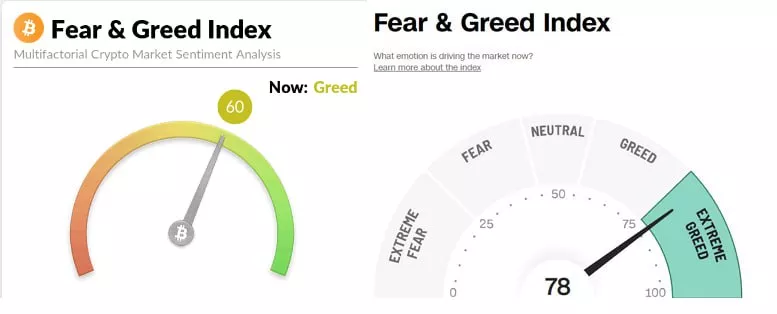

Fear and greed nasdaq, moderate greed in cryptocurrencies, greed in stocks is at risk. What are we trying to say?

Why was the stock market depressed on Friday? US: The overheated labor market doesn’t want to cool down. Fear and greed nasdaq

Statisticians traditionally revised the U.S. labor market numbers in February, with historical data revised up by 813,000, and the gain in employment in January was an incredulous 517,000, of which 443,000 was in the private sector. So quite unexpectedly there was another million employed, i.e., the labor market was even hotter than thought. Of course, the main thing here is the data revision, but compared to the December report, there were 1.3 million more people employed in January.

The unemployment rate in January was at its lowest level since 1969, dropping to 3.4%. Labor force participation rose slightly (62.4%), but it’s still decently below pre-decline levels. The labor force participation rate has also risen slightly to 60.2%, although it too remains below pre-set levels, and that’s with the current near-zero unemployment rate. The fact that the labor market has even improved in recent weeks was indicated by the benefits data, which fell below 200K per week, the current report has confirmed it.

With wages also turned out to be somewhat better, the slowdown in 2022 was lower than previously thought, and growth even accelerated somewhat in January. This was not due to an increase in hourly wages (+0.3% mom), but more to the estimate of hours worked. Production and non-management payrolls added 0.8% mom and 9.2% yoy, more than twice the average pre-crisis level.

It’s worth discounting the fact that this is a February report and revisions, but still, after seeing job openings rise sharply in December and amid record-low unemployment benefits, the market still looks like it’s very hot. And that will give the hawks at the Fed new arguments to kick the growing pigeonhole army. The market, on this, of course, is depressed …

A little clarity. The Fed took it away, the Ministry of Finance added

The Fed continued to reduce the portfolio this week, removing $38 billion of government bonds from the balance sheet at once, over the past 4 weeks the portfolio has decreased by $60 billion – everything is according to plan. The Fed is not getting steadily on mortgages, but this is already a familiar story. The US Treasury, on the contrary, added $ 72 billion to the system, raising bank liquidity by $ 30 billion. Local fluctuations will occur here, but the main process will not change: the US Treasury will borrow little, the Fed will continue to QT, but the overall supply of public debt will be low. At the same time, the budget will spend the cache, adding liquidity, and the Fed will withdraw it through QT. And there will be such a swamp until Yellen runs out of cash on her accounts and “emergency measures” and the debt ceiling is raised – then the situation can shake up.

The US Treasury has published plans for the first half of the year, it needs to borrow $1.3 trillion in the market to end the half-year with $0.55 trillion in cash on the balance sheet. But they estimate the actual financing needs at $0.6 trillion for the first half of the year – this is due to the fact that annual taxes are paid in the second quarter and there is virtually no budget deficit. In this regard, Yellen, of course, rather catches up with fears, saying that the money will last until June, in reality they are quite capable of holding out until September without raising the ceiling, if there are no emergency expenses.

Interest expenses on debt in the 4th quarter have already officially amounted to $0.85 trillion (in annual terms, or 3.3% of GDP) – increased by 42% YoY. Net interest expenses adjusted for Fed payments and interest income in annual terms increased to $0.82 trillion (3.1% of GDP), which is 77% higher than in the 4th quarter of last year. By the end of the year, we expect more than $1 trillion in interest on the debt, which is comparable to the records of the 80s and a big fight over the budget.

Looking back at the decisions of the Fed and the ECB (the Bank of England does not count – they initially rather pretend that they are struggling with something, even though the head of the Central Bank said that this is not the end of the increase), although the Central Bank itself did not show much softness – they showed complete uncertainty, and if they themselves are not in why are you not sure – why should the market believe them and their forecasts? Well, the market generally does not believe them, but I think the market overestimates the softness of the Central Bank and underestimates the risks of recession and inflation …

#USA # inflation #economy #Fed #debt # rates #dollar

What did Powell tell us? Powell: postpone until March

What did Powell tell us? Powell: postpone until March

The press conference of the head of the Fed turned out to be even more insipid than her press release. Perhaps its main motive is only one thing: to raise it by the expected 25 bp and sit out until the March meeting, and then we’ll see. This is exactly what the entire speech of J. was dedicated to.Powell. He repeated dozens of times everything that the market has already heard many times and which he does not really believe.

In fact, trying (which is typical for the Fed under Powell) to sit behind the locomotive, because they are not sure of anything and (apparently) are very afraid to make a mistake again. The peak of the bid – we do not know, maybe higher, maybe lower… how long – some time, where it will turn – we will go there.

Powell said a lot of “I think”, “I think”, as a rule, everything he says after these phrases means a little more than nothing – it showed up well in the first term, the crown “I think inflation is temporary”, because he doesn’t have much of his own expertise.

“Powell is talking hawkishly at every opportunity he can, using all the standard phrases, but the dollar scoffs at this admonishment.” – in this comment, the whole attitude of the market to the signals of the Fed. When the market sees fear (to make a mistake) and uncertainty, it always bends its line. By the way, this does not mean at all that the market is right in its expectations, but while it bends, it bends.

It is possible to understand the Fed, the second mistake in a row can cost not only the chair to Powell himself, but also bear the quite material risk of losing the formal independence of the Fed, which forces them to take an extremely cautious position, leaving the doors open in all directions. But the markets are taking a very specific position, which threatens volatility on the one hand, while reducing the effectiveness of the Fed’s policy on the other.

Anyway, the Fed has suspended the situation until the March meeting, when they will have to publish forecasts. The markets interpret this as weakness, driving the dollar rates down, and risk assets and gold up. It is not a fact that this fuse will last for a long time, the first good reports on the labor market, or bad ones on inflation will be nervously perceived.

#Fed #rate #inflation #USA

It is not a recommendation for action.

“Praemonitus, praemunitus”

@ESG_Stock_Market