The first target for TMF. If you like this format of information submission, please like and subscribe. I will consider TLT

https://t.me/stockesg – group

https://t.me/ESG_Stock_Market – channel

@ESG_Stock_Market

The first target for TMF. If you like this format of information submission, please like and subscribe. I will consider TLT

https://t.me/stockesg – group

https://t.me/ESG_Stock_Market – channel

@ESG_Stock_Market

Already available! The weekly World Economic Digest (Wednesday) on 20.08.2023 presents the most significant economic events and their impact on the world economy. In this issue, we will look at the latest updates in world trade, the development of financial markets, changes in the political situation and their possible impact on international firms and investors.

UK CPI: THE BASELINE INDICATOR RAISES CERTAIN CONCERNS

The growth of consumer prices in the UK in July was 6.8% kg vs 7.9% yoy and 8.7% yoy two months earlier (forecast: 6.8%). Monthly rates: -0.4% mm vs 0.1% mm and 0.7% mm in June-May (forecast: -0.5%). The annual indicator is moving away from the maximum marks that were reached in October last year (11.1% yy)

The biggest contribution to the monthly CPI change was made by the reduction in electricity and gas prices. But prices for transport and hotel services are rising.

At the same time, that the annual pace of the base CPI remained in place: 6.9% yy vs 6.9% yy and 7.1% yy earlier (forecast: 6.8% yy), and monthly – increased: 0.3% mm vs 0.2% mm and 0.9% mm (0.2% mm was expected)

The situation with prices in the UK is still the most problematic among the most developed Western countries. VoE has not yet announced any plans to mitigate its PREP

EUROZONE ECONOMY: SMALL SIGNS OF IMPROVEMENT, GOOD GROWTH IN FRANCE

According to a preliminary estimate by Eurostat, Eurozone GDP growth in 2Q2023 was 0.3% QoQ vs 0.0% QoQ and -0.1% QoQ two quarters earlier. Recall that during the third assessment, the pace of the first quarter was revised up (from -0.1% QoQ to 0.0% QoQ), i.e. there is no recession on the continent. Annual dynamics decreased: 0.6% kg vs 1.1% y.

In the context of countries where the growth rates have become higher, Lithuania (2.8% QoQ vs -2.1% QoQ) turned out to be quite unexpectedly, the rates of steel were higher in Ireland (3.3% QoQ vs -2.8% QoQ) and Slovenia (1.4% QoQ vs 0.7% QoQ). The situation is worse in Italy (-0.3% sqq vs 0.6% sqq) and Austria (-0.4% sqq vs 0.1% sqq)

Leading economies of the region: Germany (0.0% sqq vs -0.1% sqq, recession is over), France (0.5% sqq vs 0.1% sqq).

British inflation has slowed down on tariffs... but it remained high

Consumer prices in the UK fell by 0.4% mom in July, annual inflation slowed to 6.8% YoY, but the Bank of England is unlikely to be happy here, because inflation remains the highest among the largest developed economies, and the slowdown in inflation is again more modest than expected. The slowdown in inflation is based on a planned reduction in gas tariffs (-25.7% mom and 1.4% YoY) and electricity (-8.6% mom and 6.7% yoy), i.e. the effect of rising energy prices has almost gone out of inflation, and inflation has remained high.

Although the impact of food price growth remains partially here (0.2% mom and 14.8% YoY), but commodity prices fell by 1.7% mom and are growing by 6.1% YoY.

But prices for services continue to grow actively by 1% mom, annual growth accelerated to a record 7.4% YoY. As a result, core inflation remained at the June level of 6.9% YoY, which is only slightly higher than the May record of 7.1% YoY. Medicine (8.9% YoY) and restaurants/hotels (9.6% YoY) rose the most cheerfully. In general, core inflation remains extremely high, and the Bank of England’s current rates remain in a deeply negative zone.

The markets, of course, are trying to play a little in favor of the pound and the Central Bank’s tougher policy on the rate, government bond yields are growing again, debt servicing is becoming more expensive, yields are near highs, and it will be increasingly difficult for the Bank of England not to notice this.

#UK #inflation #economy #rates #BOE

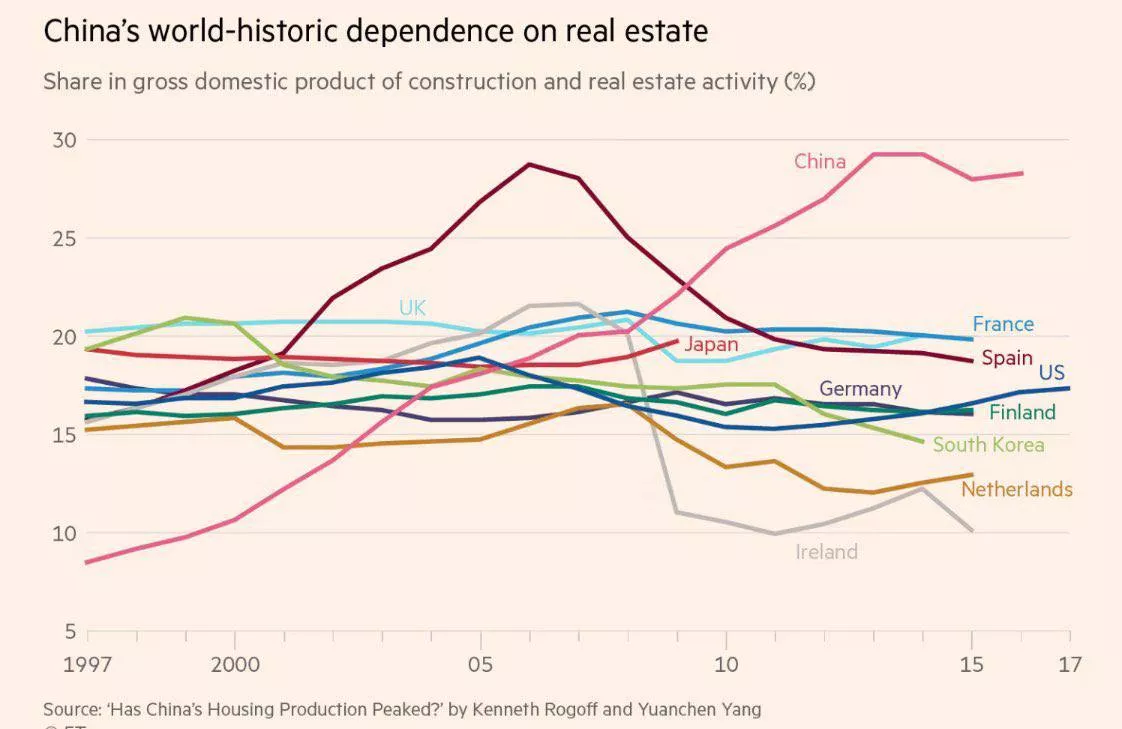

The real estate sector accounts for 30% of the Chinese economy.

Currently, there are 50 million vacant apartments in China, which indicates unfavorable prospects in the country’s construction industry. The media are increasingly publishing negative headlines about the economic situation in China and its prospects.

