How is the US economy affected by wage inflation? USA: s/p are growing – inflation too

Income & Expenses. In January, American statisticians again revised income data, as a result, it turned out that disposable incomes are growing by 2.0% mom and 8.5% yoy. The revision for previous periods concerned the growth of nominal s/p in the private sector, which turned out to be more intense than previously thought and amounted to 1% mom and 8.4% yoy, and since December 2019 the growth was 25%. Additionally, in January, the budget threw money (taxes were reduced). Inflation, of course, ate up part of the income, real disposable incomes showed an increase of 1.4% mom and 2.3% YoY.

Consumer spending increased by 1.8% mom and 7.9% YoY in nominal terms, but monthly increases are a consequence of the seasonal calculation curve of retail sales in December/January, the annual dynamics here is more indicative, and it indicates an acceleration in the growth of real spending per capita to 1.9% yoy and this 7.1% higher than the levels of December 2019. The revision of the growth of the s/p also led to a revision of the savings rate, which in January was 4.7%, so there is where to go down if anything.

Inflation. The deflator of consumer spending accelerated sharply to 0.6% mom and 5.4% YoY, core inflation (Core PCE) accelerated to 0.6% mom and 4.7% YoY. Moreover, the price increase was quite widespread across the basket. It is clear that prices in the housing sector are growing quite actively (0.7% mom and 8% yoy), the growth of goods without energy and food is more modest (0.5% mom and 2.8% yoy), food and energy have risen in price (0.4% mom and 11.1% yoy/d). But the most important thing is that the beloved now J.Powell’s price index for services without energy and housing accelerated its growth to 0.6% mom (a record since November 2021) and 4.8% yoy (the maximum since February 2022). Cyclical components of core inflation accelerated growth to 8% YoY, their contribution to overall inflation is about 3 percentage points.

What we have in the end: wages grew faster than expected, the consumer is active, inflation accelerated (especially where it is sensitive for the Fed) stronger than forecasts. The markets, of course, are depressed… expectations of a Fed rate hike rose to 5.25-5.5%. Shares of “hawks” in the Fed sharply up.

#USA #income #economy #Crisis #spending #budget #inflation

Loretta Mester:

(24.02.2023)

“The rate should be raised above 5% and kept there for some time. I hope the Fed will be able to return inflation to 2% without destroying the labor market.”

James Bullard:

(22.02.2023)

“A more aggressive rate hike will give the Fed a better chance of reducing inflation.”

Source: cnbc.com

Evercore:

The probability of achieving a soft landing is reduced. We still believe that the Fed is unlikely to return to raising rates by 0.50%, however, such a risk appeared after the release of the latest data on the PCE Price Index.

Minutes of the Fed meeting January 31-February 1, 2023 (FOMC Minutes).

(pub. 22.02.23)

(page 11)

“Almost all officials were in favor of raising the rate by 0.25%. FOMC members who were in favor of raising the rate by 0.50% noted that a more significant increase would bring the rate closer to the levels that, in their opinion, would allow achieving a fairly restrictive position.”

source: federalreserve.gov

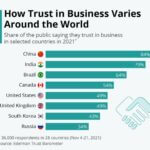

For 100 years, the US stock market has entered the overbought zone for the third time

#stocks #usa #sp500 #overbought #stock market #finance

Over the past 100 years, the American stock market has entered an overbought zone for the third time in relation to the global stock market. This means that the cycle of dominance of American stocks in the global financial market is over. Pay attention to the exhibitor from 2008, it looks epic.

In the West, this schedule is not yet discussed enough, however, with the onset of depression, it will definitely become relevant.

Of course, this does not mean that the American market will not grow, but investors will give priority to other developed and emerging markets.

investors have had a paradigm shift

#rates #bonds #cash #stocks #finance #allocation

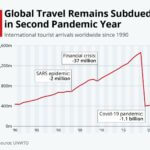

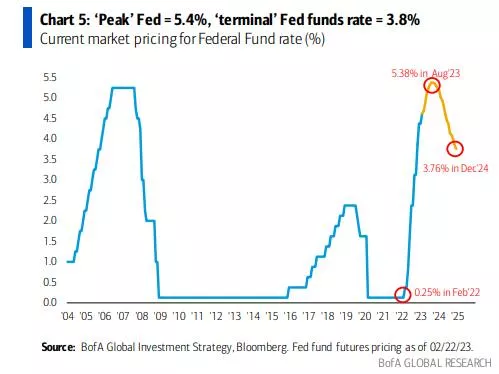

This month, investors experienced a paradigm shift in expectations of the peak discount rate in the United States: at the beginning of the month, expectations were 4.5% in March-April, now – 5.4% in August, with a further decline to 3.8% by the end of the year.

