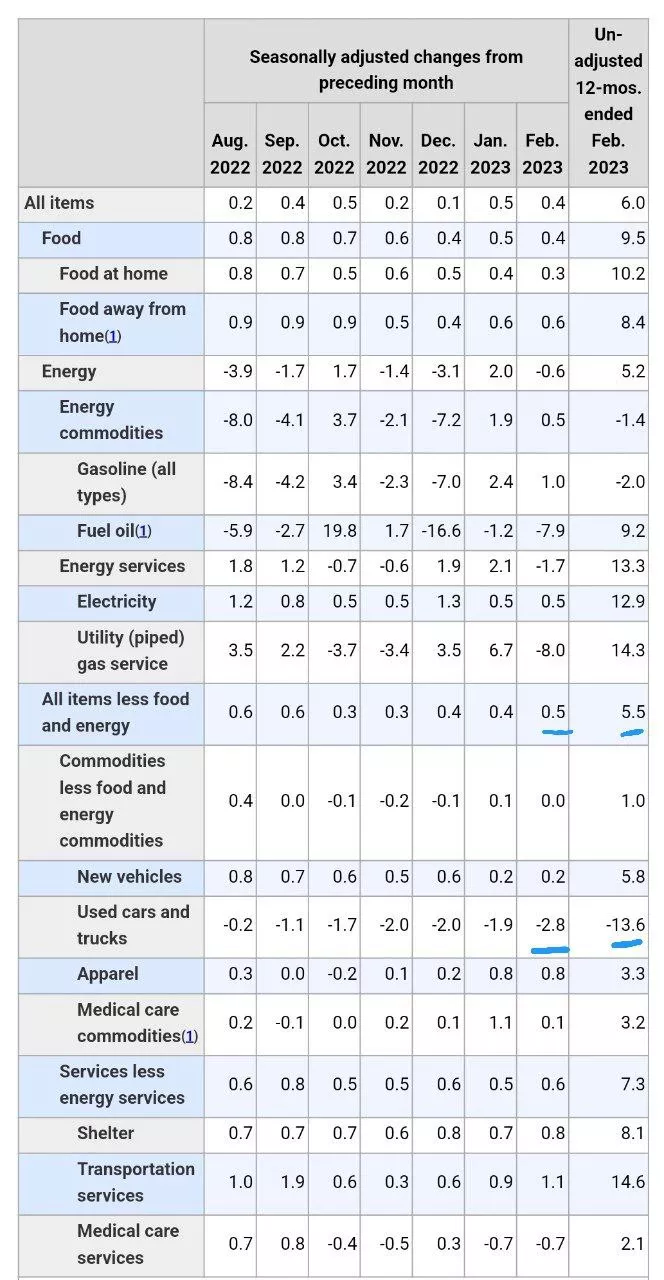

❗️US inflation in February was 0.4% mom, 6.0% YoY, core inflation 0.5% mom, 5.5% YoY. And this despite the fact that used cars unexpectedly gave out a drop again – 2.8% m/m…

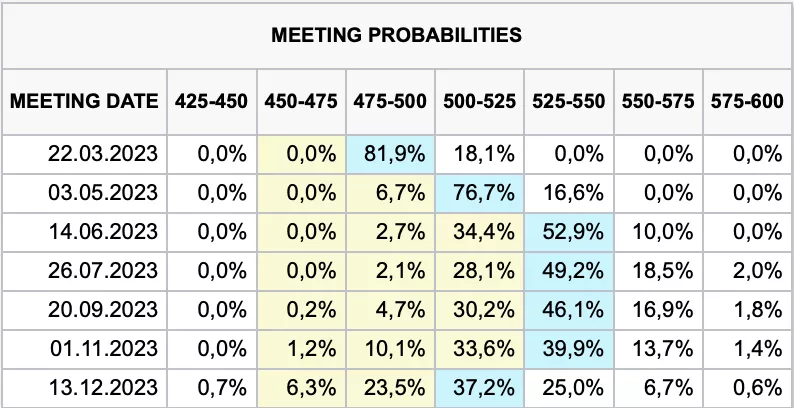

The banks’ opinions on the Fed’s further actions are divided, some believe that the Fed will cut rates in March… someone that leave unchanged… someone who will raise (1-3 times by 25 bps). The market has calmed down a little and is waiting for a 25 bps rate increase (69% probability) rather than remaining unchanged (31%), and another increase in May … but since July, he has been betting on a reduction in rates. The Fed needs to save face…

