Already available! The weekly World Economic Digest (Wednesday) on 26.08.2023 presents the most significant economic events and their impact on the world economy. In this issue, we will look at the latest updates in world trade, the development of financial markets, changes in the political situation and their possible impact on international firms and investors.

Eurozone

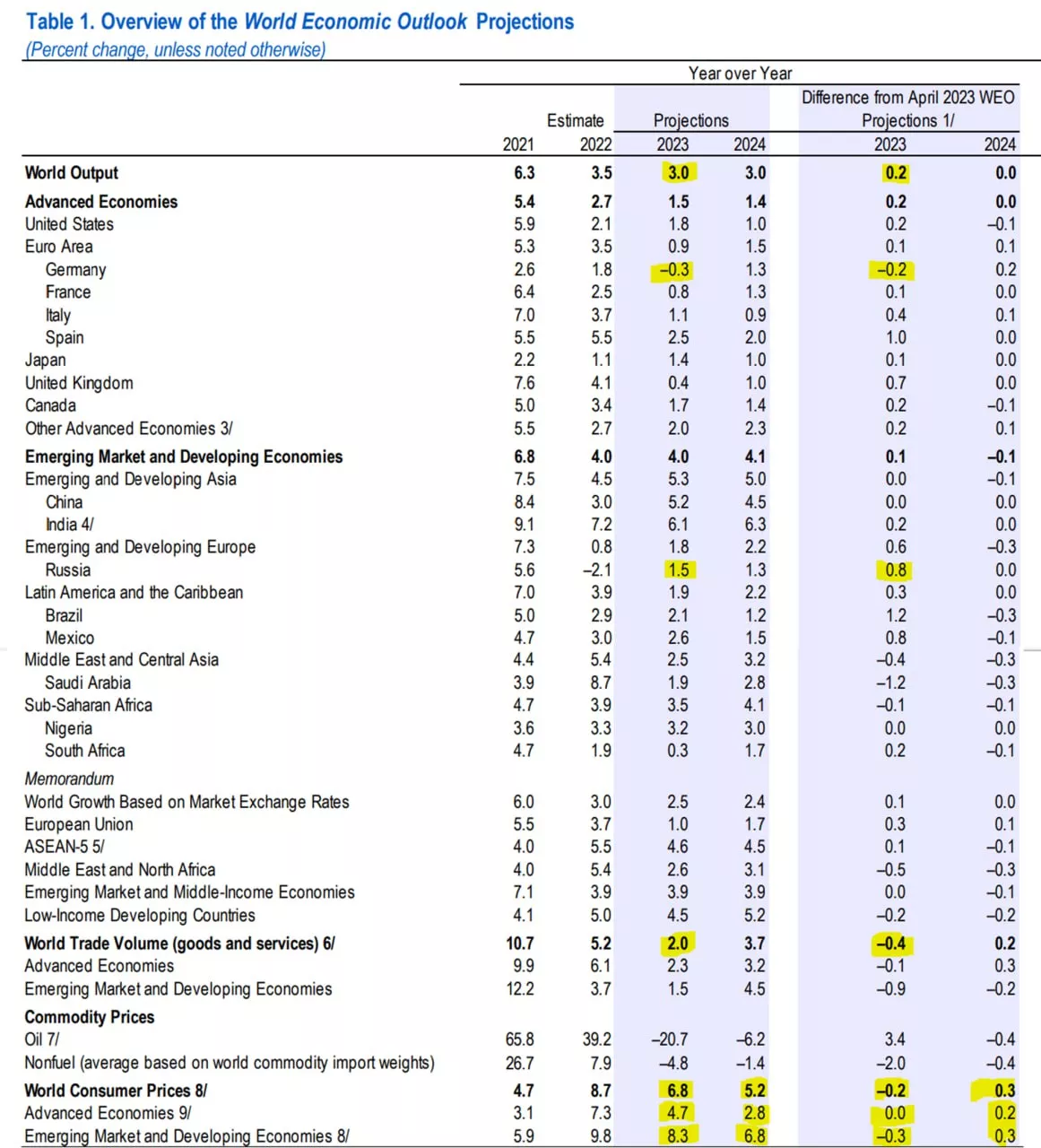

Swift "annihilated" the euro in settlements

According to Swift data, in July 2023, in one month, the share of the euro in settlements outside the eurozone collapsed from 36.7% to 13.6%.❗️

Can this be assessed as a real drop in the share of the euro – probably not. Apparently, finally, they made a slightly more adequate assessment, because it is obvious that outside the perimeter of the eurozone, the use of the euro is significantly lower than the dollar, before the July report they were almost identical currencies. In fact, such a revision is possible only if a decent part of the settlements in euros between the eurozone countries went through a conditional London hub, and now through some Frankfurt.

The share of yuan in Swift has grown to 2.23%, but even here, most likely, the data does not adequately reflect reality due to the fact that most of the payments in yuan go through Chinese infrastructure and CIPS, and Swift sees mainly netting between banks.

But in general, this says a lot about the quality of Swift estimates by calculations.

#USD #EUR #CNY #fx

The Turkish Central Bank nevertheless escalated and immediately moved the rate by 750 bps to 25%

The Turkish Central Bank nevertheless escalated and immediately moved the rate by 750 bps to 25%, after a rather sluggish start to the tightening cycle, which greatly disappointed the markets. This is still well below the inflation rate of 47.8% YoY, but it still helps the lira to hold on at the moment.

While, obviously, this is not enough, in order to return inflation to 5%, we will have to go through a long thorny path, while there are great doubts that a collision with problems in the economy and the financial system (and they will be on this path) will not turn everything 180.