#china #gdp #real estate #economy

Thrifty Chinese …

While everyone is waiting for a decision on the rate of the Bank of Russia, China has published the main economic reports for July:

Industrial production slowed down to 3.7% YoY against 4.4% in June, indicating a deterioration in the dynamics in the manufacturing sector, which is associated with both weakening external demand and weak domestic demand. Adjusted for seasonality, there was simply no production growth in July (0% mom).

Retail sales increased in nominal value by only 2.5% YoY, in real terms, the growth is comparable. Directly in July, retail sales decreased -0.1% mom adjusted for seasonality, a big role was played, of course, by a drop in sales of building materials, but this was offset by an increase in catering costs.

#China #economy #manufacturing #retail #rates

Chinese banks have faced difficulties due to economic fluctuations and growing problems in the real estate market

📌 Chinese banks, which reported earnings next week, are struggling with a number of operational challenges as the economy and real estate market falter.

China Construction Bank Corp., Bank of Communications Co. and China Merchants Bank Co. may face a heavier reserve burden in the second half of 2023 and early 2024 after developer Country Garden Holdings Co. couldn’t pay the dollar bonds on time. Global investors, including BlackRock Inc. and Allianz SE, have also recently invested in bonds.

Banks also faced scrutiny after the shadow bank Zhongrong International Trust Co. missed payments on dozens of products and planned to restructure debt. The liquidity problems highlight how problems in the real estate sector and a weak economy are affecting the financial sector.

According to Bloomberg Intelligence analyst Francis Chan, the impact of local government financial instruments and the deflationary economy exacerbate the pressure.

Chinese Investors rush into municipal bonds, hopes for government support outweigh debt Problems

▪️ China’s promise of a “comprehensive” package to solve local debt problems has caused a stir regarding bonds issued by local government financial institutions (LGFV), as investors feel an implicit state guarantee for these provincial firms.

The yield on LGFV bonds, which account for half of China’s corporate bond market, has fallen to its lowest level this year, even despite the deepening debt crisis in the real estate sector, to which most of them are exposed.

However, investor confidence in LGFV bonds worth about $1.9 trillion returned after the July meeting of the Politburo of China, at which senior politicians announced their intention to develop a comprehensive scheme to eliminate local debt risks.

Chinese Asset Manager Signals Debt Review, Stoking Contagion Fears

A major Chinese asset manager has told its investors that it needs to restructure its debt, raising fears that a chain of defaults could spread to the financial sector and cause a destabilizing shock to the country’s weakened economy.

Zhongzhi Enterprise Group, which raises money from companies and the general public and reportedly manages assets of 1 trillion yuan ($137 billion), spoke about the restructuring at a meeting with investors on Wednesday, as shown by a video viewed by Reuters.

Concerned retail investors are bombarding listed companies with questions about their exposure to Zhongrong, a subsidiary of Zhongzhi, after the trust company’s missed payments raised fears of a wider spread.

Goldman: India is becoming popular among foreigners again

According to Goldman Sachs Group Inc., shares of Indian companies with medium capitalization are gaining popularity among foreign investors again after a five-year decline.

“We are seeing a sharp change in the share of foreigners in the ownership of Indian mid—cap companies,” strategists, including Amorita Goel and Sunil Cole, wrote in a note on Wednesday, referring to their analysis of stock ownership data for the second quarter.

They added that the share of foreign investors with average capitalization increased by 175 basis points to 16% of their market capitalization this year, compared with a drop of 250 basis points over the past five years.

The return of the world’s money to smaller and riskier Indian stocks shows their confidence in the Indian stock market, despite concerns about the valuation premium. Small stocks attract foreign buyers, even though they remain more expensive than large ones.

🔺 The S&P BSE MidCap index is up more than 20% this year, surpassing the 7.4% gain in India’s benchmark stock index. According to data compiled by Bloomberg, it trades 24 times on a profit-based valuation, versus 19 times on the Sensex index.

According to data compiled by Bloomberg, the Indian stock market has received about $15.5 billion in net foreign exchange inflows this year, which is almost $1.5 billion less than last year’s record outflow. This support helped Sensex to rise by 14% compared to the March low amid minor changes in the indicator of emerging market stocks due to the sell-off of risky assets in China.

* According to Goldman strategists, international investors preferred Indian stocks focused on the domestic market more than local investors, while their share increased most in the consumer and cyclical sectors.

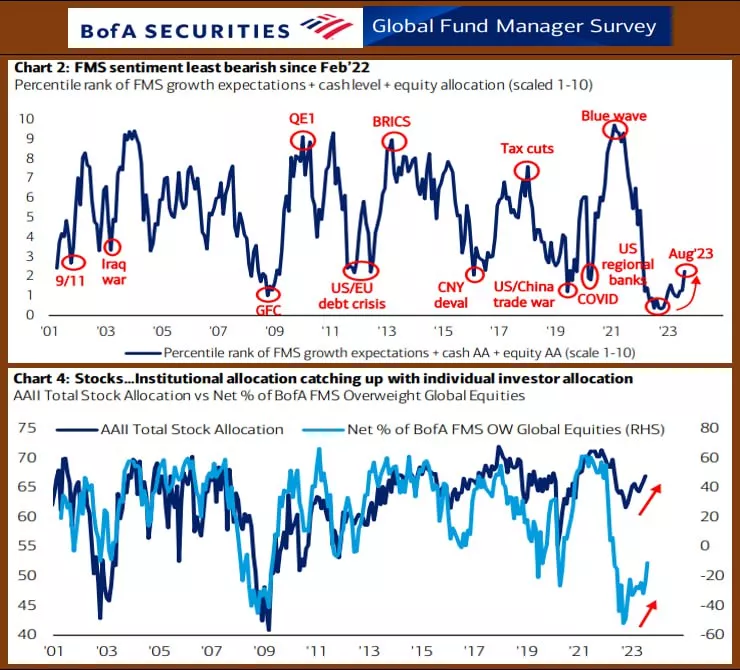

BofA GLOBAL FUND MANAGERS SURVEY: OPTIMISM HAS GROWN SIGNIFICANTLY, ESPECIALLY IN STOCKS

The result of the August survey of managers (Global FMS):

• Least bearish FMS since February 2022

• Global economic growth expectations: 4/10 say a recession is “unlikely” (it was 1/10 in November 2022)

• Forecasts for the start of Fed rate cuts are now the highest since November 2008.

• Three quarters of respondents expect a soft landing of the American economy

• The CASH level has significantly decreased: from 5.3% to 4.8%, this is a 21-month low

• The lowest Underweight in stocks since April 2022,

• The largest Overweight in Tech stocks since December 2021

USA: SOME RECOVERY IN INDUSTRY, AND MORE OBVIOUS - IN CONSUMER DEMAND

Industrial production index in July: 1.0% mm vs -0.8% mm and -0.5% mm. Annual dynamics: -0.23% yy vs -0.78% yy . We were waiting for 0.3% mm and -0.1% yy.