According to the current decisions on SVB and Signature, $264 billion of deposits need to be returned, of which about $30 billion and about $234 billion should be given by the Fed as collateral for assets (there are not enough securities on the balance sheets of both banks for collateral). The FDIC itself had $128 billion at the end of 2022, mainly in government bonds (for $126 billion of government bonds at face value). In 2021 and 2022, they managed to consolidate ~ $5 billion a year into the insurance fund. One way or another, the Fed will simply “print” about a quarter of a trillion dollars, which the FDIC will receive at 5% + per annum and distribute to depositors. The $25 billion that the US Treasury will provide is an amount close to the difference between the nominal and market value of collateral assets (a guarantee for the Fed).

At the weekend, J. Yellen refused to comment on the Fed’s further actions, saying on duty about the Fed’s independence and that they would evaluate it in the coming days and weeks. At the same time, she actually admitted that bankruptcies are a consequence of high rates: “The problems of this bank, from reporting about its situation, suggest that because we’re in a higher interest rate environment…”. There is no doubt that Yellen and Powell discussed this issue, but most likely no decisions have been made yet.

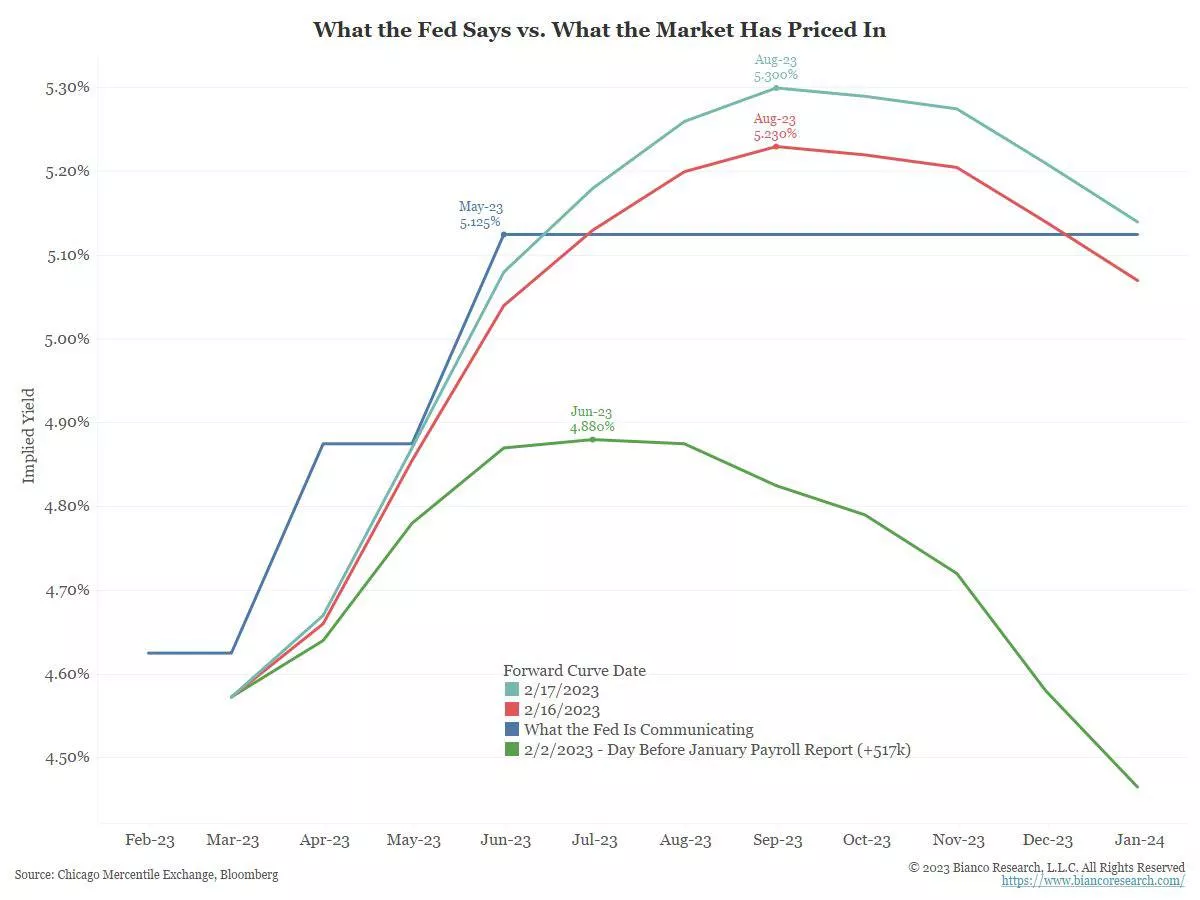

It is already obvious to everyone that what is happening is a consequence of the increase in rates, it is not obvious to everyone… but these are only the first signs of the consequences of the rate hike cycle, the losses of the financial system from the rate increase will continue to accumulate. For Powell, the situation is extremely unpleasant, a couple of days ago he went “hawk” (and not only he, but also other representatives of the Fed)… whether something has changed with inflation – not significantly. And just like that, to turn around right away is an epic failure and a blow to trust (which is so not very high). The market is already showing what it thinks – the growth of gold / bitcoin, the fall of the dollar, etc.

If inflation had slowed down on Tuesday, it would have been easier for the Fed to justify a reverse move. But no …