#Turkey #rates #inflation #Crisis #TRY #banks

GERMAN BUSINESS CLIMATE INDEX: AGAIN WORSE THAN FORECASTS

The IFO business climate index, calculated on the basis of a survey of German companies, fell in August to 85.7% vs 87.4 earlier (forecast: 86.7). The assessment of the current situation has worsened – 89.0 vs 91.4 (90.0 was expected). Business expectations for the month: decrease to 82.6 points vs 83.6 a month earlier (expectations: 83.8).

All three indices are going down, and the head of the IFO, Clemens Fuest, was extremely concise: “… the German economy has not yet emerged from the crisis…”

Earlier:

• German economy, there is no positive

• Flash PMI for Germany – MFG below 40 points, services are also falling

• deterioration of ZEW indices

GERMAN ECONOMY: THE THIRD QUARTERLY MINUS WAS AVOIDED

According to preliminary data from the Federal Statistical Office, Germany’s GDP in 2Q23 was 0.0% QoQ vs -0.1% QoQ in 1Q2023 (forecast: 0.0% QoQ). Annual rates continue to be in the negative range: -0.2% kg vs -0.2% y quarter earlier (forecast: -0.2% y).

Both household consumption improved (0.0% sqq vs -0.3% sqq) and government spending (0.1% sqq vs -1.9% sqq). Gross capital accumulation (2.1% QoQ vs -1.7% QoQ). At the same time, exports collapsed (this is reflected in the very low German PMI index): -1.1% QoQ vs 0.4% QoQ.

CENTRAL BANK OF KAZAKHSTAN: THE CYCLE IS TURNING DOWN, THE REGULATOR HAS INDICATED THE LIKELIHOOD OF A FURTHER RATE CUT

The National Bank of Kazakhstan has decided to reduce the key rate by -25 bp to the level of 16.5% per annum, given that annual inflation in July continued to decline amounted to 14.0% yy vs 14.6% yy and 15.9% yy two months earlier.

The regulator notes that “… the pro-inflationary pressure from the external environment continues to gradually weaken. Prices on the world food markets, as well as logistics costs are decreasing.

At the same time, pro-inflationary pressure remains within the economy from the expanding fiscal stimulus, stable domestic demand, high and unstable inflation expectations, as well as rising production costs.

As a result, the cumulative balance of risks due to some easing of pressure from external factors remains in a weakly disinflationary zone.

With a further slowdown in actual inflation and its stable part, the policy of a smooth and prudent reduction in the base rate will continue…”

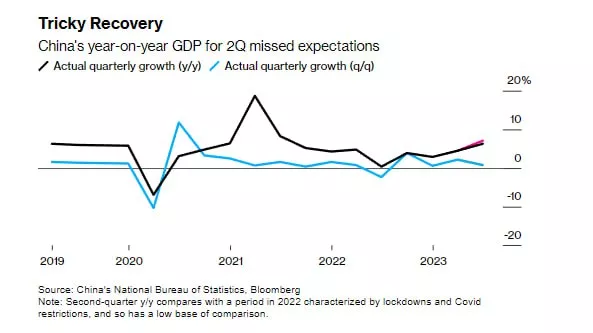

China

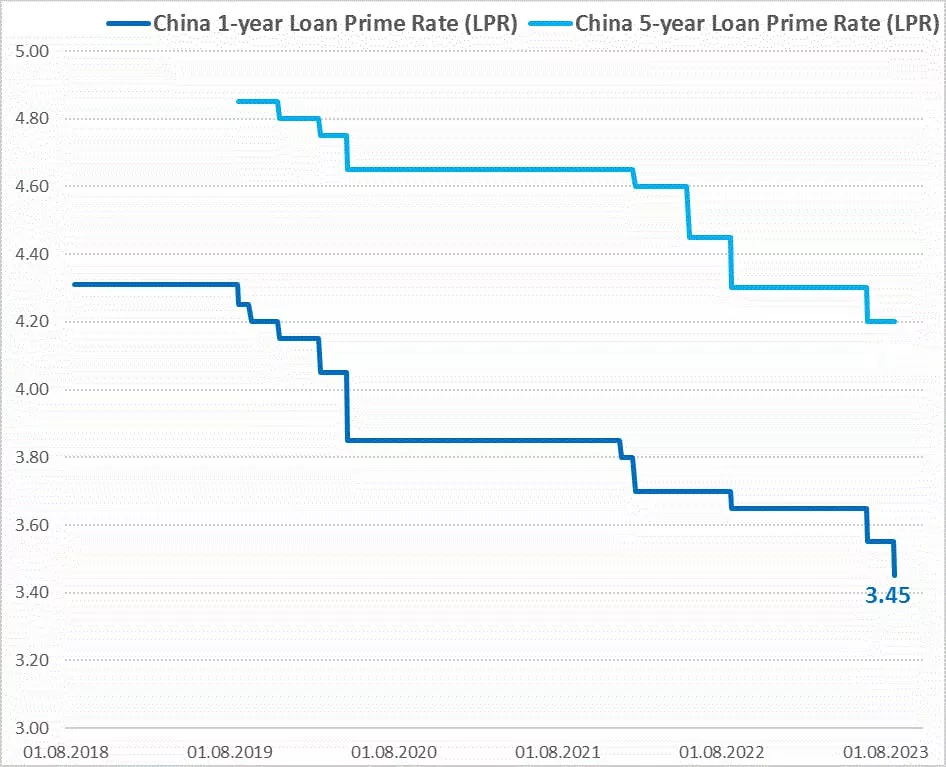

NBC; lowered, but cautiously

The People’s Bank of China has not yet decided on a more active reduction in rates and has reduced the annual LPR rate by 10 bps to 3.45%, and has not changed the five-year LPR rate at all, leaving it at 4.2%.

Although, obviously, there is a need for further rate cuts, but against the background of the strengthening of the dollar in foreign markets and the multidirectional movement of rates, the NBK holds the easing, risking sliding further into the Japanese scenario, since inflation is close to zero against the background of weak domestic demand. Although, of course, there is still a fiscal incentive….