The change of mood led to the breakdown of trends in the financial market: the growth of the dollar brought down the prices of precious metals and base currencies, and led to the sale of the US debt market, the stock market is still holding, but the positive there is also over.

At the next stage, the market will increase expectations for the duration of the high-rate cycle, which will also lead to a decrease in risk appetite.

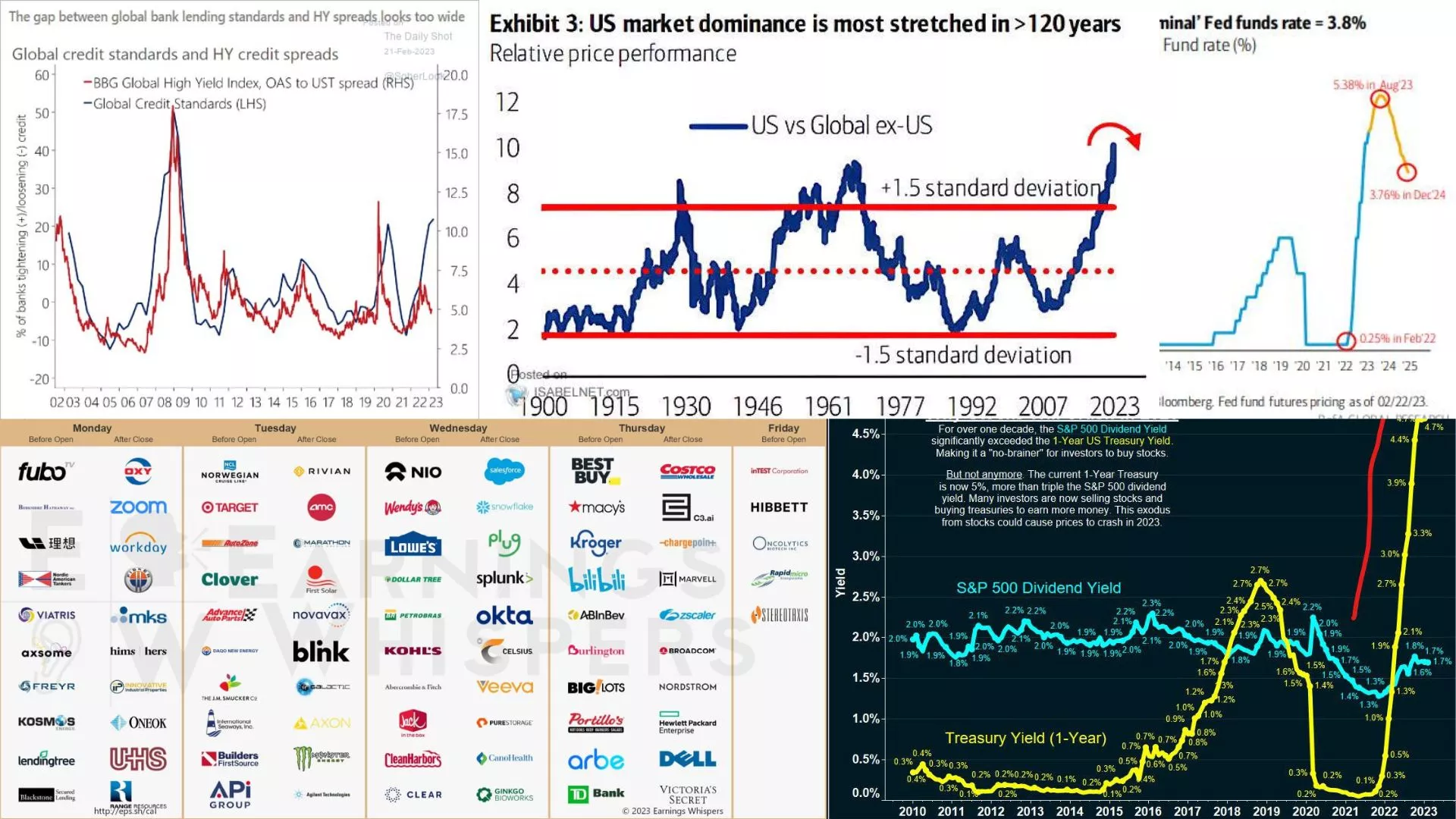

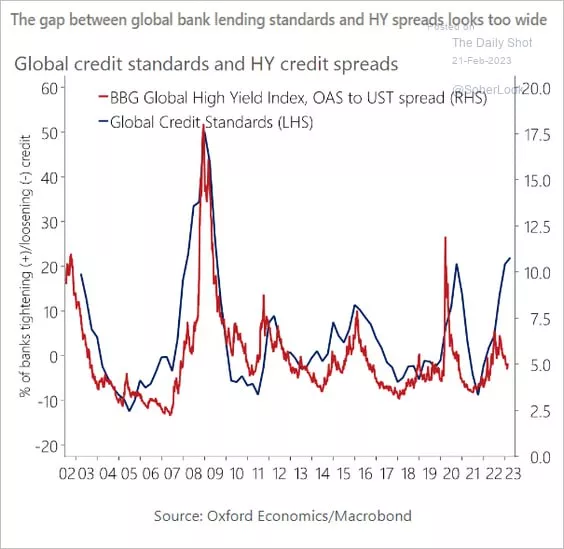

The red line on the chart is the difference between the yield of junk bonds and treasuries; the indicator is steadily decreasing, i.e., according to the market, garbage carries less risk than risk-free government bonds;

The blue line is the world’s lending standards, which are already worse than they were in 2020; that is, it is more difficult to get a loan, and this primarily concerns less reliable borrowers who issue junk bonds.

Actually, the situation was similar in the pre-crisis 2007, but now all the processes are going faster, so this year the global financial system may plunge into depression.

