The Impact of REPO Operations on the Fed’s Balance Sheet. Half a trillion in a couple of weeks

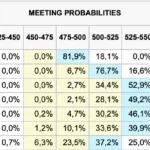

During the week, the Fed reduced its securities portfolio by a modest $3.5 billion at the expense of MBS, but this is a drop in the bucket compared to the $96 billion that the Fed issued in REPO to banks ($60 billion), loans to banks and FDIC ($36 billion), as a result of these operations, the Fed’s assets increased by another $94.5 billion for the week. At the same time, banks reduced borrowing through an expensive discount window (-$42.6 billion) and increased borrowing under the BTFP program (+$41.7 billion), and the FDIC took an additional $37 billion to pay deposits.

The US Treasury continued to actively spend the “cache” from accounts at the Fed, adding another $77.8 billion to the financial system (of which $28.5 billion is still in the same FDIC for deposit payments), Yellen has only $200 billion left in her accounts, but April is ahead with its annual taxes. In general, the Fed, together with the US Treasury, poured $172.3 billion into the financial system.

In total, in 2 weeks, the US Treasury added $112 billion to the financial system, the Fed poured $ 386 billion, i.e. in the amount of about $0.5 trillion – about as many deposits apparently moved. It is clear that some of them were simply transferred to other banks, more than half went to money market funds and government bonds. Americans did not run much into cash, but they nevertheless became more active ($8.4 billion).

While some banks are running to the Fed for money, others are placing money there through reverse REPO (+$226.9 billion per week) in order to draw beautiful reports. As a result, despite the actively working printing press, money on bank accounts at the Fed has become less by $74.2 billion. In fact, such a story may indicate that the banking system is bad with trust, some banks are actively attracting money from the Fed, others are even more actively parking a free “cache” in it – this is more reliable. In general, “the banking system is stable” (c) Yellen, but banks’ limits on colleagues are beginning to be cut. At the same time, some part of the deposits of the population runs to money market funds, funds working with government bonds received an influx of $276.5 billion in 2 weeks – a record for many years. A little has flowed into cash, but just a little + $8.3 billion.

The most powerful weekly dumping of US government bonds by foreign central banks, which are stored in the Fed, has passed since 2014 – $70 billion in a week, it was more only when Russia dumped in March 2014 ($106 billion). @ESG_Stock_Market