Extraction: 2.0% vs 2.8% yy in June, processing: -0.7% yy vs -0.3% yy, utilities: -0.9% yy vs -6.2% yy . For some subcategories in processing , the dynamics are as follows – consumer goods: 0.2% yy vs -0.7% yy earlier, equipment: – 0.2% yy in these two months, building materials: -2.7% yy vs -1.1% yy

Retail sales (non-inflation adjusted) in the States showed an improvement in dynamics in July: 0.7% mm vs 0.3% mm, annual rates: 3.17% yy vs 1.6% yy. The figures came out noticeably better than expected in 0.4% mm and 1.5% yy. The base indicator was also higher: 1.0% mm vs 0.4% mm with a forecast of 0.1% mm.

By breakdown, the growth is shown by purchases in online stores (1.9% yy), sports and hobbies (1.5% yy), catering (1.4% yy), and clothing (1% yy), while cars (-0.3% yy), furniture stores (-1.8% yy), electronics decreased (-1.3% yy).

LEADING INDICATORS OF LEI: THE FALL CONTINUES

The US Leading Indicators Index (LEI) calculated by the Conference Board decreased from June 106.2 to 105.8 points in July, this is -0.4% mm and -9.1% yy vs -0.7% mm and -9.4% yy a month earlier. This is the sixteenth consecutive month of falling LEI.

The Conference Board notes that “… the prospects remain very uncertain. Weak new orders, high interest rates, a deterioration in consumers’ perception of the prospects for business conditions and a reduction in working hours in the manufacturing industry contributed to the decline of the leading indicator, which still indicates that economic activity is likely to slow down and turn into a moderate recession in the coming months. Now the Conference Board predicts a short and shallow recession in the period from the 4th quarter of 2023 to the 1st quarter of 2024…”

FED: THE RHETORIC REMAINS QUITE TOUGH, DO NOT COUNT ON A RATE CUT THIS YEAR

The Federal Reserve’s balance sheet has shrunk by $67 billion over the past week. vs +$1 billion a week earlier. Now it is $8.197 trillion. From the highs ($9.015 trillion), the balance decreased by -$818 billion

The rhetoric of the Fed representatives:

Williams, Harker:

• the rate may be reduced, but not earlier than 2024

Bowman:

• I do not rule out a further increase in the rate

Harker:

• we have to keep the bid high for a long time

Given:

• it is very premature to talk about a rate cut

Kashkari:

• * uncertainty that enough work has been done to reduce inflation

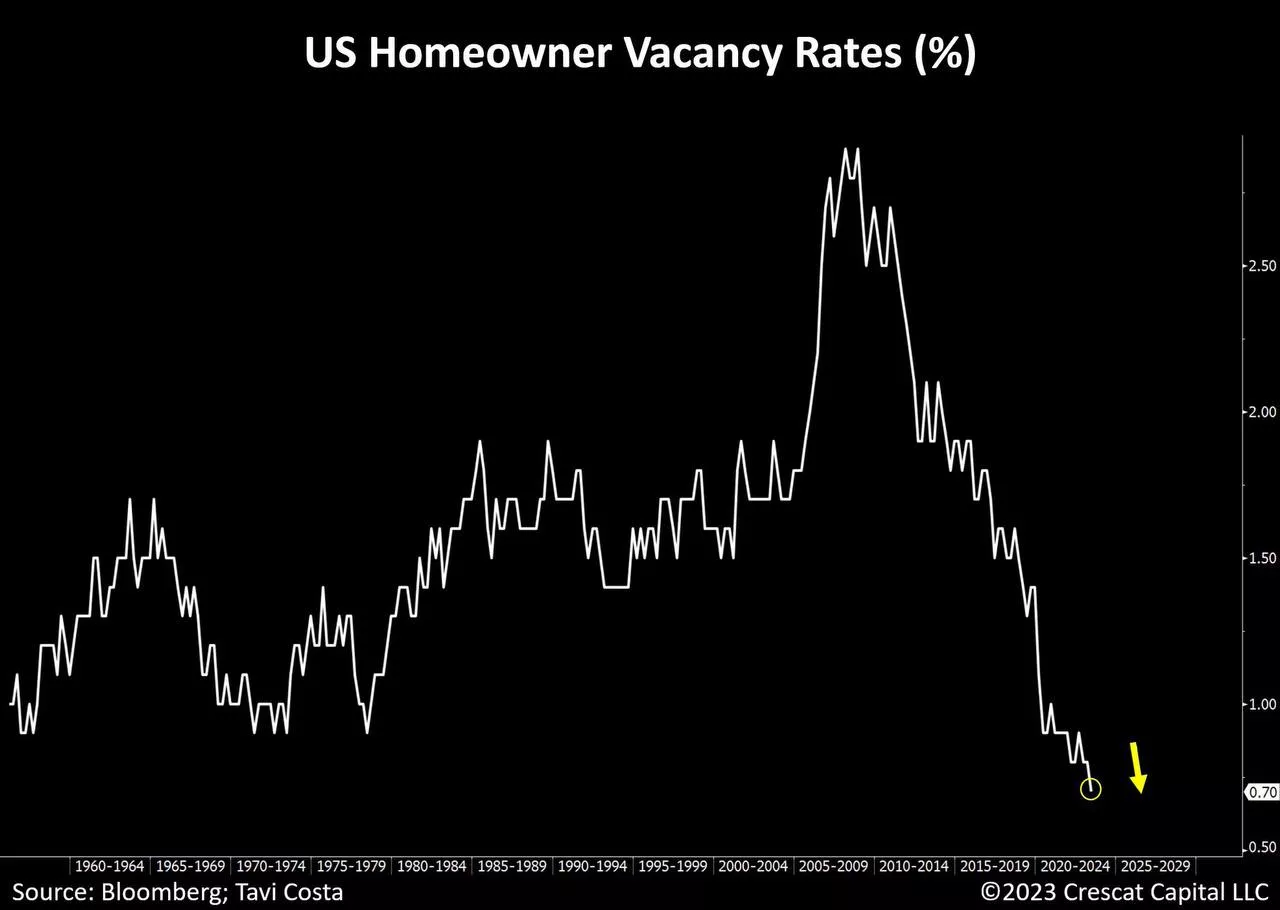

This chart has changed my understanding of the real estate market in the United States, and I think it will cause you a similar reflection.

The share of unoccupied space in the American real estate market has reached its lowest values in the last 60 years. Consequently, there is a housing shortage, in contrast to the surplus before the mortgage crisis of 2008.

Experts in the field of real estate in the USA note that the deficit is associated with the active purchase of space by funds and other institutional investors. If this is the case, then it distorts the real demand, since eventually people should live in these premises. The funds, in fact, act as intermediaries, and the question of whether they will be able to sell the acquired areas remains open. Only then will the real demand become clear.

Regardless of the real reasons for the high demand in the American real estate market, today the construction sector in the United States remains stable, supporting the demand for materials and labor resources, which, in turn, contributes to inflationary processes.

#usa #real estate #economy #housing

The graph of expectations regarding the prospects of the American economy of CEOs, who expected the worst last year, looks interesting.

When earlier CEO expectations were at lows, the S&P500 index also set a multi-year low.

