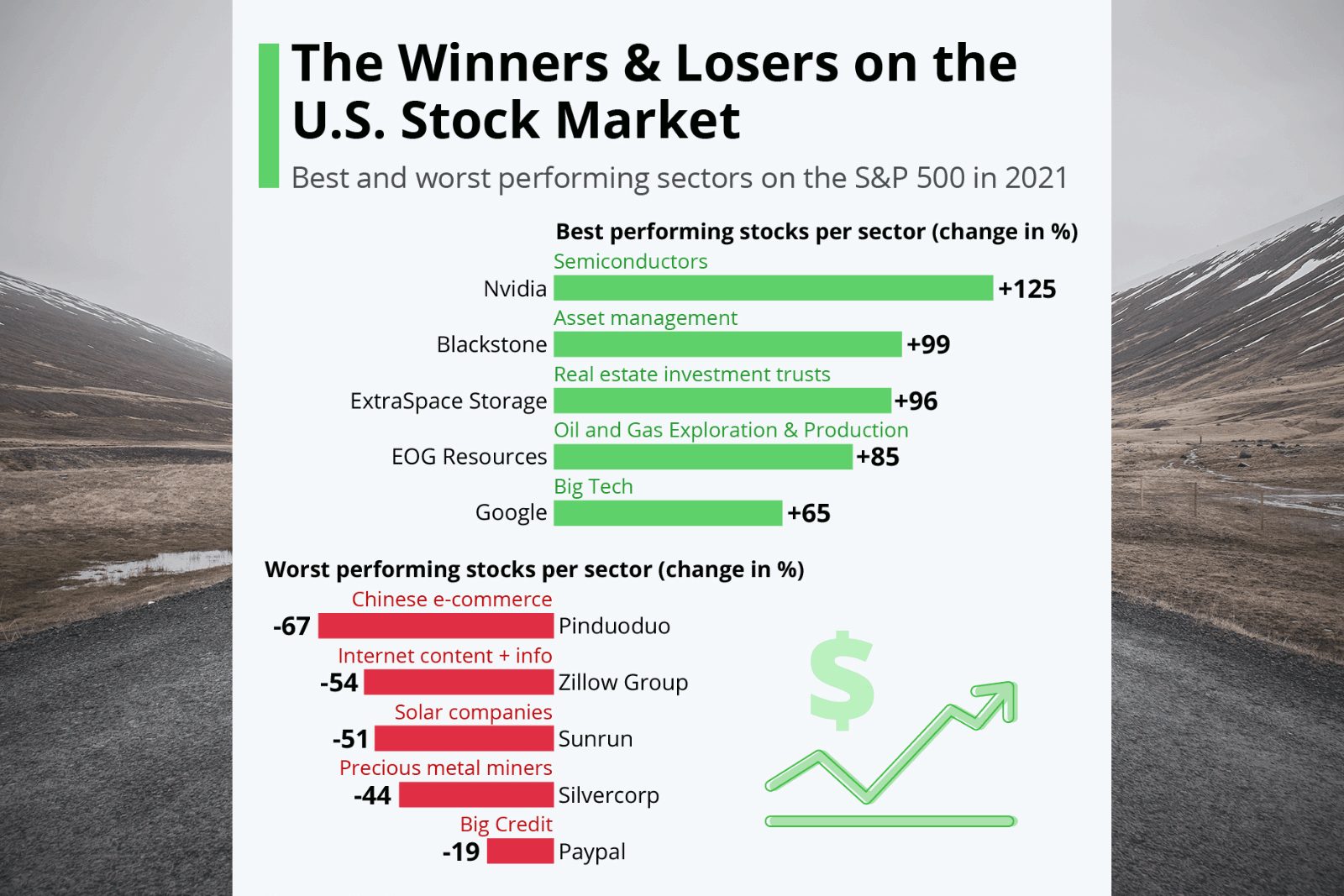

In terms of results in U.S. stock markets, the big tech, semiconductor and asset management sectors were among the best performers in 2021, according to Visual Capitalist’s analysis of S&P 500 stocks using data from finviz.com . While the reasons for their successes, such as lack of resources and a greater focus on e-commerce and online solutions during the pandemic, are obvious, as our chart shows, there are losers in unexpected areas.

For a long time, Chinese e-commerce companies such as Alibaba, Meituan or Pinduoduo have been relatively safe investment bets, with the Republic of China leading the segment in total revenue. The reasons for making it one of the worst sectors in 2021 are varied, but mostly have to do with stricter regulations for tech companies and the Chinese government’s proposed amendments to the e-commerce law in an effort to improve data security and prevent further monopolization. Precious metals miners are another unlikely candidate for a bad year. Because of the stability of gold and silver prices, this sector is usually able to withstand inflation and uncertain price dynamics in more volatile areas. Both precious metals have had negative year-to-date returns this year, which in turn has caused share prices of companies such as Silvercorp, the largest primary silver producer in China with four mining operations in the People’s Republic of China, to plummet.

While the stock market is known for its volatility, especially in fast-growing sectors such as technology and e-commerce, there have still been some unexpected turns last year. After the first year of the pandemic, the beginning of the rollout of the coronavirus vaccine, the emergence of new dominant variants of the virus and the ongoing shortage of semiconductors played an important role in affecting the stock market, for better or worse. With supply chain disruptions and shortages not going away anytime soon, and the rise in COVID-19 cases being an additional cause for concern, these factors will likely continue to affect the U.S. stock market in the coming year.

#stockmarkets #usa #2021

@ESG_Stock_Market