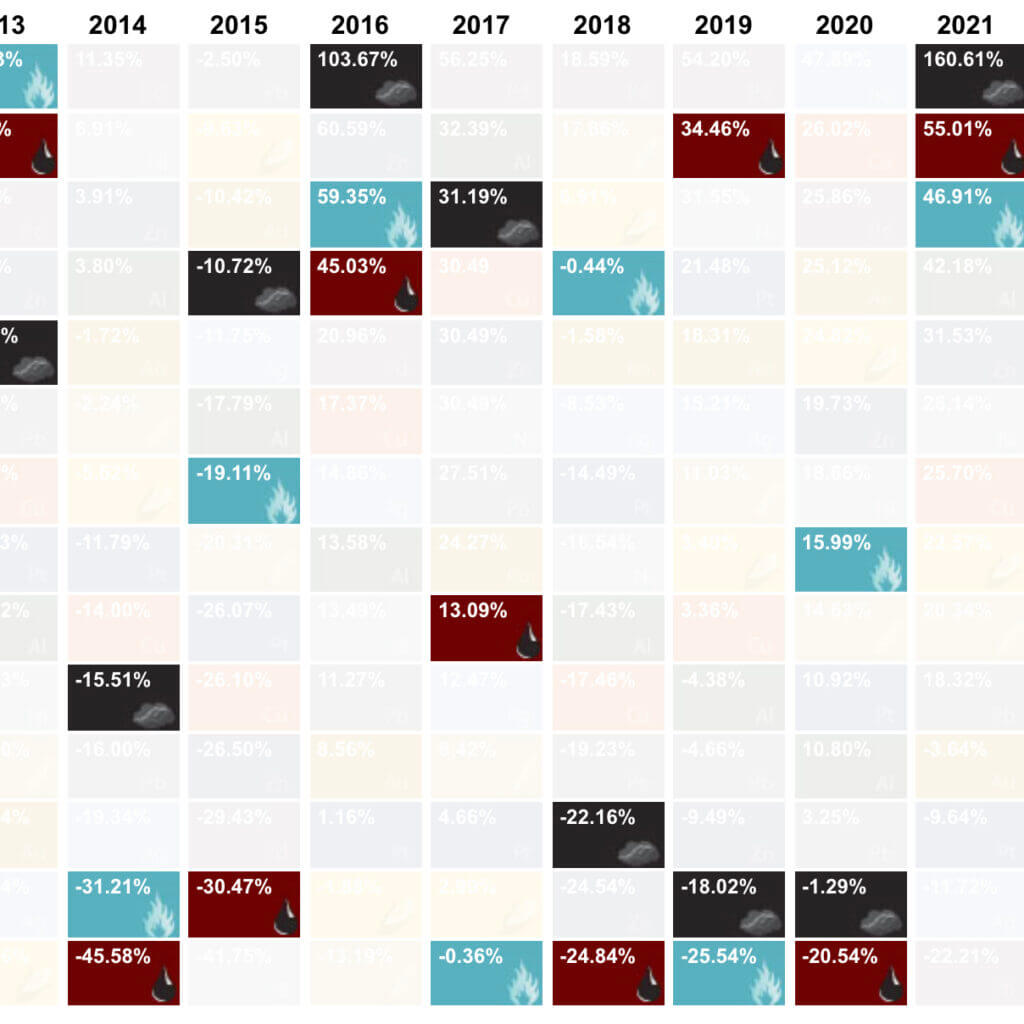

This chart from U.S. Global Investors tracks individual commodity returns over the past decade, ranking them by individual performance for each year.

A surge in commodity prices in 2021

After the strong performance of commodities (especially metals) in the previous year, 2021 was all about energy commodities.

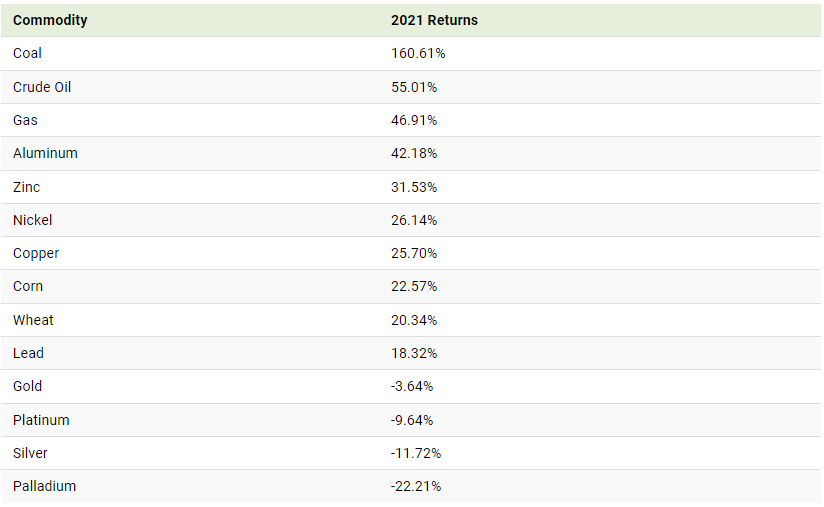

Energy fuels made up the top three for 2021, with coal providing the highest annual return of any commodity in the past 10 years at 160.6%. According to U.S. Global Investors, coal was also the least volatile commodity of 2021, meaning investors could ride easy as fossil fuel prices rose.