In my opinion, the current situation in the US economy and stock market can be compared with the 70-80 years of the last century. This makes it pointless to compare the cycles of events in the current century, since the influence of inflationary processes can violate any established patterns.

However, the revealed pattern has its own value: only in the case of a decrease in inflation, we can expect a strengthening of the US economy and stock market. So far, the data for July signal stable inflationary processes.

#forecasts #estimates #usa #ceo #economics #analytics #sp500

USA: consumer consumes

Last week, data on manufacturing and retail in the United States were released, retail sales increased by 0.7% mom, which is quite good, considering that quite volatile car sales even declined in July. In real terms, sales have also grown, although fluctuations have been occurring here for a long time without obvious dynamics, just after a sharp increase in covid, sales have stabilized at historically high levels. Excluding cars, gasoline and food, sales increased by 1.1% mom and 5.9% YoY. In general, the American consumer is quite indifferent to the Fed’s attempts to slow down demand.

Production in the United States in July increased by 1% mom, but the data for the past months revised down, because the annual dynamics remained negative -0.2% yoy. In the manufacturing industry, the situation is worse +0.5% mom, but -0.6% YoY. At the same time, capacity utilization at sufficiently high levels and significantly increase production will not work, which in itself is an inflationary factor.

The Fed’s minutes are not aggressive in general, but the markets have tightened, because “most central bank officials still see significant risks of rising inflation, which may require further tightening of monetary policy.” Against this background, the pressure on risky assets has increased, bonds have gone under a new wave of sales, which is reinforced by large budget deficits (which keep the economy overheated). In reality, this only increases the likelihood of a scenario where problems will first come to the financial sector, which will be increasingly affected by the rate increase that has already occurred, and only then will they reach an economy that is under strong budget support… while.

Government bonds have gone to new highs, mortgage rates in the US have reached records since the early 2000s, it should be interesting in the fall and winter.

#USA #economy #retail #manufacturing #rates

⚡️ S&P: on all shoulders... records

The July report on margin positions on the US stock market set new records – the volume of margin positions increased by $29 billion in a month to $710 billion – the maximum since last spring. Although this is still below the records of 2021, when there was more than $900 billion, but the situation is objectively different, because there was only $148 billion of free cache on margin accounts.

As a result, the ratio of the volume of margin debt to free balances on margin accounts flew up to 4.8, i.e. we see a record leverage on the American market by the end of July, with a slowdown in market growth. A large leverage is always the pain of margin calls and corrections during a market reversal.

In June, it also turned out that in addition to the growth of margin positions, foreigners also aggressively bought up American stocks. For the first time in history, inflows into stocks exceeded $120 billion in one month. On the AI-HYIP, both foreigners and Americans were tightly packed into the market… the latter are in debt with a far from low cost margin, given the Fed’s rate hike. To this it is worth adding another background of cashbacks, which will shrink as the profits of companies shrink against the background of rather expensive borrowings.

#USA #SP #stocks

Powell and Yellen are miracles of balancing act...

The Fed’s assets decreased by an impressive $62.5 billion this week, of which the portfolio of government bonds decreased by $42.4 billion, but there was no less money in the system. Because the US Treasury this week reduced its “cache” balance on the Fed’s accounts by $47.4 billion to $384.8 billion at once – in fact, Powell withdrew it synchronously, Yellen added not for the first time, which indicates a fairly high level of coordination. At the end of September, the US Treasury wants to have $650 billion of “cash” in the account.

At the same time, Yellen’s office continued to increase debt, and not only spent its cash reserve – since the beginning of the month, market debt has increased by $ 142 billion and everything is still following the trajectory of further growth of the budget deficit in August, although it has not been the whole month yet – we’ll see.

As a result, despite a rather sharp reduction in the Fed’s balance sheet, the banks did not have much less money. But if the Finance Ministry implements its plan, it will need to withdraw more than $250 billion from the system by the end of the quarter, especially in September, when there is usually a budget surplus. There are no fewer dollars in the system yet, but the supply of public debt is growing (both due to loans from the Ministry of Finance and due to a reduction in the Fed’s portfolio), which continues to put pressure on yields – the public debt curve is growing. Yellen has to give a premium on bills relative to the futures curve.

At the same time, the balance sheets of money market funds continue to swell, which have grown to a record $5.57 trillion, i.e. by $0.75 trillion since the beginning of problems in the banking sector. In autumn and winter, the momentum of monetary tightening will increase, and the fiscal momentum (given the growing cost of debt servicing) will have to be reduced.

#USA #inflation #economy #Fed #debt #rates #dollar

Comparison of forecasts of the market of “critical” minerals (important for energy transfer) August 2023 from the International Energy Forum (IEF)

The New World Gas Order: Prospects for 2030 (July 2023) from The Oxford Institute for Energy Studies

Results of the day, August 14

🇷🇺 The euro exchange rate on the Moscow Exchange exceeded 111 rubles for the first time since March last year, the dollar is more expensive than 101 rubles.

Today Telegram turns 10 years old — Pavel Durov said that during this time more than 800 million people have registered in the messenger, only thanks to word of mouth.

🕵️♂️ Scammers deceived a Muscovite for more than 23 million rubles in BTC — the guy met with “traders” on Instagram and they promised him to increase his capital through trading on the stock exchange.

👀 Someone accidentally leaked $2 million — the user sent 2 million aUSD to Binance to the USDT address, now he is asking for help.

💰 The payment giant PayPal has announced the launch of a crypto hub “for selected users”.

🇨🇦 The Coinbase crypto exchange is being launched in Canada.

🏡 Huobi founder Li Lin bought a house in Hong Kong for $128,000,000 — this is one of the most expensive mansions in the country.

Elon Musk’s company has received a license to provide payment services in the U.S. state of Georgia.

Justin Sun stated that he is a supporter of the first cryptocurrency and is now spending more than 100,000 BTC.

A bitcoin whale with 1005 BTC ($29.8 million) on its account woke up after 13 years of hibernation.

Results of the day, August 15

The publisher of the GTA series of games, Take-Two company, launches the first crypto game called Sugartown on the Ethereum blockchain.

👁 Big brother is watching you through the keyboard.

A Chinese resident was sentenced to 9 months in prison for buying 13,000 USDT — he will also be required to pay a fine of 5,000 yuan ($690).

📊 BTC volatility has updated the absolute minimum. The indicator stopped at 15.52%. The previous low of 18.91% was recorded on January 12, 2018.

The Central Bank of the Russian Federation and a group of banks are beginning to test the digital ruble (CBDC).

👀 With Gemini, 10,798 BTC and 39,540 ETH were withdrawn in two transactions in a short period of time — a total of $390 million.

Binance has filed a petition against the SEC in court — the exchange wants the regulator to be banned from interrogating witnesses on issues beyond the scope of the case.

🇪🇺 The first spot Bitcoin ETF with the ticker BCOIN has been launched in the European Union on the Euronext Amsterdam exchange.

Results of the day, August 16

Uzbekistan has allowed two private banks to issue cryptocurrency cards.

💸 Yuri Dud advertises Binance.

🔪 An American crypto investor was found dismembered in Bulgaria — a familiar bartender was involved in the murder.

