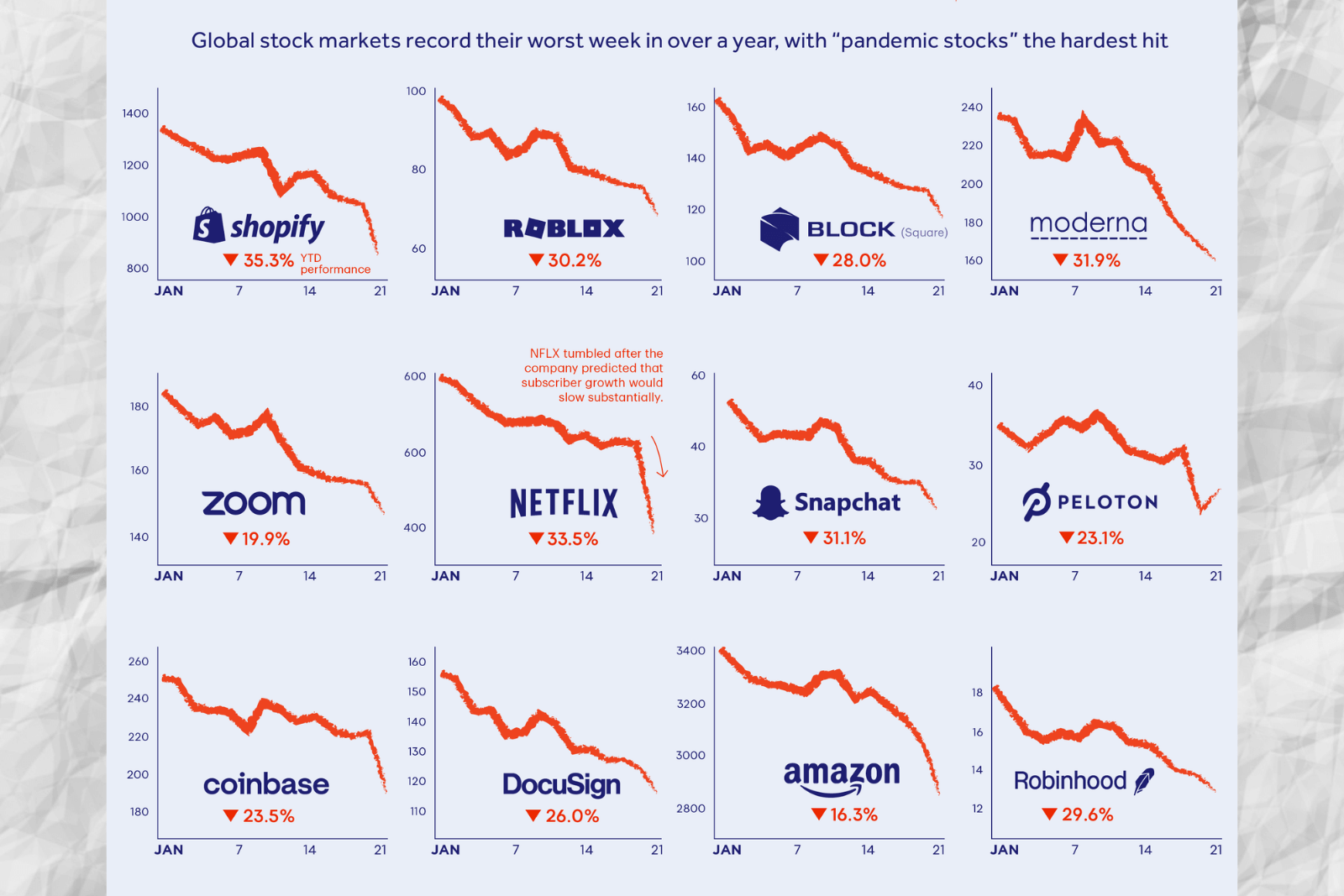

Global stocks are in a downward spiral and have experienced their worst week in more than a year.

Worries about slowing demand in the aftermath of the crisis and rising rates contributed to the sell-off.

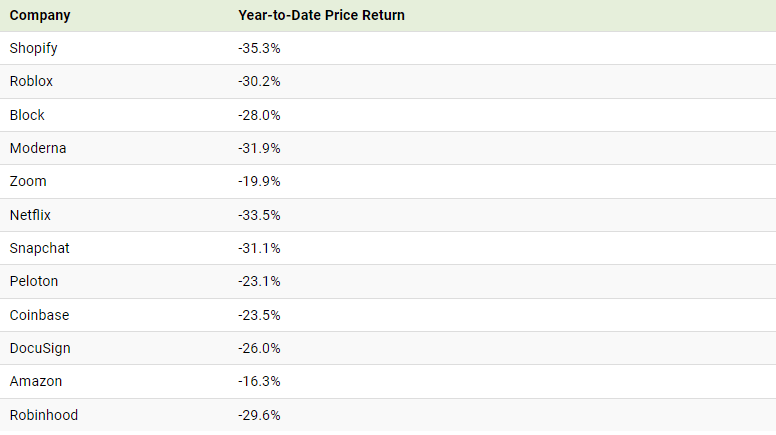

Pandemic stocks suffered the most, with Shopify and Netflix down 35.3% and 33.5%, respectively.

The stock market, and in particular the stocks that thrived during the COVID-19 pandemic, are having a bad time in 2022. If you watch your investment accounts, you probably see a lot of red. Shaken by uncertainty about the pandemic recovery and future interest rate hikes, investors are selling off their stocks.

This market sell-off – which occurs when investors sell a large volume of securities in a short period of time, resulting in rapid price declines – is troubling for investors. In fact, search interest in the term “sell-off” recently peaked at 100. If Google Trends is to be believed.

Unconvincing pandemic stock returns

Pandemic stocks and technology-focused companies suffered the most. Here’s a more detailed look at individual stock returns for the year.

Netflix triggered a sell-off after it reported a disappointing increase in subscribers. The company added 8.28 million subscribers in the fourth quarter, down from the 8.5 million it added in the fourth quarter of 2020. The company also predicts slower year-over-year subscriber growth in the near future, citing competition from other streaming services . company .

Meanwhile, Coinbase stock has lost nearly a quarter of its value this year. As prices of cryptocurrencies such as bitcoin have plummeted, investors fear that Coinbase will see lower trading volume and therefore lower fees.

Infection has also spread to other pandemic stocks such as Zoom and DocuSign , as investors have begun to question the resilience of stocks staying home.

2022 is starting to paint a different picture

While investor exuberance drove many of these stocks higher last year, 2022 is starting to paint a different picture.

Investors are concerned that rising rates will negatively impact fast-growing stocks because it means it’s more expensive to borrow money. Not only that, they may also see Netflix’s rise as a harbinger of future events for other pandemic stocks.

Market cycle psychology also plays a role – among these fears, investors have adopted a herd mentality and started selling their stocks en masse.

#stocks

@ESG_Stock_Market