#CNY #China #betting #NBK #fx

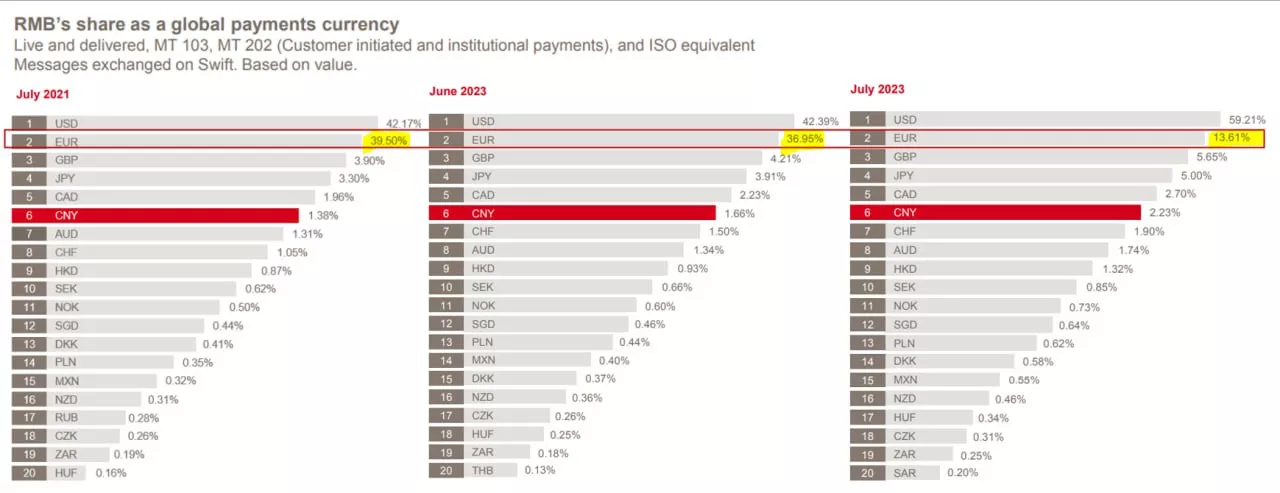

China is actively switching to the yuan

China systematically continues to transfer its foreign economic activity to the yuan. Payments from China have exceeded payments in dollars for several months, the total outgoing payments in yuan for 6 months amounted to $1.52 trillion, while in dollars they dropped to $1.36 trillion. The share of the dollar in payments received in 6 months fell below the yuan for the first time, respectively, $1.47 trillion versus $1.49 trillion.

At the same time, China’s dollar balance is positive (+$111 billion in six months), and negative in yuan (-$30 billion in six months). The outflow of yuan to foreign markets is relatively small, but it is gradually growing, which indicates a gradual increase in yuan liquidity outside the Chinese economy. The volumes, of course, are ridiculous for China so far, but given the rather small volumes of the offshore market, they are already quite noticeable.

"A flock of aimless flies": Chinese hedge fund accuses foreign investors of ruining stocks

China’s largest macro hedge fund blamed global capital for the country’s stock falling to its lowest level since November.

⛔️ Foreign funds are the main drivers of the recent sell-off in Chinese stocks, said Li Bei, founder of the Shanghai Investment Management Center Banxia. Foreign investors have caused market volatility, and “together they are a bunch of aimless flies,” she said in an article posted on the social media platform WeChat.

According to Li, initiatives to recharge slum reconstruction and eliminate the risks associated with financing local governments are more effective for stimulating the economy than lowering rates. Based on recent policy moves by the central bank and the retreat of foreign funds, this is probably “another good point to buy,” she said in the article.

China steps up fight against yuan Bears to stop Sell-off spiral

📍 China is strengthening its protection of the yuan, increasing the cost of financing in the offshore market to reduce short positions, and is setting a new record with a stronger-than-expected benchmark rate for the currency.

Analysts say that these steps are aimed at slowing the pace of depreciation of the yuan, and not to provoke a sustained rally. Analysts from JPMorgan Chase & Co., Nomura Holdings Inc. and UBS Wealth Management predict further weakness of the currency this year. The offshore yuan reversed earlier gains and weakened on Tuesday, returning to its 2023 low set last week.

The People’s Bank of China set the daily fixing of the currency at 7.1992 per dollar on Tuesday, compared with the average estimate of 7.3103 in the Bloomberg survey. This was the largest gap since the polls began in 2018.