52 years ago, Richard Nixon abolished the gold standard.

The head of the SEC has shown interest in regulating the artificial intelligence market.

Elon Musk said that Mark Zuckerberg refused to fight with him in the Roman Colosseum. Now he hints that the idea of a duel is a joke.

🪙 Donald Trump owns approximately $5 million in Ethereum, new financial reports show, confirming the source of income — the sale of NFT and royalties.

The author of the bestseller “Rich Dad, Poor Dad” and entrepreneur Robert Kiyosaki predicted a rise in the price of BTC to $ 1 million in the event of a collapse of the global economy.

On August 16, Binance will stop the operation of the platform for exchanging fiat for the Binance Connect cryptocurrency (Bifinity).

💸 Coinbase has received approval to trade cryptocurrency futures in the United States.

Results of the day, August 17

Salvadoran cryptans teach 12-year-olds how to send BTC.

🧬 The Shiba Inu meme project has launched its own L2 blockchain on Ethereum called Shibarium – the network has already broken down, and $2.6 million of user funds are now temporarily blocked.

Polygon Labs has entered into partnership agreements with a major Korean telecom operator SK Telecom.

China will allocate more than $34 billion for the creation and development of a Metaverse in Sichuan Province.

Hackers from the DPRK in 2023 stole over $180 million in cryptocurrencies — in total, since 2015, North Korea has stolen virtual assets worth more than $1.5 billion.

Opinion: if the SEC gives the green light to Bitcoin ETF, the first cryptocurrency will be able to overcome the $150,000 mark and approach $180,000.

🪙 Tether will stop issuing USD₮ on Omni, Kusama and Bitcoin Cash SLP from August 17.

Results of the day, August 18

🐹 Against the background of news about the possible bankruptcy of Evergrande and the sale of Cue Balls by SpaceX, the crypto market has fallen.

🪙 Tonight, one trader was liquidated by $55.92 million on Binance — he had 38,896 ETH in the long.

Roskomnadzor restored access to the OKX exchange for users from Russia.

The British payment provider Checkout terminated the contract with Binance due to problems with compliance with regulatory requirements and AML.

🪙 Dogecoin-whales are actively accumulating coins.

Tether Technical Director Paolo Arduino announced 3 new mass products by the end of the year.

⛔️ Hackers hacked the vending protocol Exactly Protocol in the second-level network of Optimism and brought out more than 7160 TK (~$12 million).

The court rejected Coinbase’s motion to lift sanctions against Tornado Cash.

🪙 15 years ago, on August 18, 2008, the anonymous creator of Bitcoin Satoshi Nakamoto registered the domain bitcoin․org.

Monday 21.08

• 🇨🇳 China, Central Bank meeting (est. 3.40%, -15 bp)

Tuesday 22.08

• 🇺🇸 USA, second home sales, July (est. 4.15M)

Wednesday 23.08

• 🇦🇺,🇯🇵,🇪🇺,🇩🇪,🇫🇷,🇬🇧,🇺🇸, Flash PMI (August)

• 🇺🇸 USA, new construction, July (est. 701K)

* • USA, building permits,July (est. 1.442K)

* 🇷🇺 Russia, weekly inflation MMI Forecast: 0.05%

• 🇷🇺 Russia, industrial production, July

Thursday 24.08

• 🇹🇷 Turkey, Central Bank meeting

• 🇺🇸 * USA, Initial Jobless Claims (asp. 244K)

• 🇺🇸 USA, Jackson Hole Symposium 24-26.08

• 🇺🇸 USA, the sale of goods lasts. usage (est. -4.0% mm)

Friday 25.08

• 🇩🇪 Germany, GDP, 2Q23 (est. 0.0% mm, -0.2% yy)

https://t.me/stockesg – group

https://t.me/ESG_Stock_Market – channel

@ESG_Stock_Market

Already available! The weekly World Economic Digest (Wednesday) on 30.07.2023 presents the most significant economic events and their impact on the world economy. In this issue, we will look at the latest updates in world trade, the development of financial markets, changes in the political situation and their possible impact on international firms and investors.

In June, after mortgage rates rose to ~6.8% per annum on a thirty-year mortgage in the United States, the average mortgage payment set a new record of $2.16 thousand per month, or 51.2% of the average salary of non-management personnel.

Relative to the s/p, the payment for the first time turned out to be higher than the highs of 1989 and 2006.

USA: housing prices are rising

The S&P/Case-Shiller US house price index in May showed a third consecutive month of growth, this time by 0.7% mom (sa), the annual price drop was a modest 0.5% YoY, after a 44% increase since 2019, prices have so far only moderately adjusted and that is mainly due to inflation. In real terms, the dynamics of prices are worse, but here, too, price growth has been outpacing inflation for three months in a row. In the 20 largest cities, prices increased by 1% mom, although they decreased by 1.7% YoY.

Moreover, according to Zillow, prices continued to rise in June, and nominal prices were able to rise above the highs of 2022. Although after the rise in mortgage rates, the demand for houses shrank, but the supply also decreased. Rent, although it has slowed down growth, has reached new highs and is adding further.

U.S. consumer confidence rose in July. An interesting point is that although more than 70% of American households believe a recession is likely, most of them personally expect the situation to improve.

PS: The Fed will raise the rate by 25 bp today, and the signal may be tougher than the market expects.

The Fed, as expected, raised the rate by 25 bps to 5.25-5.50%, the market was fully laying this decision, so there are no surprises here.

Recently, the belief in the markets that this is the last increase has started to decline a little, although it dominated. The Fed practically repeated the June statement, leaving itself the opportunity to raise the rate in the fall, but still the general tone is expected to be a little more cautious.

QT will continue at the same volumes, Powell may try to add some rigidity… but the market doesn’t really believe him.

US GDP – on government incentives and services

US GDP growth in the second quarter was 2.4% QoQ in annual terms (0.6% QoQ), annual growth was 2.6% YoY (but it should be taken into account that in the first half of 2022, GDP was declining, i.e. relatively low base). In fact, the entire growth of 2.4% is:

✔️ Consumption of services with a contribution of 0.9 pp (the one that supports inflation);

Growth of investments of companies with a contribution of 1.1 percentage points (mainly subsidized under state programs);

✔️ Growth of government spending with a contribution of 0.4 pp.;

On the one hand, the growth is certainly higher than expected, on the other hand, its structure is still largely launched state stimulus programs with a huge budget deficit and record interest costs, as well as the inflationary service sector with a fairly strong labor shortage – the number of new applications for benefits is again declining.

All this will complicate the situation for the Fed, especially if some price increases from the resource markets are added…

#USA #economy #GDP #mortgage #real estate #rate #fed #rates #inflation #crisis

The total volume of China’s external payments on the current and financial account increased by $268 billion, while in dollars it decreased to $226 billion. Payments in yuan for the last 4 months have consistently exceeded payments in dollars and in general exceeded dollar payments for the first half of the year.

The total volume of receipts from foreign economic activity to China in June rose to $264 billion in yuan and amounted to $255 billion in dollars. Although here the yuan has surpassed the dollar only in the last 2 months and for half a year so far the dollar has not caught up.

