Post Views: 66

Bulls on Chinese stocks are hoping for a 10 percent market pullback before the Lunar New Year to buy a fall: BofA survey

According to a Bank of America survey, investment managers from Hong Kong fear a decline in Chinese stock prices after a sharp rise over the past two months. Some funds are counting on a rollback before the Lunar New Year next week.

“Given the good results, some investors hope to make a profit on the eve of the Lunar New Year,” according to a report dated January 18 by equity strategists at the American bank. They waited for a 5-10% drop before replenishing their positions on dips, as the report showed.

The answer came from a survey of 80 fund managers in the city who attended several meetings and presentations held by Bank of America this month,

as analysts at Wall Street stores including Goldman Sachs, Morgan Stanley and JPMorgan predicted bullish market forecasts based on China’s opening.

Despite the short-term worries, investors are still “unabashedly optimistic,” according to the survey, as China’s economic recovery leaves more room for growth. While the assessment of MSCI China members has expanded to a long—term average multiple of 12 times earnings, “we expect more growth given the cyclical upswing in 2023,” the bank’s strategists added.

About 84% of respondents have a “net long position and overweight” in China, while 78% expect further growth in Chinese markets by 10-20% by the end of this year. About 74% of them believe that China’s markets will not reach their peak before June or even later.

Most financial managers named the internet sector as their top choice, followed by consumers and healthcare. The study showed that most investors prefer stocks registered in Hong Kong or New York to stocks traded on local markets. Most of all, they are concerned about a weaker-than-expected recovery in consumption, geopolitical tensions and negative government policies.

“All key risks on the domestic front have dissipated, with optimism about easing geopolitical tensions in the region this year as well,” Bank of America strategists, including Ajay Singh Kapoor, said in a separate note to clients on Tuesday.

He added that policies aimed at Covid-19, private sector regulation, geopolitics, the credit cycle and property are “more conducive to high stock returns,” and clients do not need to worry that the rally in China could exhaust itself.

However, the powerful rally is starting to falter as the lunar New Year approaches. Some investors have reduced their assets, said Zhang Yidong, chief global investment strategist at Industrial Securities in Shanghai.

Online classroom giant Koolearn has Tripled its Revenue by Switching to Live Streaming e-commerce

China’s most famous online school chain has tripled its sales in six months, switching to selling food and agricultural products live after Beijing’s abrupt ban on commercial extracurricular education in 2021, which upended the multibillion-dollar industry.

Koolearn Technology Holding, a subsidiary of Beijing-based private tutoring giant New Oriental Education & Technology Group, on Tuesday reported revenue of 2.08 billion yuan (US$307 million) from June to November, up 260% from the same period in 2021.

✔️ According to the interim report of a company registered in Hong Kong, companies related to live e-commerce generated more than 85% of total revenue.

The results show that Koolearn has “successfully turned into an online business for e-commerce,” analysts at Shanghai-based research and consulting company SWS Research said in a note.

Koolearn currently has more than 35 million subscribers on six accounts of Douyin, TikTok’s Chinese sibling, which boasts more than 600 million daily active users.

According to the interim report, the company placed more than 70 million orders in the six months ended November 2022, for a total transaction amount of 4.8 billion yuan.

The share price of Koolearn fell by more than 8% and closed at 61.9 Hong Kong dollars on Wednesday, compared with about 4 Hong Kong dollars at the beginning of June last year and exceeded the level before the crackdown.

TAL Education Report released

Key events of the third quarter of fiscal year 2023:

⛔️ Revenue amounted to 232.7M$, compared with revenue of 1,020.9M$ in the same period of the previous year.

✅ The loss from operations amounted to 32.9M$, compared with a loss from operations of 108.4M$ in the same period of the previous year.

➡️ The loss per American depositary share amounted to $0.08

✅ The amount of cash, cash equivalents and short-term investments is $3,040.5M as of November 30, 2022, compared to $2,708.7M as of February 28, 2022.

Key events for the 9 months ended November 30, 2022:

⛔️ Revenue of $750,8M, compared to revenue of $3,849,8M in the same period of the previous year.

✅ The loss from operations amounted to 46.3M$, compared with a loss from operations of 615.2M$ in the same period of the previous year.

✅ Income from non-GAAP operations excluding share-based compensation expenses was $35.9M, compared to a non-GAAP loss from operations of $440.5M in the same period of the previous year.

The first reaction of the market is a slight drop.

Credit Suisse is cautiously optimistic as mainland investors support China’s opening and foreign funds are unsure

According to Credit Suisse, mainland Chinese investors support Beijing’s reopening plan, even if foreign investors seem unsure.

“The overall message this year is cautious optimism,” said John Woods, the Swiss bank’s chief investment officer for Asia Pacific.