The only commodities that were in the negative this year were precious metals, which failed to maintain positive momentum despite rising inflation across all commodities and asset prices. Gold and silver yielded -3.6% and -11.7% respectively, platinum -9.6%, and palladium, the lowest-yielding commodity of 2021, -22.2%.

In addition to precious metals, all other commodities posted double-digit positive returns, and four commodities (crude oil, coal, aluminum, and wheat) had their best performance in a decade.

Energy commodities are thriving as the world reopens

The partial reopening of travel and the reopening of businesses in 2021 have been powerful catalysts for energy commodity prices.

After crude oil prices plunged to negative levels in April 2020, black gold showed a strong comeback in 2021 as it returned 55.01%, even though it was the most volatile commodity of the year.

Natural gas prices also rose significantly (46.91%), with natural gas prices in the U.K. and Europe rising even more as supply constraints faced a winter surge in demand.

Although coal was the second worst performer of 2020, with the transition to clean energy looming on the horizon, it was the best commodity of 2021.

The strong demand for electricity has made coal popular again, especially in China, which accounts for one-third of global coal consumption.

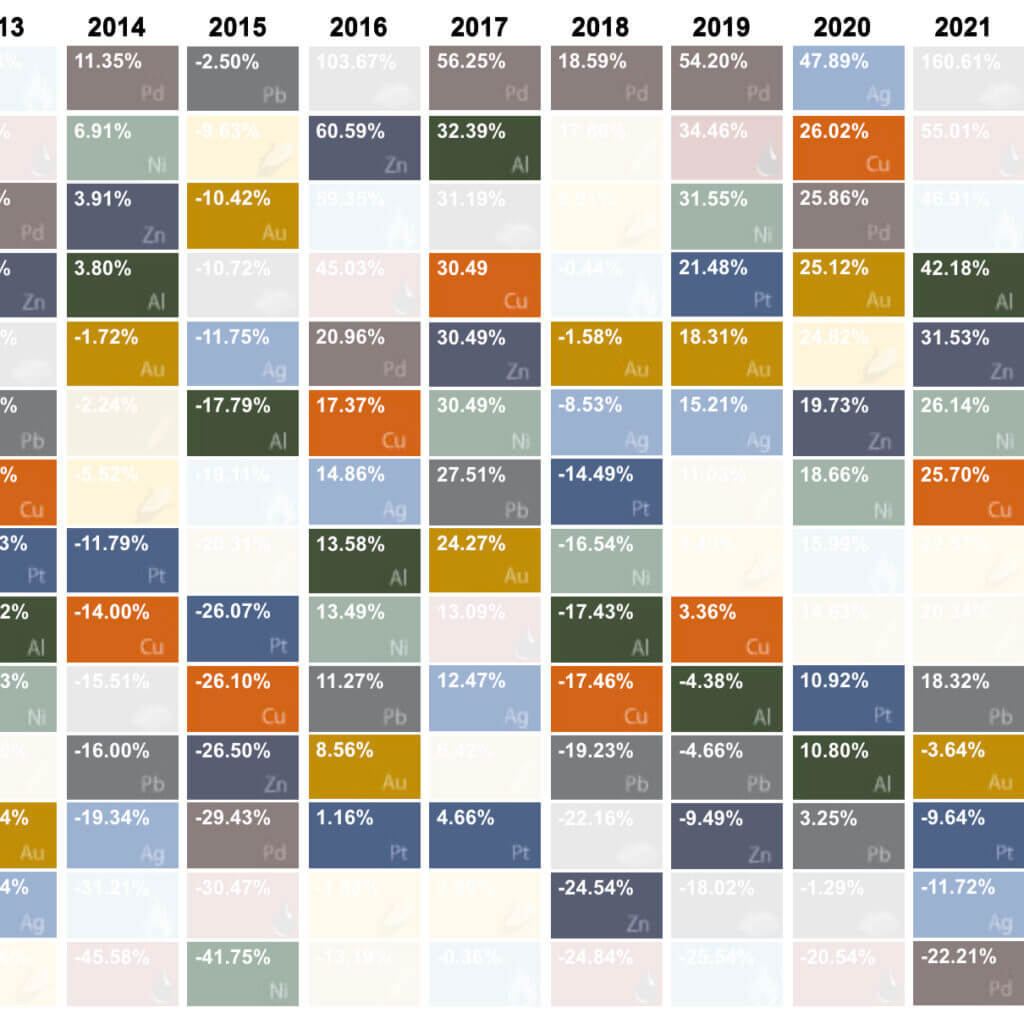

Base metals beat precious metals

The year 2021 was a tale of two metals, as precious and base metals had opposite returns.