#USA #inflation #economy #Fed #debt #rates #dollar

Looking more closely at American inflation…

Externally, the report has no large deviations from expectations, total inflation is 0.4% mom and 6.0% YoY, without energy and food 0.5% mom and 5.5% yoy. But in reality, only one–time stories saved from a sharper price increase: used cars (-2.8% mom disinflation after a rapid takeoff), gas (-8% mom – heat), eggs (-6.7% mom disinflation) and medical insurance (-4.1% mom to the current inflationary reality has a very distant relationship). Together, these factors reduced monthly inflation by ~0.2 percentage points – too much.

Grocery inflation slowed down slightly by 0.4% mom and 9.5% YoY, but remains aggressive. Goods without energy, food and used cars added 0.4% mom and 4.2% YoY, growth decently slowed down from highs amid the migration of consumption from goods to services, but in the last three months the price increase has stabilized around 4-5% YoY. The main drive remains in services (0.5% mom and 7.6% yoy), active growth in housing continues (0.8% mom and 8.1% yoy), although this is an inertial growth, transport has accelerated (1.1% mom and 14.6% yoy), but mainly due to air travel (6.4% m/m).

If we discard various one–time emissions, inflation accelerated in February rather, various inflation indices cleared of volatile components remained at the ceiling of 6-7% YoY and even accelerated at the moment. I would still estimate the steady inflationary momentum as 4.5-5%, the New York Federal Reserve estimates at 4.9%. This means that even a neutral rate is 5-5.5%… and a restrictive policy means the rate is even higher. However, the same New York Fed published data on inflation expectations – annual expectations decreased from 5% to 4.2% than the Fed may try to justify caution. But the inflationary history as a whole speaks for an increase further.

PS: If anyone remembers, a couple of years ago, the Fed approved a new strategy and switched to targeting the average inflation rate (the average for 5 years is already 3.5%, for example), so if you approach it quite formally, then in order to fulfill your goals, Powell should lower inflation below 2% and keep it for a long time

@ESG_Stock_Market