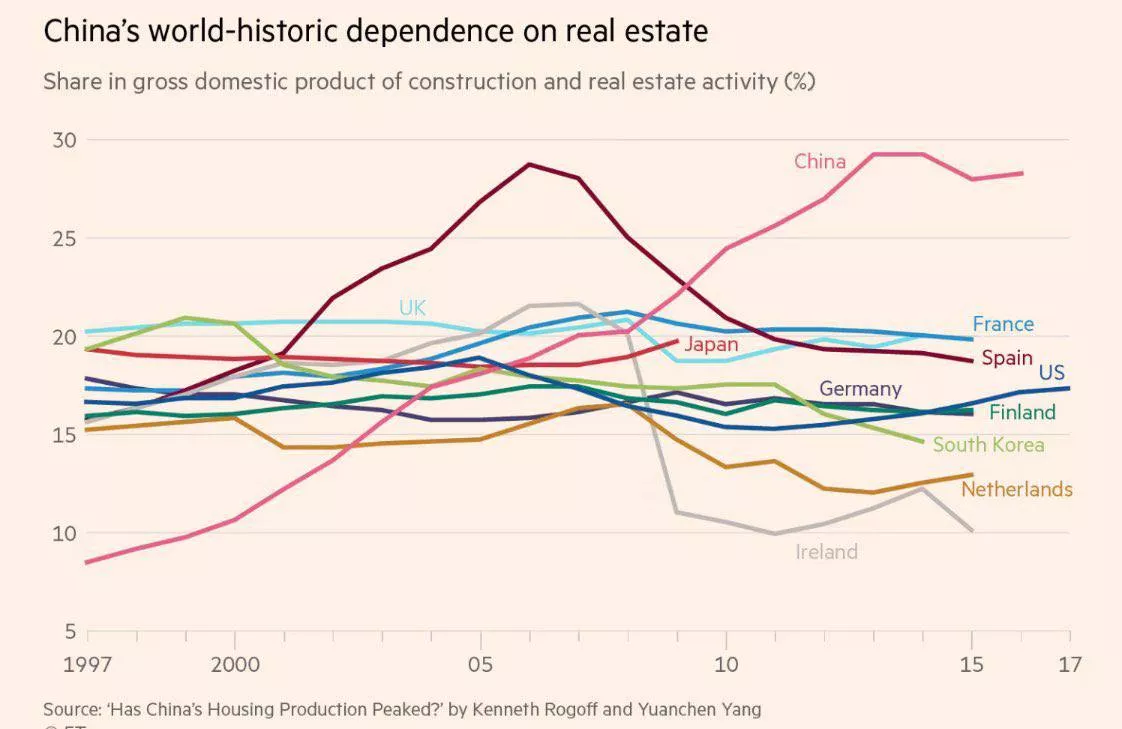

Cities owe billions of dollars to Chinese real estate companies - report

According to local media reports, local authorities in some Chinese cities owe developers from 1 to 2 billion yuan ($137 million) in unpaid bills.

The outstanding debt to real estate firms includes tax benefits and promised reimbursement of commissions for the sale of land, the Economic Observer magazine reported late on Monday, citing unnamed executives of developers.

According to the report, various districts and counties in cities, including Zhengzhou in central Henan Province, have recently asked private real estate firms to provide detailed information about the debt owed to them by the government.

Pessimists in China's real estate market are missing out on underlying demand, says an economist with experience in making correct forecasts

Investors are too pessimistic about China’s real estate market, where demand for housing is still supported by high sales among state-backed developers and rising rents, according to an experienced analyst who correctly predicted the resumption of trade last year.

🔸 Sales of government-backed developers have deviated from the general downturn in the industry this year, and housing rents are also rising, Hong Hao, chief economist at Grow Investment Group, said on Monday. For example, sales of Poly Developments and Holdings Group jumped 109% year-on-year in the first seven months, and Yuexiu Property registered a 68% increase over that period, he said.

“Their strong sales hint at continued demand for housing, which is not affected by general market conditions and prevailing pessimism,” Hong said. “Rents are rising, which suggests that people are delaying buying decisions and renting instead. If that’s the case, then housing demand is probably lingering rather than disappearing.”

U.S. Commerce Secretary to visit China next week for talks

U.S. Commerce Secretary Gina Raimondo will travel to China next week for meetings with senior Chinese government officials and U.S. business leaders, the Ministry said on Tuesday.

🇨🇳🇺🇸 Last month, Raimondo promised to continue the visit, despite reports that her department’s email was hacked by the Chinese.

Raimondo “looks forward to constructive discussions” during a visit to Beijing and Shanghai from August 27 to 30, the ministry said in a statement.

🇨🇳🇺🇸 The talks will address issues related to commercial relations between the United States and China, problems faced by American business, and areas of potential cooperation.

According to Bloomberg, 40 companies included in the Hang Seng index have now published interim results and reported a decrease in profit by an average of 3.7% compared with an increase in annual profit by 5.5% last year.

“The recent weakness of the yuan, together with poor performance in real estate and stocks, as well as record high youth unemployment, have led to a decline in consumer spending. Consumers are feeling financial uncertainty, which has further undermined consumer confidence and increased the risk of deflation,” PwC analysts say.

U.S. Commerce Chief Gina Raimondo will visit China for three days in search of a “constructive discussion.” This trip increases the likelihood of a meeting between Xi Jinping and Joe Biden this year.

The US has lifted restrictions on 27 Chinese companies and organizations, which is a sign that Washington is extending an olive branch ahead of Trade Minister Gina Raimondo. Among others, restrictions were lifted from the chemical company and manufacturer of materials for lithium batteries Guangdong Guanghua Sci-Tech and sensor manufacturer NanJing GOVA Technology.

British Foreign Secretary James Cleverley is going to visit China at the end of August. Cleverley’s visit is rather a preliminary contact between the two sides after the pandemic and an attempt to resume relations.

Hong Kong and Macau will impose import controls on some food products from Japan in response to the country’s plan to start dumping purified radioactive water from the Fukushima nuclear power plant into the sea.

China promises to take action against Japan’s “selfish” plan to clean up nuclear waste.

🇨🇳🇪🇬🇮🇶🇸🇦🇸🇾🇾🇪 The Speaker of the Arab Parliament, Adel bin Abdulrahman al-Asumi, will visit China.

🇭🇰🇺🇸 Are American companies leaving Hong Kong? The chief U.S. envoy to Hong Kong, Gregory May, says firms are staying put, but some are expressing concerns about the national security law and Internet censorship.

🇺🇸🇨🇳 Washington will impose visa restrictions on some officials in China behind public boarding schools for their involvement in forcing Tibetan children to assimilate. According to UN experts, this policy has led to the fact that 1 million children have been separated from their families.

Experts disagreed when the 30-day period for Country Garden bonds ends on September 5 or 6 due to the fact that this period began on Sunday, when payments could only be made from Monday, the company does not comment on this point in any way.

