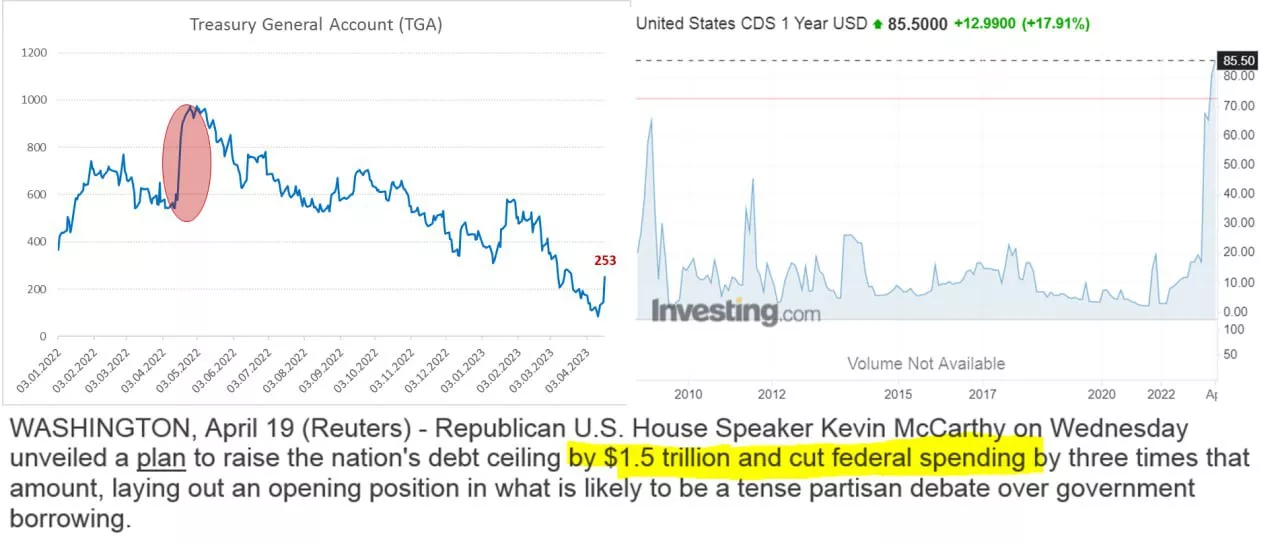

USA: bidding for the limit. As the US Treasury is running out of money, and the April taxes do not yet give hopes for a large budget surplus, politicians are stirring. Republicans in the House of Representatives of Congress are ready to raise the debt limit by $1.5 trillion, or within this amount by the end of March 2024. But with the condition of budget cuts on topics sensitive to Democrats, which will almost certainly lead to Democrats “wrapping up” the draft in the Senate, even if Republicans can get it through the House. The Democrats themselves have already said that the ceiling should be raised without any conditions, but the political fuss has begun.

How much time Biden and Yellen have left… As of April 18, the cash on Treasury accounts was $252.6 billion, which is $75 billion more than it was at the end of March. The situation is worse than in 2022, when by April 20 it was possible to increase the cache by ~ $190 relative to March, i.e. while Yellen is rather closer to the lower limit of expectations of a $150-200 billion surplus in April. The US Treasury can get up to $300 billion more by borrowing as part of the implementation of emergency measures, i.e. in the amount of ~ $0.5-0.6 trillion should still remain at the end of April – this should be enough for May-July and maybe for part of August this year. Some people say that June is already “everything”, but for now it’s more like speculation, although we need to wait until the end of April.

The Republicans’ proposal pushes the ceiling issue right under the election, and the proposed debt growth limit of $1.5 trillion, of which most will go to interest on the debt, does not give Yellen the opportunity to restore the cache to skip the election. The Democrats, of course, cannot allow this, but at least the subject trade has begun. We are watching the continuation of the show with curiosity … @ESG_Stock_Market

P.S.: annual CDS on the US national debt are confidently at historical highs

#USA #inflation #Finance Ministry #debt #rates #dollar