The net balance of income from foreign economic activity in dollars is positive, i.e. more dollars come to China than go (in June + $28 billion). On the contrary, the balance of receipts in yuan is slightly negative (in June – $ 4 billion), i.e. gradually the number of yuan in the foreign market is growing, although extremely slowly.

Last time, the active process of internationalization of the yuan was brought down on the fly and actually stopped for 4-5 years by the crisis in the stock market, which provoked a powerful outflow of capital and the loss of $1 trillion in reserves. After that, conclusions were drawn and the Chinese are promoting the yuan through trade with strict moderation of capital flows.

#CNY #China #export #economy #fx

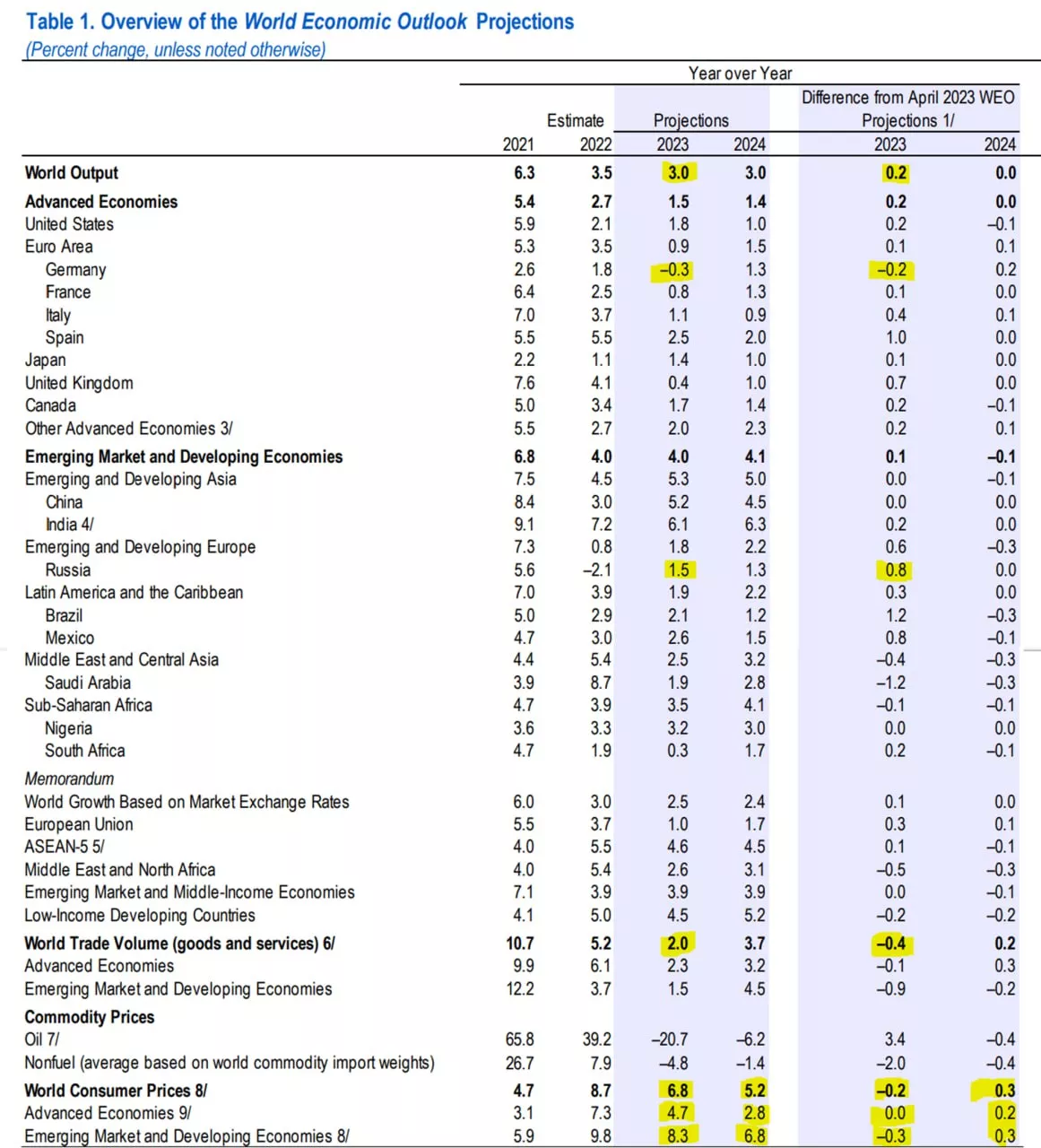

The only major economy that will face a recession according to the IMF is the German economy: -0.3% in 2023, but it will grow by 1.3% in 2024. But in Britain, the IMF did not find a recession. But the forecast for world trade has been lowered. There is every chance in the autumn forecast to see a downward revision.

But the forecast for inflation is 6.8%, for developed countries 4.7% for 2023 – unchanged, but it will not be possible to return to the goal in 2024 (2.8%), for developing countries 8.3% in 2023 and 6.8% in 2024.

#world #IMF #economy

The Bank of Japan left its short-term negative interest rate unchanged at -0.1%. The Central Bank kept the target yield of 10-year bonds at about 0%, but said that its ceiling of 0.5% is a guideline, not a hard limit in an attempt to make its easing program more flexible.

Although formally all the goals have remained the same, the Bank of Japan, trying to find a way out and abandon the control of the yield curve, no longer guarantees a tight retention of the yield of ten-year government bonds below 0.5%. In general, this is the first step in giving up control of the curve, Japan’s government bonds, of course, tried to sell off and the yield jumped to 0.56, the yen strengthened slightly, but the Central Bank will continue active interventions… but the market will try to attack by getting rid of JGB and trying to break the Bank of Japan.

Yesterday, the ECB predictably raised the rate by 25 bps to 4.25%, but it signals the imminent completion of this process, it is obvious that it is becoming increasingly difficult to raise, the economy is close to recession, although inflation is still significantly higher than the target. In September, an increase is still likely, but the ECB no longer gives any clear signals “everything will be determined by data”, just like the Fed.

#Japan #rates #inflation #BOJ #JPY

The International Monetary Fund on Tuesday raised its economic forecast for India this year amid a slight improvement in global growth prospects, but said China’s recovery from the pandemic has weakened.

According to the IMF’s World Economic Outlook bulletin for July, India remains the fastest-growing major economy in the world with growth of 6.1% this year, 0.2 percentage points higher than the IMF’s April forecast. The IMF expects India to account for about a sixth of total global growth this year.

The IMF said China will be the second-fastest growing major economy with a 5.2% growth rate this year, but its recovery from the COVID-19 pandemic is slowing, so the fund left its forecast unchanged.

The IMF currently forecasts that global growth will reach 3% this year, which is 0.2 percentage points higher than in April, but still below the 3.5% growth recorded in 2022.

The exchange rate of the US dollar to the Indian Rupee. Thoughts.

Perhaps for me, as an investor, the main problem of investing in India is the regular fall of the Indian rupee against the US dollar. Although from October 2022 to the present, the rupee to the dollar have been in the same place, moreover, technical indicators speak for a correction, but if you look at history, the rupee is falling all the time. When investing in India in rupees, be sure to keep in mind that with a high probability of 10-15% per year there may be a depreciation of the local currency.