Ant Group uses Alipay+ to improve the technological image of Hangzhou before the Asian Games. The company is expanding support for several Asian e-wallets through the Alipay+ service to facilitate a trip to your hometown.

⬇️ CK Asset, Sino Land and Henderson Land together plan to sell a total of 293 apartments this weekend with big discounts.

Shares of Anta Sports Products jumped by 7.3% after the report for the first half of the year, which exceeded forecasts. According to Jefferies, Anta management noted the stabilization of the demand situation and remained optimistic about the upcoming political support.

US removes control over some Chinese firms ahead of Raimondo trip

The United States has lifted restrictions on 27 Chinese companies and organizations, which is a sign that Washington is clearly extending an olive branch ahead of Trade Minister Gina Raimondo’s planned trip to Beijing this month.

The U.S. Department of Commerce on Monday excluded Chinese businesses such as chemical firm and lithium battery materials manufacturer Guangdong Guanghua Sci-Tech Co. and sensor manufacturer NanJing GOVA Technology Co., from its “untested list”, which limits the company’s ability to buy American technology.

🇨🇳🇺🇸 According to a government statement, the companies were removed from the list after they successfully completed end-use checks, which allowed the Commerce Department’s Bureau of Industry and Security to confirm their “legitimacy and reliability.”

China's gloomy economic outlook has led to a decline in consumer spending, according to PwC

Chinese consumers are adjusting their buying habits, taking into account the less than optimistic economic prospects of the country.

The crisis in China’s real estate sector and high youth unemployment are among the problems putting pressure on consumer spending, according to a report published on Tuesday.

“Although the degree of financial concern of Chinese consumers is less acute than that of global counterparts, consumers refrain from secondary spending,” said Michael Cheng, PwC’s leader in consumer markets in the Asia-Pacific region.

India

Forget about world domination, India won't catch up with China soon

Last year, when Prime Minister Narendra Modi celebrated the 75th anniversary of India’s independence from British rule, he called on the nation to “rule the world.” Earlier this week, once again at the Red Fort, he mentioned “Amrit Kaal” — a crucial era when the gates of opportunity open.

His mantra of “reform, fulfill, transform” suggests big dreams. Perhaps he dreamed of those halcyon days before 1870, when India and China were considered the two largest and most powerful economies in the world.

But the dream does not make a plan. And in the nine years since Modi came to power, his plans to bring India to first place in the ranking of the most powerful economies in the world have remained plans.

Graham Ellison of Harvard University reminded us in a recent foreign policy report that about a decade ago, the late Singapore leader Lee Kwan Yew said that India would never catch up with China and would always remain the “country of the future.” Li said, “Don’t talk about India and China in the same breath,” throwing down the gauntlet to those who see India biting China’s heels and cheering India on in the hope of thwarting China’s ascent.”

To be fair to Modi, his government’s economic performance is worthy of respect after decades of stagnation and disappointment. India’s gross domestic product has grown by an average of about 6 percent every year since 2014, reaching a record high of 9.1 percent last year, which is impressive in light of the turmoil caused by the Covid-19 pandemic and recession in many parts of the world.

But a wide range of structural reforms is needed if India is to break out of the shackles of its economic past. These include the power of caste, bureaucratic friction, impenetrable tax rules, the still chronic protection of local business magnates, and import tariffs that are among the highest in the world.

Any country that has risen from such a low level should recognize that it will take many decades to achieve what the late Li called parity with China, and that there is nothing shameful about it. Last month, Goldman Sachs predicted that by 2075, China will become the world’s largest economy (57 trillion US dollars), and India (52.5 trillion US dollars) will overtake the United States (51.5 trillion US dollars).

Adani Group's quarterly profit rose sharply due to increased liquidity

Adani Group reported record profits for the quarter ended in June thanks to its infrastructure and renewable energy business, bolstering the finances of Gautam Adani’s business empire as it seeks to build investor confidence and resume fundraising months after a devastating attack by the shortseller.

The electricity conglomerate reported that quarterly profit for June before interest, taxes, depreciation and amortization jumped 42% compared to the same period a year ago to 235 billion rupees ($2.8 billion), which is the highest the group has seen in a single quarter and almost the same, how much profit he made for the entire 2019 fiscal year.

The high performance achieved by the infrastructure and utility business of its flagship company Adani Enterprises Ltd., as well as its clean energy and cement production units, “ensure a high level of stability, as well as predictability and transparency of revenues for several decades,” the company said in a statement.

Profitability also supported the company’s liquidity: the cash balance at the end of June increased by 4.2% compared to the end of March and amounted to 421 billion rupees. An improved liquidity position could help boost investor confidence more than six months after the short-listed company Hindenburg Research accused the company of widespread corporate abuse, resulting at one point in its listed companies losing more than $150 billion. Adani denies any wrongdoing.

After the shortseller attack, the embattled conglomerate managed to raise billions from GQG Partners and Qatar Investment Authority, which acquired shares owned by its founders. The company is also negotiating with international banks to refinance loans taken out last year to acquire Ambuja Cements Ltd.

However, investors are waiting for an opinion from the Securities and Exchange Board of India, which oversees Indian markets, which has examined some of the allegations made by Hindenburg. Sebi appealed to the country’s Supreme Court with a request to postpone the investigation until the end of August.