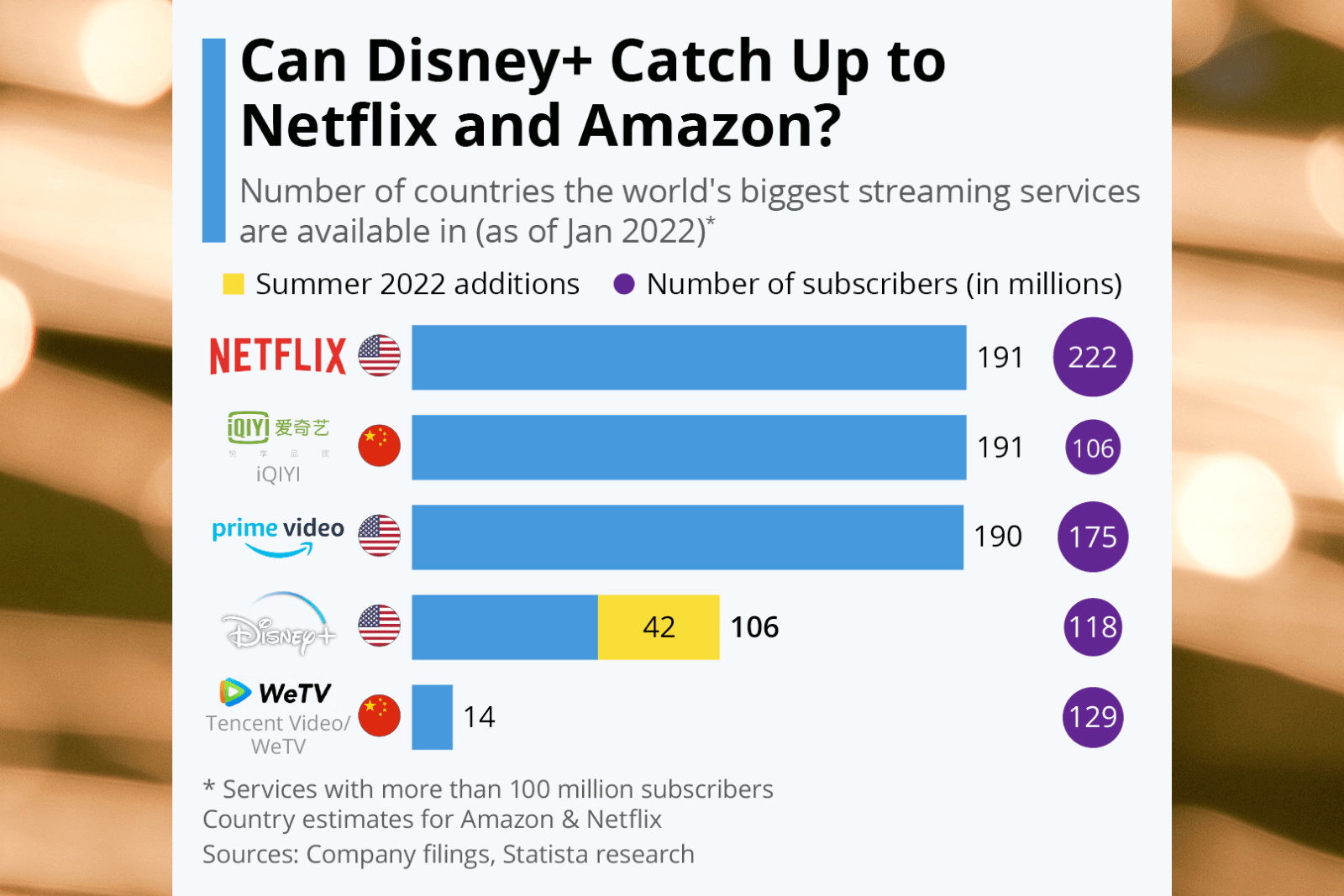

China is the main market for the bank’s clients in the Asia-Pacific region, among them pharmaceuticals, tourism and the Internet sector. According to Credit Suisse, high-yield bonds and investment-grade loans are among the main investment topics of the bank in the first half of 2023.

However, foreign investors do not yet believe in the story of China’s discovery due to concerns about the impact of the rapidly growing number of cases of infection on the growth and profits of companies, Woods said. China reopened its border with Hong Kong and the world on January 8 after almost three years, lifting strict quarantine requirements.

“Despite the fact that there is no suitable scenario to effectively manage the Covid-19 outbreak, the opening of China was too chaotic,” Woods said. Credit Suisse believes that it will take at least one quarter to normalize business activity.