@ESG_Stock_Market

#insiders #stocks #sp500 #nasdaq #sale

An interesting event is taking place on the American stock market – since the beginning of the year, insiders have mostly been selling stocks (the chart is longer and deeper in the bearish zone). Insiders are top managers and CEOs of companies who have more information about their activities than other investors. If they decide to sell their shares in a growing market, this is probably an unfavorable signal for a steady rise in stock prices. @ESG_Stock_Market

The Impact of REPO Operations on the Fed’s Balance Sheet. Half a trillion in a couple of weeks

During the week, the Fed reduced its securities portfolio by a modest $3.5 billion at the expense of MBS, but this is a drop in the bucket compared to the $96 billion that the Fed issued in REPO to banks ($60 billion), loans to banks and FDIC ($36 billion), as a result of these operations, the Fed’s assets increased by another $94.5 billion for the week. At the same time, banks reduced borrowing through an expensive discount window (-$42.6 billion) and increased borrowing under the BTFP program (+$41.7 billion), and the FDIC took an additional $37 billion to pay deposits.

The US Treasury continued to actively spend the “cache” from accounts at the Fed, adding another $77.8 billion to the financial system (of which $28.5 billion is still in the same FDIC for deposit payments), Yellen has only $200 billion left in her accounts, but April is ahead with its annual taxes. In general, the Fed, together with the US Treasury, poured $172.3 billion into the financial system.

In total, in 2 weeks, the US Treasury added $112 billion to the financial system, the Fed poured $ 386 billion, i.e. in the amount of about $0.5 trillion – about as many deposits apparently moved. It is clear that some of them were simply transferred to other banks, more than half went to money market funds and government bonds. Americans did not run much into cash, but they nevertheless became more active ($8.4 billion).

While some banks are running to the Fed for money, others are placing money there through reverse REPO (+$226.9 billion per week) in order to draw beautiful reports. As a result, despite the actively working printing press, money on bank accounts at the Fed has become less by $74.2 billion. In fact, such a story may indicate that the banking system is bad with trust, some banks are actively attracting money from the Fed, others are even more actively parking a free “cache” in it – this is more reliable. In general, “the banking system is stable” (c) Yellen, but banks’ limits on colleagues are beginning to be cut. At the same time, some part of the deposits of the population runs to money market funds, funds working with government bonds received an influx of $276.5 billion in 2 weeks – a record for many years. A little has flowed into cash, but just a little + $8.3 billion.

The most powerful weekly dumping of US government bonds by foreign central banks, which are stored in the Fed, has passed since 2014 – $70 billion in a week, it was more only when Russia dumped in March 2014 ($106 billion). @ESG_Stock_Market

The banks’ opinions on the Fed’s further actions are divided, some believe that the Fed will cut rates in March… someone that leave unchanged… someone who will raise (1-3 times by 25 bps). The market has calmed down a little and is waiting for a 25 bps rate increase (69% probability) rather than remaining unchanged (31%), and another increase in May … but since July, he has been betting on a reduction in rates. The Fed needs to save face…

According to the current decisions on SVB and Signature, $264 billion of deposits need to be returned, of which about $30 billion and about $234 billion should be given by the Fed as collateral for assets (there are not enough securities on the balance sheets of both banks for collateral). The FDIC itself had $128 billion at the end of 2022, mainly in government bonds (for $126 billion of government bonds at face value). In 2021 and 2022, they managed to consolidate ~ $5 billion a year into the insurance fund. One way or another, the Fed will simply “print” about a quarter of a trillion dollars, which the FDIC will receive at 5% + per annum and distribute to depositors. The $25 billion that the US Treasury will provide is an amount close to the difference between the nominal and market value of collateral assets (a guarantee for the Fed).

At the weekend, J. Yellen refused to comment on the Fed’s further actions, saying on duty about the Fed’s independence and that they would evaluate it in the coming days and weeks. At the same time, she actually admitted that bankruptcies are a consequence of high rates: “The problems of this bank, from reporting about its situation, suggest that because we’re in a higher interest rate environment…”. There is no doubt that Yellen and Powell discussed this issue, but most likely no decisions have been made yet.

It is already obvious to everyone that what is happening is a consequence of the increase in rates, it is not obvious to everyone… but these are only the first signs of the consequences of the rate hike cycle, the losses of the financial system from the rate increase will continue to accumulate. For Powell, the situation is extremely unpleasant, a couple of days ago he went “hawk” (and not only he, but also other representatives of the Fed)… whether something has changed with inflation – not significantly. And just like that, to turn around right away is an epic failure and a blow to trust (which is so not very high). The market is already showing what it thinks – the growth of gold / bitcoin, the fall of the dollar, etc.

If inflation had slowed down on Tuesday, it would have been easier for the Fed to justify a reverse move. But no …

#USA #inflation #economy #Fed #debt #rates #dollar

Externally, the report has no large deviations from expectations, total inflation is 0.4% mom and 6.0% YoY, without energy and food 0.5% mom and 5.5% yoy. But in reality, only one–time stories saved from a sharper price increase: used cars (-2.8% mom disinflation after a rapid takeoff), gas (-8% mom – heat), eggs (-6.7% mom disinflation) and medical insurance (-4.1% mom to the current inflationary reality has a very distant relationship). Together, these factors reduced monthly inflation by ~0.2 percentage points – too much.

Grocery inflation slowed down slightly by 0.4% mom and 9.5% YoY, but remains aggressive. Goods without energy, food and used cars added 0.4% mom and 4.2% YoY, growth decently slowed down from highs amid the migration of consumption from goods to services, but in the last three months the price increase has stabilized around 4-5% YoY. The main drive remains in services (0.5% mom and 7.6% yoy), active growth in housing continues (0.8% mom and 8.1% yoy), although this is an inertial growth, transport has accelerated (1.1% mom and 14.6% yoy), but mainly due to air travel (6.4% m/m).

If we discard various one–time emissions, inflation accelerated in February rather, various inflation indices cleared of volatile components remained at the ceiling of 6-7% YoY and even accelerated at the moment. I would still estimate the steady inflationary momentum as 4.5-5%, the New York Federal Reserve estimates at 4.9%. This means that even a neutral rate is 5-5.5%… and a restrictive policy means the rate is even higher. However, the same New York Fed published data on inflation expectations – annual expectations decreased from 5% to 4.2% than the Fed may try to justify caution. But the inflationary history as a whole speaks for an increase further.

PS: If anyone remembers, a couple of years ago, the Fed approved a new strategy and switched to targeting the average inflation rate (the average for 5 years is already 3.5%, for example), so if you approach it quite formally, then in order to fulfill your goals, Powell should lower inflation below 2% and keep it for a long time

@ESG_Stock_Market

5 generators of faces of non-existent people. Neural networks for generating photos of people. A selection of neural networks for generating realistic photos of non-existent people. An alternative to the ThisPersonDoesnotExist site.