USA

US housing market: volumes are low, prices are high

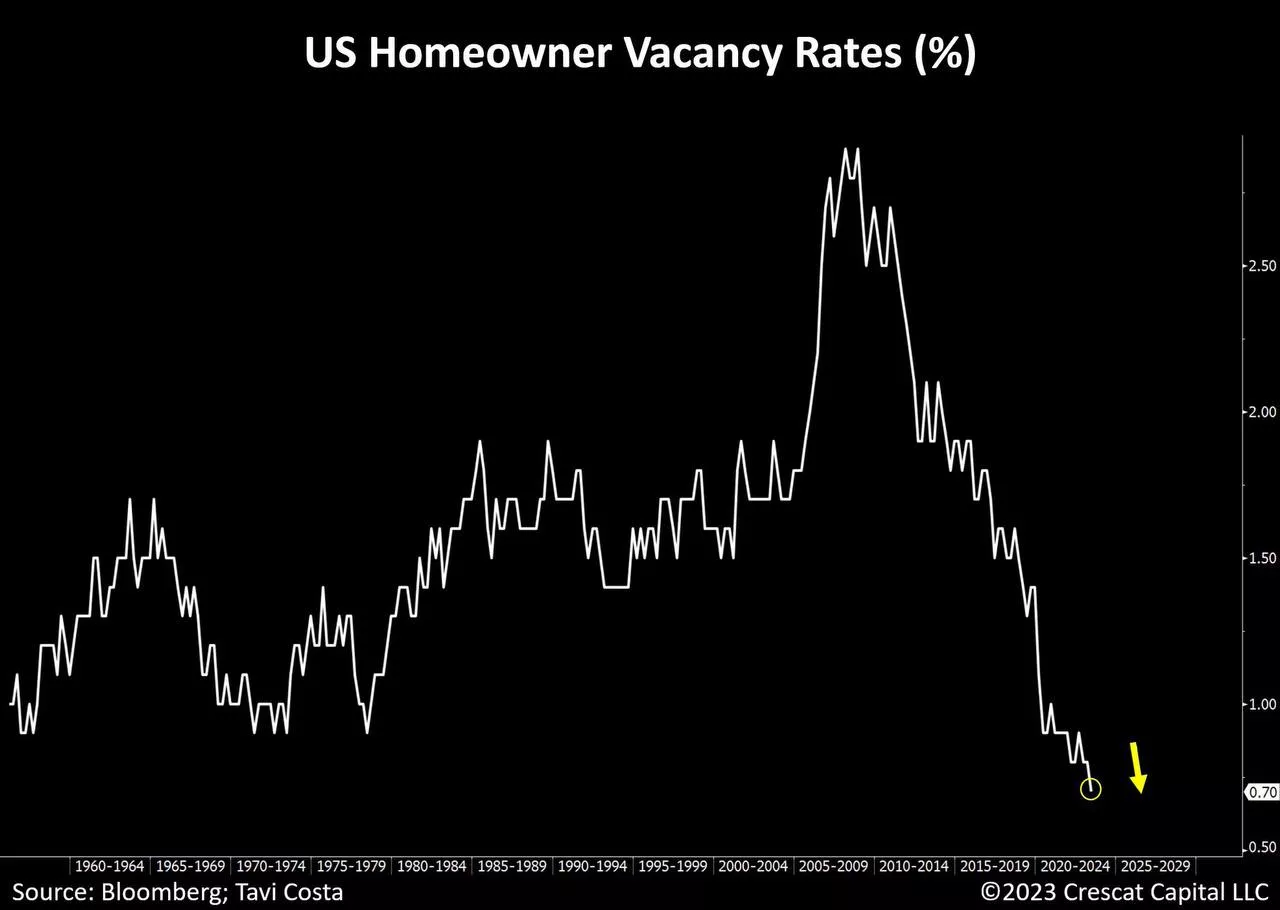

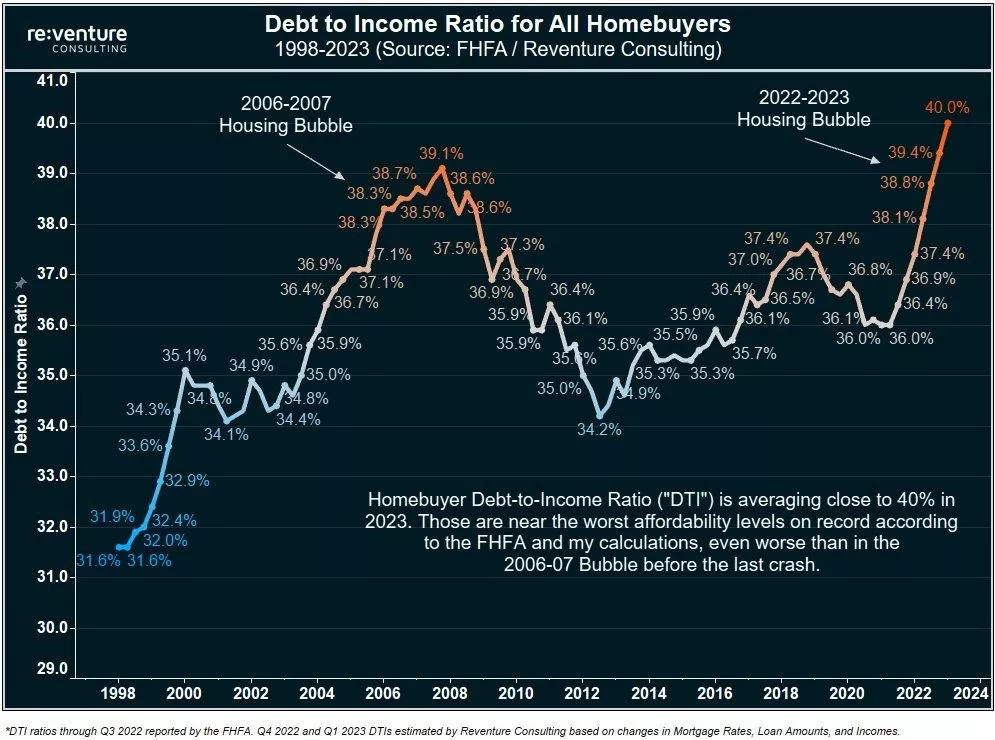

The US housing market continues to remain, on the one hand, in the mode of a shortage of supply of ready–made housing, on the other – the unavailability of this housing against the background of high rates and prices. Although some revival of market activity is fading amid a new wave of growth in mortgage rates above 7% per annum.