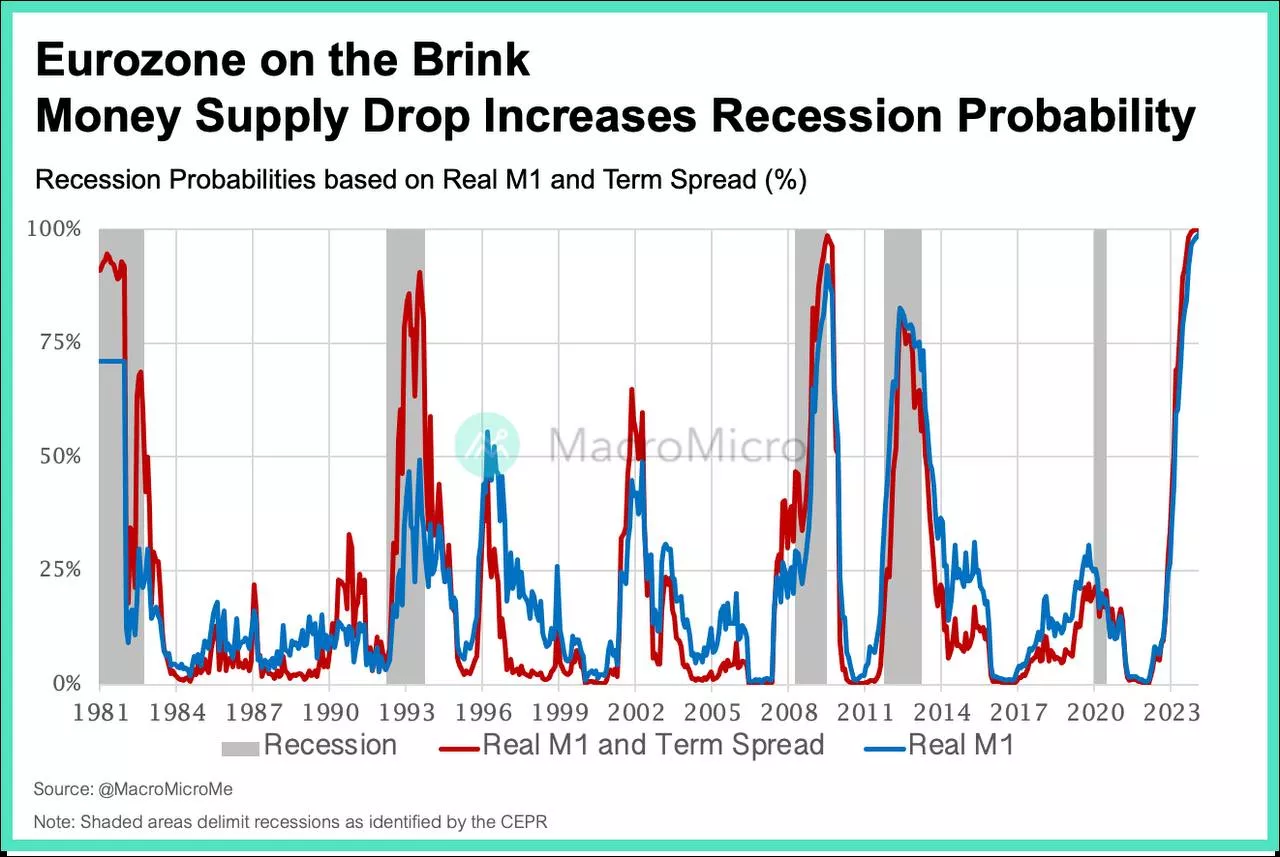

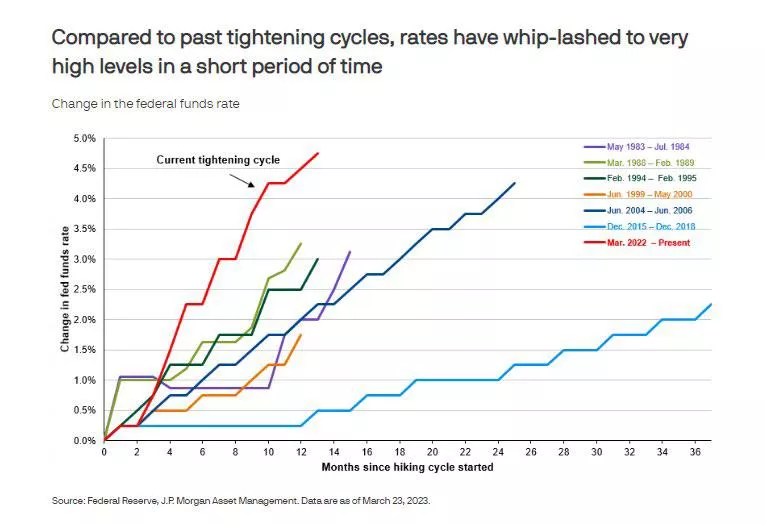

At the same time, China is the only major economy that will expand this year, and it will attract attention and an influx of investors, Woods said. Credit Suisse predicts that China’s economy will grow by 4.5% in 2023. This will be much more than in the US and Europe, whose economies will be hampered by a possible recession and higher inflation.

According to Woods, despite the fact that China’s reopening scheme will be an easy task for some investors, there will be problems along the way as authorities respond to spikes in infections and re-infections.

“The opening of China will have a positive impact on tourism, travel, hospitality and entertainment, which will create a positive halo effect in other parts of Asia,” he added.

“The reopening will mean that millions of tourists and visitors will be able to enter Hong Kong, which will have a positive impact on the city’s economy and corporate income,” Woods said, adding that investors are rallying for shares of large companies.

But Woods said the business movement between Hong Kong and Singapore has always been cyclical, and investors will eventually return. People can move to Singapore, but they often return, and the “fluctuations between the two centers” will continue.

According to him, Hong Kong “will remain the gateway to China’s markets.” “As long as the yuan remains non-convertible and Hong Kong has a convertible hard currency into the Hong Kong dollar, the city will have a very deep and secure future.”

@ESG_Stock_Market