Copper, nickel, zinc, aluminum and lead, essential to the transition to clean energy, maintained last year’s positive returns as electric car batteries and renewable energy technologies caught investors’ attention.

Demand for these energy metals looks set to continue into 2022, as Tesla has already signed a deal with Talon Metals for 75,000 tons of nickel worth $1.5 billion.

On the other hand, precious metals just sank like a rock last year.

Investors turned to stocks, real estate, and even cryptocurrencies to save and grow their investments, rather than the traditionally favorable gold (-3.64%) and silver (-11.72%). Platinum and palladium also lagged behind other commodities with returns of -9.64% and -22.21% respectively.

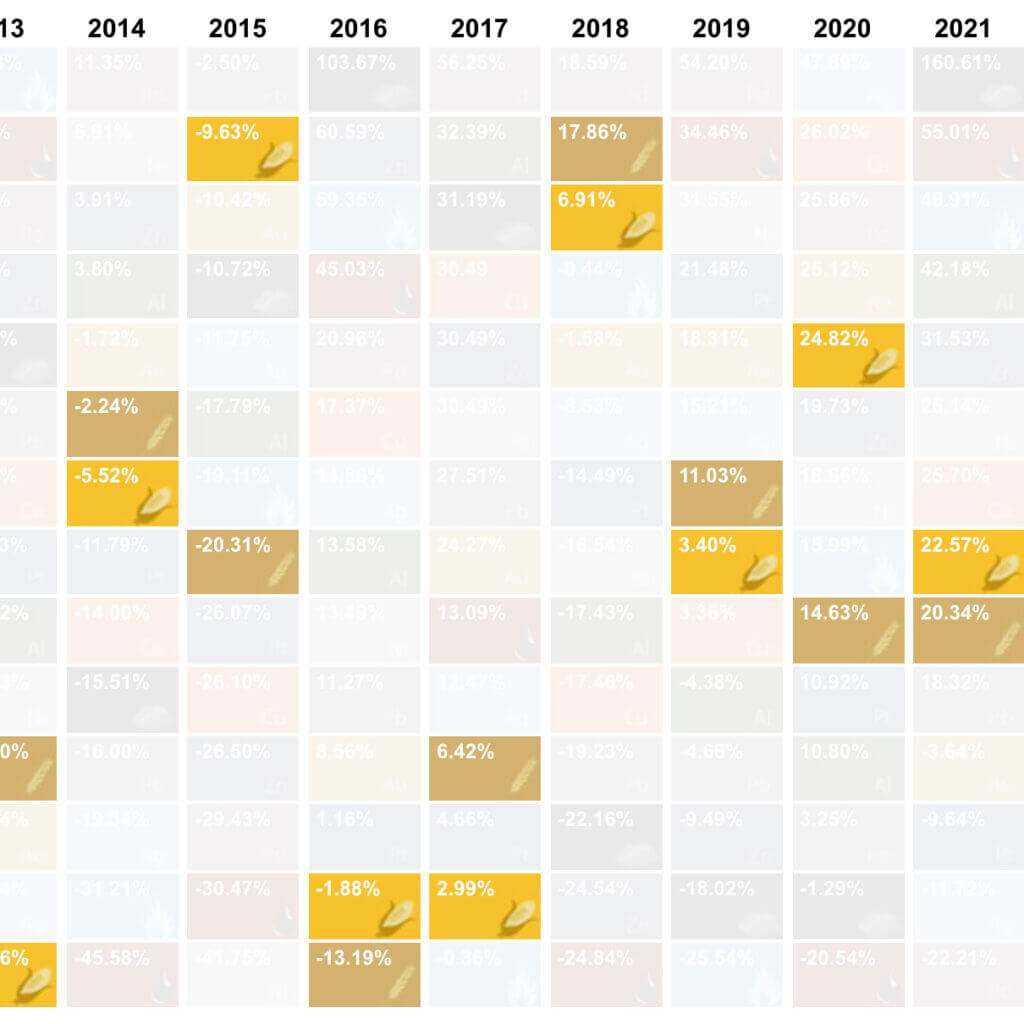

Cereals are making steady gains

In a year that saw both over- and under-performance in the market, grains maintained their steady momentum and posted positive returns for the fifth consecutive year.

Both corn and wheat delivered double-digit returns, with corn reaching eight-year highs and wheat reaching prices not seen in more than nine years. Overall, these two grains followed a trend of rising food prices in 2021 as the U.N. Food and Agriculture Organization’s Food Price Index hit a 10-year high, up 17.8 percent for the year.

As inflation for commodities, assets and consumer goods rose sharply in 2021, investors will now be watching closely for a pullback in 2022. We will have to wait and see if the Fed’s plans to raise rates and cut asset purchases succeed in keeping commodity prices stable.

#commodities #grain #metals

@ESG_Stock_Market