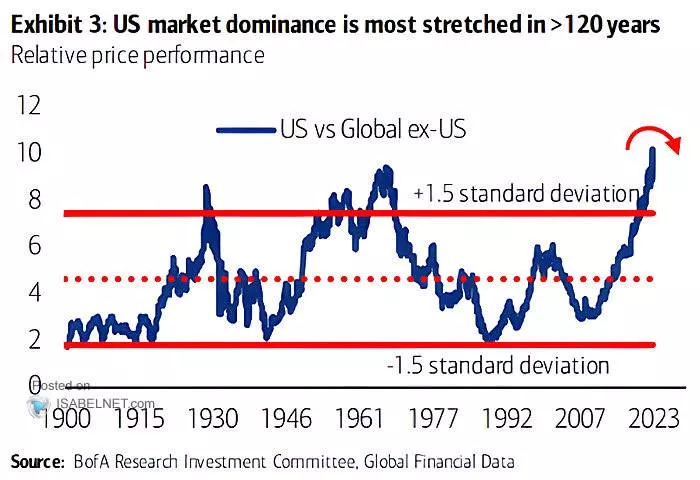

the yield of treasuries is 2.5 times higher than the internal yield of the S&P500

#finance #dividend #coupon #stocks #bonds

📍Probably the most underestimated chart to date: the yield of treasuries is 2.5 times higher than the internal yield of the S&P500 (you can not count on the income from the exchange rate difference in the rate hike cycle).

Taking into account the current risks, from the point of view of the risk/profit ratio, it is more profitable to sell shares and buy treasuries, and this flow will increase as the prices of American stocks decline – this will put additional pressure on the US stock market.

The company’s reporting for the upcoming week

🇺🇸 #USA #reporting season #reporting

in the USA the reporting season continues : corporate reporting for the upcoming week

FactSet: 68% have already exceeded earnings per share expectations this reporting season, which is below the 5-year average of 77% and below the 10-year average of 73%

66% of companies exceeded revenue expectations, which is below the 5-year average of 69%, but above the 10-year average of 63%

@ESG_Stock_Market