A supercomputer is a machine designed to process billions, if not trillions, of calculations simultaneously. Each supercomputer actually consists of many individual computers (known as nodes) that work together in parallel.

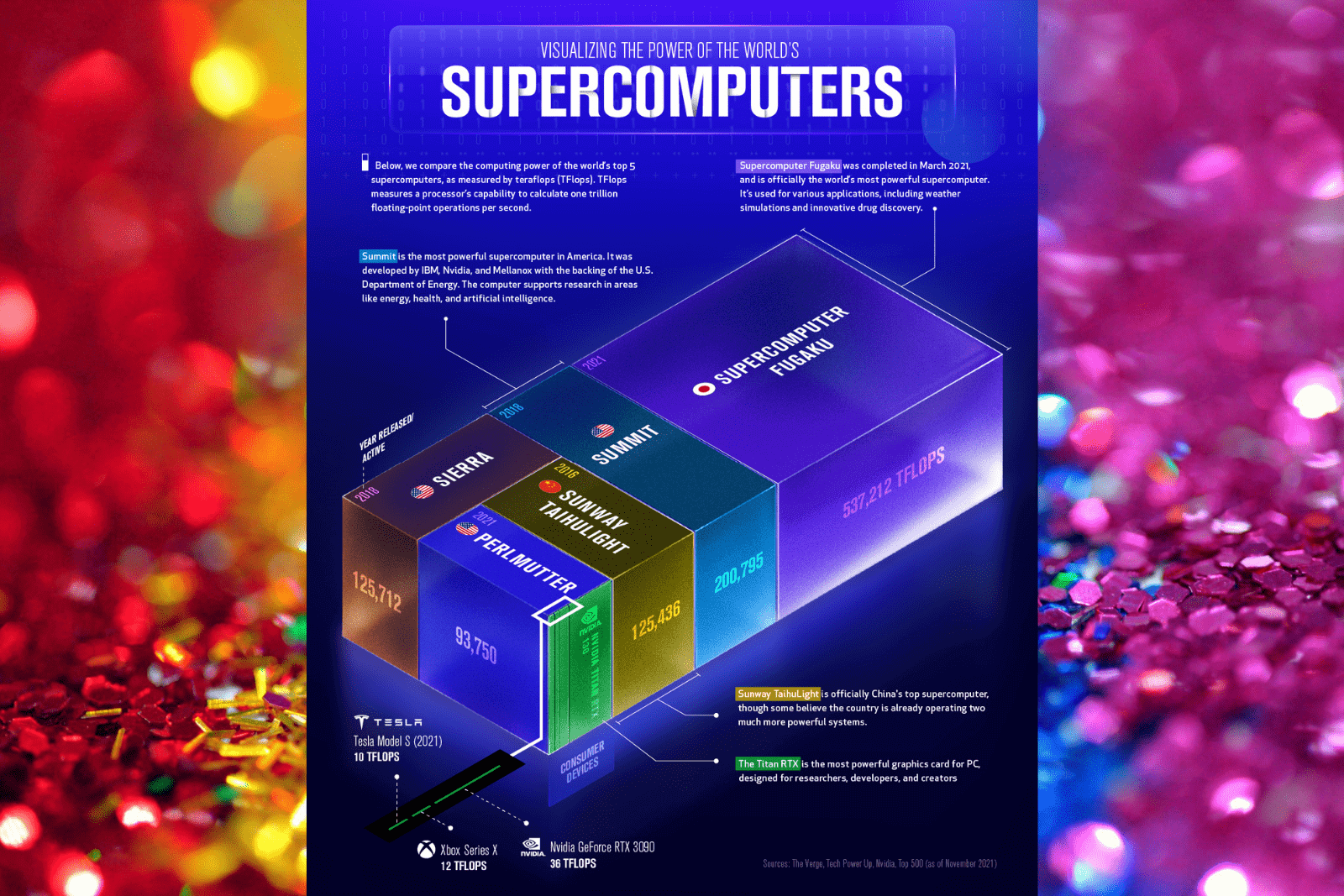

Visualizing the power of the world’s supercomputers

A common metric for measuring the performance of these machines is flops , or floating-point operations per second .