Sales of single-family homes in the US secondary market in July fell to the level of 3.65 million homes per year, slightly above recent lows. On the primary, on the contrary, they increased to 714 thousand per year. At the same time, the offer on the secondary market covers sales only for 3.2 months, which is very small by historical standards (the normal state of the market is 4-6 months), although above the minimums. There is no external shortage on the primary market – the supply covers sales in 7.1 months, but this applies only to housing under construction or where construction has not yet begun, with ready-made new houses there is also a shortage (supply covers demand in 3.1 months).

The average settlement payment on a mortgage in the secondary market at current rates of about $2.2 thousand per month and more than 51% of the average s/p is the maximum since 1984, when there were double–digit mortgage “Volcker rates” of 14-15% per annum.

Against the background of a shortage of ready-made housing and prices do not want to fall, despite the collapse of mortgage applications to a minimum since the 1990s (despite the fact that the population in the United States has grown over three decades) and below the level of the mortgage crisis. If we remove seasonality, then the cost of a house on the secondary market increased by 1% mom, even the annual dynamics came out in a small plus 1.6% yoy. Zillow also records a price increase of 0.9% mom and 1.4% yoy.

The market is shrinking in volume, but it is not getting cheaper. In part, these trends correspond to what happened before the 2008 crisis, but with the shift of risks from private ownership to institutional – here credit risks are now higher. And in this regard, the problems from high rates are still ahead.

#USA #mortgage #real estate #economy #inflation

Less than six months have passed ... how Bloomberg took care of the problem of the US budget deficit and public debt, noting that "The US budget deficit is growing like never before" in the conditions of a generally relatively good state of the economy.

It’s about discussing the budget for next year, and it will be difficult to discuss it. The increase in interest rates leads to the fact that only interest expenses on debt servicing will soon reach $1 trillion and will eventually exceed 4% of GDP with debt.

Moreover, it should be understood that the average debt service rates are generally not so high now – 2.84%, which is comparable to the Fed’s neutral rate (2.5%) with 2% inflation. The peculiarity is that it is extremely difficult to lower the deficit on other items below 2-4% of GDP. This makes the total potential budget deficit for many years decently higher than the US can afford if it wants to stabilize the debt (<4.5% of GDP).

Moreover, even if the Fed can (theoretically) stabilize inflation at 2% and the Fed rate will be in the neutral zone of about 2.5%, the average debt service rates should be higher than the current 2.84% and be around ~3.5%, which implies a non-interest budget deficit close to zero on a long horizon… and this has not happened in America for a couple of decades.

#budget #debt #rates

Speech by J.Powell's trip to Jackson Hole was fairly smooth, however, nothing else was expected.

Although the head of the Fed has come to life – even outwardly noticeably (a couple of months of comfortable inflation reports) in the hope that after the failure in previous years, prices can be reined in. And that ‘s what should strain the markets … The Fed needs to recoup for the failure with inflation and they will perceive any signal that is against it as an “elusive victory”. And in general, this is exactly what the rhetoric pointed to (in addition to the statements on duty and stories about extreme uncertainty):

“We are attentive to signs that the economy may not be cooling as expected.”..

“Evidence of sustained above-trend growth may jeopardize further progress in inflation and become the basis for further tightening of monetary policy.”..

“Evidence that labor market tensions are no longer easing may also require monetary policy responses.”…

In fact, this means that the Fed is pleased with the current trends and, if they persist, they will not change anything, but if they see that these trends are fading, or suddenly begin to change, they will react painfully to this and tighten policy.

This increases the likelihood of another rate hike, because the Fed will be very sensitive to data, and this sensitivity will be one–sided – in the direction of tightening.

P.S. If something doesn’t break sooner…

#USA #inflation #economy #Fed #debt #rates #dollar

US PRELIMINARY PMI INDICES (MARKIT): DOWNWARD TREND IN EVERYTHING

• Composite index: 50.4 vs 52.0 in July.

• Manufacturing industry: 47.0 vs 49.0

• Services: 51.0 vs 52.3

Both industry and services are declining in the US in August. In production, a reduction is recorded both in output and in new orders, volumes have also decreased in services. There is also a reduction in exports in production, primarily to Europ

Commodity

Dubai Residential Real Estate Market Overview (Summer 2023) by Knight Frank

European Battery Recycling Market (August 2023) by Strategy & (PWC)

Crypto

Results of the day, August 21

A trader who bought the BAIC 85 NET token from the Bored Ape Yacht Club collection for 777 ETH sold it at a loss of 80% for 153 ETH after just 11 months.

🪙 The lone man again managed to single-handedly mine a block on the Bitcoin network and get 6.25 BTC for it.

The trader liquidated 14 times in 1 day and lost about $430,000.

🗺 Mining 1 BTC in Russia costs $14,900 — that’s how much the cost of the electricity needed for this is.

Vitalik Buterin transferred 600 ETH (~$1 million) to the Coinbase exchange.

Raiffeisenbank has been introducing a 50% commission on incoming transfers in dollars from other banks since September.

The Indian Army will use the blockchain platform from Beyond Imagination Technologies (BIT) for communications.

Bitget crypto exchange will introduce mandatory customer verification from September 1.

Results of the day, August 22

🪙 Coinbase increases investments in Circle, the USDC issuer.

🪙 USDT in Brazil can be cashed in 24,000 cryptocurrencies across the country.

An unknown Bitcoin address has accumulated 118,300 BTC ($3 billion) in a month and a half — analysts claim that this is the new address of the Gemini exchange.

🇰🇷 The authorities of the South Korean city of Cheongju demanded that 7 crypto exchanges provide information about the assets of 8520 users who have not paid taxes — they plan to confiscate the crypt.