Content

1. Random Face Generator

2. Bored Humans

3. Unreal Person

4. Which face is real

5. Generated photos

Creates a random human face in 1 click. Artificial intelligence generates photos of a man, woman or child.

One-click generation.

The AI face generator is based on StyleGAN.

Free generation is available.

Link: https://this-person-does-not-exist.com

This neural network was trained to create fake people using a database of 70,000 photos of real people.

One-click generation.

There is an old version on StyleGAN-Tensorflow and a new version — StyleGAN Chainer.

There are 50 funny pages of Artificial intelligence (AI).

Free service.

Link: https://boredhumans.com/faces.php

It is an artificial intelligence image generator that has been trained on billions of human faces to create a completely new face that does not exist.

One-click generation

Generation of human faces, animals and art images.

Completely free service

Link: https://www.unrealperson.com

All images are either computer generated using StyleGAN software, or are real photos from the FFHQ Creative Commons dataset and publicly available images.

The site offers to guess which photo is real. When you click one of them, the correct option will be highlighted with a green frame. So the second one is a generated neural network.

One-click generation

The page displays 2 photos – one real, the second generated.

Link: https://www.whichfaceisreal.com/index.php

The service generates faces according to the specified parameters.

Generation of faces, portraits, emotions, objects, surfaces

There is a choice of background

There is a choice of face generation, head pose, gender, age and so on.

Free rate and paid rate — $19.99

Link: https://generated.photos/faces/

With each passing year, more and more of the population no longer remembers images loading one line of pixels at a time, the deafening sound of the 56k modem, or the early dominance of Web portals.

Many of the leading Web sites in 1998 were news aggregators or search portals that were easy to understand. Today, brand touchpoints are often spread across devices (e.g., mobile apps and desktops) and multiple services and sub-brands (e.g., the Facebook app constellation). As a result, the world’s largest websites are complex, interconnected web resources.

The above visualization, which primarily uses data from ComScore’s US multiplatform property rankings, shows which of the Internet giants have evolved to stay on top, and which have disappeared into Internet lore.

For millions of curious people in the late ’90s, the iconic AOL CD was the key that opened the door to the World Wide Web. At its peak, an estimated 35 million people used the Internet through AOL , and the company raised the dot-com bubble to dizzying heights, reaching a valuation of $222 billion in 1999.

The AOL brand may no longer carry the cachet it once had, but the brand has never completely faded into obscurity. The company continually evolved and finally merged with Yahoo after Verizon acquired both legendary Internet brands. Verizon had high hopes for a company called Oath, which had become a “third option” for advertisers and users who were fed up with Google and Facebook.

Unfortunately, those ambitions did not materialize as planned. Oath was renamed Verizon Media in 2019 and sold again in 2021.

When Internet use began to reach critical mass, Web hosts like AngelFire and GeoCities made it easy for people to create a new home online.

GeoCities, in particular, had a huge impact on the early Internet, hosting millions of Web sites and giving people a real stake in creating online content. If it were a physical community of “home” pages, it would be the third largest city in America after Los Angeles.

This early online community was in danger of being completely destroyed when Yahoo finally shut down GeoCities in 2009, but fortunately the nonprofit Internet Archive made a special effort to create a thorough record of the pages hosted on GeoCities.

In December 1998, long before Amazon became the well-oiled retail machine we know today, the company was in the midst of the holiday season.

In the real world, employees worked long hours and even slept in their cars to ensure the flow of goods, while online Amazon.com became one of the largest sites on the Internet as people began to get used to the idea of shopping online. . Demand skyrocketed when the company began to expand its offerings beyond books.

Meredith will be an unfamiliar brand to many people reviewing today’s top 20 list. While Meredith’s name may not be a household name, the company has controlled many of the country’s most popular magazine brands (People, AllRecipes, Martha Stewart, Health, etc.), including their significant digital footprints. The company also owned many local television networks in the United States.

After acquiring Time Inc. in 2017, Meredith became the largest magazine publisher in the world. Since then, however, Meredith has sold many of its most valuable assets (Time, Sports Illustrated, Fortune). In December 2021 Meredith merged with Dotdash IAC .

When people have burning questions, they increasingly turn to the Internet for answers, but the variety of sources for those answers is shrinking.

Even as recently as 2013, we see that About.com, Ask.com and Answers.com were still among the largest websites in America. Today, however, Google seems to have cemented its status as the universal answer source.

As smart speakers and voice assistants continue to permeate the market and influence search behavior, Google is unlikely to face competition from any company not already in the top 20.

Social media has long outgrown its quirky stage and is now a common digital thread that connects people around the world. While Facebook quickly made it into the top 20 by 2007, other social media-based brands took longer to evolve into Internet giants.

By 2018, Twitter, Snapchat and the Facebook platform were in the top 20, and you can see a more detailed and up-to-date breakdown of the social media universe here .

Today’s Internet giants have far surpassed their ancestors of two decades ago. Many of the top 20 companies operate numerous platforms and content streams, and more often than not, they are not household names.

Some, such as Mediavine and CafeMedia, are ad management services. Others manage the distribution of content, such as music, or manage a constellation of smaller media resources, as in the case of Hearst.

Finally, there are the technology giants. Notably, in 1998, three of the top five Web resources made the top 20 list. In a rapidly evolving digital ecosystem, this is remarkable resilience.

#internetgiant

@ESG_Stock_Market

While the impact of the COVID-19 pandemic has bypassed few industries, even fewer have been as hard hit as the tourism sector. The World Tourism Organization (UNWTO) reports that, as 2020 drew to a close and severe travel restrictions were still in place, international tourist arrivals were down 74 percent in 2020 from the previous year. This corresponds to a decline of about 1 billion international arrivals, returning the industry to levels last seen in the late 1980s.

Prior to the coronavirus outbreak, the global tourism sector had shown almost uninterrupted growth for decades. Since 1980, international arrivals have soared from 277 million to nearly 1.5 billion in 2019. As our chart shows, the two major crises of recent decades, the SARS epidemic of 2003 and the global financial crisis of 2009, were minor blows in the road compared to the COVID-19 pandemic.

Looking ahead, most experts don’t expect a full recovery in 2021 and 2022, which began with many countries still struggling with the second wave of the pandemic. The UNWTO estimates that it will take 2.5 to 4 years for the industry to return to pre-pandemic levels of international tourist arrivals.

#tourism #coronavirus #COVID-19

@ESG_Stock_Market

The level of customer confidence in businesses varies around the world

A high level of customer confidence will prove critical to business recovery when the pandemic finally comes to an end (or at least approaches a near-normal stage). An Edelman Research survey in November 2021 surveyed 36,000 respondents in 28 countries about their confidence that businesses are “doing the right thing. The study found that people in China, Indonesia and India have the most confidence: 84 percent, 81 percent and 79 percent, respectively.

This figure was much lower in the United States at 49 percent, while in Russia it was even lower at just 34 percent. In just eleven countries trust in business increased, while in eleven it decreased. It is interesting that in 23 out of the 28 countries surveyed, more trust is placed in business than in government. The average level of trust in business globally was 61 percent compared to 52 percent in government.

#trust #client

@ESG_Stock_Market