Post Views: 70

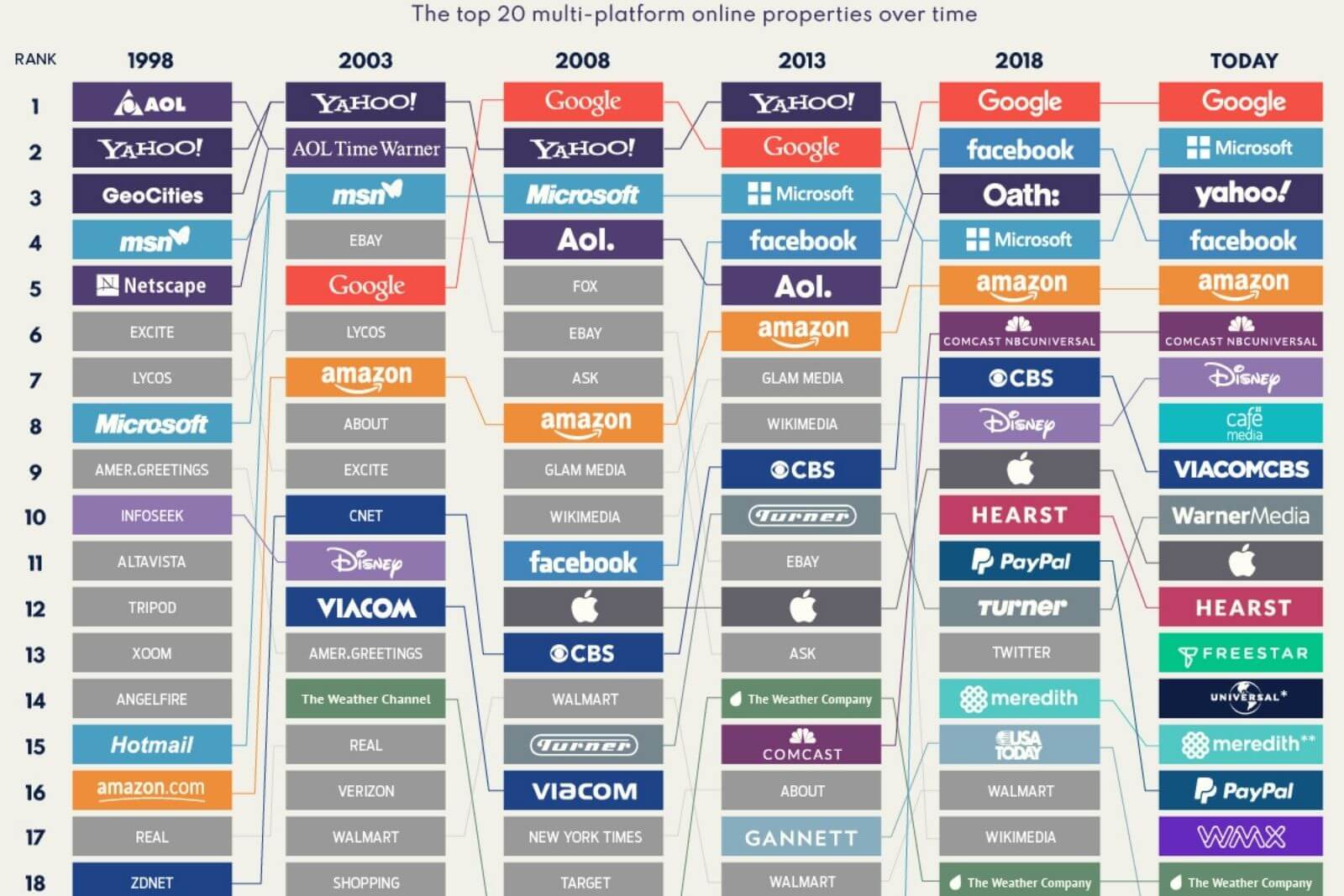

With each passing year, more and more of the population no longer remembers images loading one line of pixels at a time, the deafening sound of the 56k modem, or the early dominance of Web portals.