🪙 Twitter is spreading information that Binance is allegedly selling BTC to support the price of BNB.

Oman has launched a mining center worth $350 million – this is the second such facility in a year that was opened in the free economic zone of Salalah.

🎶 CoinGecko has compiled a rating of popular cryptocurrencies in TikTok — in the report, analysts cite 15 hashtags related to cryptocurrencies, which together have gained 115 billion views.

🇨🇳 In China, an ex-official was given a life sentence for supporting mining.

Results of the day, August 23

Thai citizens aged 16 and older will receive $300 in digital assets from the Prime Minister of the country.

Last year, the revenue of the largest mining companies in Russia amounted to 11.5 billion rubles.

🪙 Binance “removed” Rosbank (BEAC) and Tinkoff from the list of payment systems on the p2p platform, replacing their names with “Green Local Card” and “Yellow Local Card”.

The former head of the Open Sea products department was sentenced to three months in prison and a fine of $50,000.

🪙 Elon Musk is trying to remember Dogecoin again.

🕵️♂️ The co-founder of Blockchain Capital has filed a lawsuit against an anonymous hacker who stole $6.3 million from him in various digital assets by swapping a SIM card.

🇰🇵 North Korea may try to sell BTC for $40 million.

The CEO of YouTube noted the rapid development of artificial intelligence — the company will continue to invest in new technologies, and will also create a Music AI Incubator platform for research and testing generative AI.

Results of the day, August 24

The main crypt of the CIS was killed.

Paolo Ardoino showed one of the energy production facilities that is used for BTC mining by Tether.

Pantera hedge fund predicts $35,000 for 1 BTC before halving (April 2024) and $148,000 by 2025.

📚 Arthur Hayes has published a new essay entitled “Kite or Board”, the main theses.

FTX scam exchange is planning a sale of its crypto assets worth more than $3 billion – the new FTX management plans to hire Mike Novogratz to implement the plan and maximize the profit from the sale.

Nodal Power has raised $13 million for mining in landfills — in the process of burning methane in the generator, the company reduces carbon dioxide emissions, ensuring efficient use of resources.

In Israel, drones collect apples — the AI chooses only ripe fruits and makes sure that the apple is not wormy.

The Israeli police are preparing to charge businessman and ex-owner of the Beitar Jerusalem football club Moshe Hogeg for fraud with digital assets worth $290 million.

Results of the day, August 25

The PEPE hype meme token has collapsed by 25% over the past day – more than 16 trillion tokens have been sent from PEPE’s multi—signature wallet to Binance, OXK and Bybit addresses.

Visa and Mastercard refuse to cooperate with Binance.

Oman invests $1.1 billion in the Bitcoin mining sector – the country’s government sees the first cryptocurrency as “digital oil”.

A hacker stole $55,000 in a crypt from the US Drug Enforcement Agency (DEA).

💸 Coinbase has added plans for listing a PayPal stablecoin (PYUSD) to the roadmap.

The user said that he bought Dogecoin for $ 250,000, spending all his savings — in May 2021, his portfolio was worth $ 3 million, now the value of his coins is only $ 50,000.

Jerome Powell, head of the US Federal Reserve, spoke at the economic symposium in Jackson Hole, the main theses.

Tether, the issuer of USDT, has updated the report on its reserves — the company’s total assets amount to $86.1 billion, liabilities — $82.8 billion. Tether’s excess reserve is $3.29 billion.

CALENDAR OF EVENTS FOR THE WEEK FROM AUGUST 21 TO 25

CALENDAR OF EVENTS FOR THE WEEK FROM AUGUST 28 TO SEPTEMBER 1

Monday 28.08

• 🇬🇧 UK, no bidding

Tuesday 29.08

• 🇩🇪 Germany, GfK Consumer Climate, Aug (est. -24.2)

• 🇺🇸 USA, open jobs Jolts, Jul (est. 9.793 million)

• 🇺🇸 USA, Case&Shiller index (est. -1.4% yy)

• 🇺🇸 USA, consumer index. confidence, Aug (est. 113.4)

Wednesday 30.08

• 🇨🇳 China, PMI

• 🇩🇪 Germany, CPI, Aug (est. 0.2% mm, 6.0% yy)

• 🇷🇺 Russia, weekly inflation MMI Forecast: 0.04%

• 🇷🇺 Russia, Rosstat, social economy statistics for July

• 🇺🇸 USA, GDP 2Q23 (est. 2.4% QQ)

• 🇺🇸 USA, unfinished. builds-in, Jul (est. -0.1% mm)

Thursday 31.08

• 🇹🇷 Turkey, GDP, 2Q23

• 🇫🇷 France, GDP 2Q23 (est. 0.5% QQ, 0.9% yy)

• 🇪🇺 EU, CPI, Aug, prev (est. -0.1% mm, 5.1% yy)

• 🇺🇸 USA, Initial Jobless Claims (est. 235K)

• 🇺🇸 USA, PCE, Jul (est. 0.2% mm, 3.3% yy)

• 🇺🇸 USA, Core PCE, Jul (est. 0.2% mm, 4.2% yy)

Friday 01.09

• 🌏 MfG World PMI Day

• 🇧🇷 Brazil, GDP, 2Q23 (est. 0.3% QQ, 2.7% yy)

• 🇺🇸 USA, Non-Farm payrolls (est. 168K)

* • USA, Private payrolls (est. 143K)

* 🇺🇸 USA, unemployment (est. 3.5%)

• 🇺🇸 USA, labor remuneration (est. 0.3% mm, 4.4% yy)

• 🇨🇦 Canada, GDP, 2Q23

News faster in telegram

https://t.me/stockesg – group

https://t.me/ESG_Stock_Market – channel

@ESG_Stock_Market