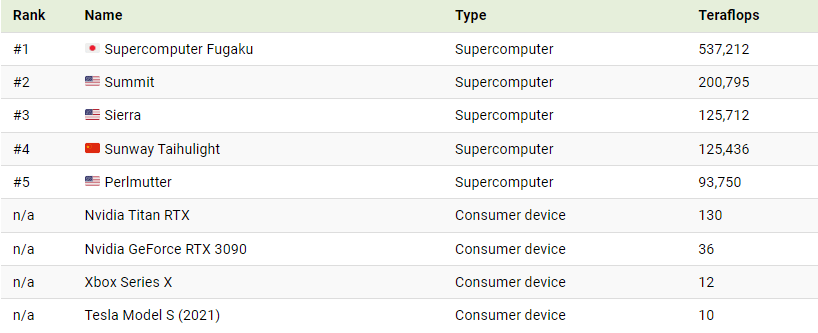

In this visualization, we used TOP500 data from November 2021 to visualize the computing power of the top five supercomputers in the world. For additional context, a number of modern consumer devices were included in the comparison.

Ranking by teraflops.

Because supercomputers can reach more than one quadrillion flops, while consumer devices are much less powerful, we used teraflops as our comparison metric.

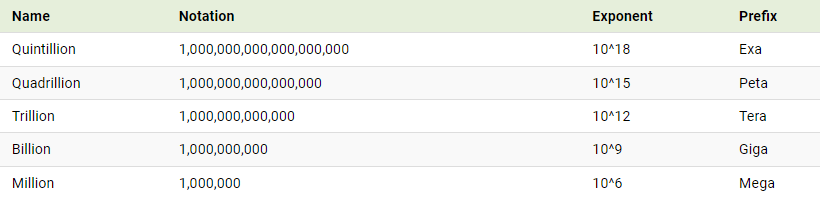

1 teraflop = 1,000,000,000,000 (1 trillion) flops.

The Fugaku supercomputer was completed in March 2021 and is officially the most powerful supercomputer in the world. It is used for various applications, including weather modeling and discovery of innovative drugs.

Sunway Taihulight is officially recognized as the best supercomputer in China and the fourth most powerful supercomputer in the world. That said, some experts believe there are already two much more powerful systems operating in the country, based on data from anonymous sources.

As you can see, the most advanced consumer devices don’t even come close to the power of supercomputers. For example, it would take the combined power of 4,000 Nvidia Titan RTX graphics cards (the most powerful consumer card available) to match Fugaku.

Future supercomputers

One of China’s undisclosed supercomputers is supposedly called Oceanlite and is the successor to Sunway Taihulight. It is believed to have reached 1.3 exaflops or 1.3 quintillion flops. The following table makes it easy to keep track of all these big numbers.

In the U.S., competing chip makers AMD and Intel received contracts from the U.S. Department of Energy to create exascale supercomputers. AMD has Frontier and El Capitan, and Intel has Aurora.

The EL Capitan project also involves Hewlett Packard Enterprise (HPE) , which claims that the supercomputer will be able to reach speeds of up to 2 exaflops when it is completed in 2023. All this power will be used to support several interesting projects:

Incorporate advanced modeling and simulation to support the U.S. nuclear arsenal and ensure its reliability and safety.

Reduce anti-cancer drug development time from six years to one year through a partnership with pharmaceutical company GlaxoSmithKline.

Understand the dynamics and mutations of RAS proteins that are associated with 30 percent of human cancers.

Overall, exascale computing allows complex analysis in seconds, not hours. This could open up an even faster pace of innovation.

#typesofsupercomputer

#frontiersupercomputer

#fastestsupercomputerofworld

#perlmuttersupercomputer

@ESG_Stock_Market