The 20 Internet giants that ruled the Internet from 1998 to the present

Many of the leading Web sites in 1998 were news aggregators or search portals that were easy to understand. Today, brand touchpoints are often spread across devices (e.g., mobile apps and desktops) and multiple services and sub-brands (e.g., the Facebook app constellation). As a result, the world’s largest websites are complex, interconnected web resources.

The above visualization, which primarily uses data from ComScore’s US multiplatform property rankings, shows which of the Internet giants have evolved to stay on top, and which have disappeared into Internet lore.

America goes online

For millions of curious people in the late ’90s, the iconic AOL CD was the key that opened the door to the World Wide Web. At its peak, an estimated 35 million people used the Internet through AOL , and the company raised the dot-com bubble to dizzying heights, reaching a valuation of $222 billion in 1999.

The AOL brand may no longer carry the cachet it once had, but the brand has never completely faded into obscurity. The company continually evolved and finally merged with Yahoo after Verizon acquired both legendary Internet brands. Verizon had high hopes for a company called Oath, which had become a “third option” for advertisers and users who were fed up with Google and Facebook.

Unfortunately, those ambitions did not materialize as planned. Oath was renamed Verizon Media in 2019 and sold again in 2021.

City of gifs and web logs

When Internet use began to reach critical mass, Web hosts like AngelFire and GeoCities made it easy for people to create a new home online.

GeoCities, in particular, had a huge impact on the early Internet, hosting millions of Web sites and giving people a real stake in creating online content. If it were a physical community of “home” pages, it would be the third largest city in America after Los Angeles.

This early online community was in danger of being completely destroyed when Yahoo finally shut down GeoCities in 2009, but fortunately the nonprofit Internet Archive made a special effort to create a thorough record of the pages hosted on GeoCities.

From A to Z

In December 1998, long before Amazon became the well-oiled retail machine we know today, the company was in the midst of the holiday season.

In the real world, employees worked long hours and even slept in their cars to ensure the flow of goods, while online Amazon.com became one of the largest sites on the Internet as people began to get used to the idea of shopping online. . Demand skyrocketed when the company began to expand its offerings beyond books.

Rack for digital magazines

Meredith will be an unfamiliar brand to many people reviewing today’s top 20 list. While Meredith’s name may not be a household name, the company has controlled many of the country’s most popular magazine brands (People, AllRecipes, Martha Stewart, Health, etc.), including their significant digital footprints. The company also owned many local television networks in the United States.

After acquiring Time Inc. in 2017, Meredith became the largest magazine publisher in the world. Since then, however, Meredith has sold many of its most valuable assets (Time, Sports Illustrated, Fortune). In December 2021 Meredith merged with Dotdash IAC .

Google

When people have burning questions, they increasingly turn to the Internet for answers, but the variety of sources for those answers is shrinking.

Even as recently as 2013, we see that About.com, Ask.com and Answers.com were still among the largest websites in America. Today, however, Google seems to have cemented its status as the universal answer source.

As smart speakers and voice assistants continue to permeate the market and influence search behavior, Google is unlikely to face competition from any company not already in the top 20.

New Kids in the Neighborhood

Social media has long outgrown its quirky stage and is now a common digital thread that connects people around the world. While Facebook quickly made it into the top 20 by 2007, other social media-based brands took longer to evolve into Internet giants.

By 2018, Twitter, Snapchat and the Facebook platform were in the top 20, and you can see a more detailed and up-to-date breakdown of the social media universe here .

The Tangled Web

Today’s Internet giants have far surpassed their ancestors of two decades ago. Many of the top 20 companies operate numerous platforms and content streams, and more often than not, they are not household names.

Some, such as Mediavine and CafeMedia, are ad management services. Others manage the distribution of content, such as music, or manage a constellation of smaller media resources, as in the case of Hearst.

Finally, there are the technology giants. Notably, in 1998, three of the top five Web resources made the top 20 list. In a rapidly evolving digital ecosystem, this is remarkable resilience.

#internetgiant

@ESG_Stock_Market