Post Views: 39

World inflation data. Inflation in the US, what has changed? Powell’s inflation indicator. Inflation in Europe. I’ll give you a couple of tips

1️⃣ US labor market: still hot. The situation with vacancies remained very aggressive, the number of open vacancies even increased and is 1.9 times higher than the number of unemployed, which is a lot. Weekly applications for unemployment benefits remain below 200 thousand. The salary fund is growing by 7.7% YoY – this is a couple of tenths less than it was a quarter earlier, but still significantly higher than what would meet the Fed’s 2% inflation target. The flow of nominal income remains quite aggressive.

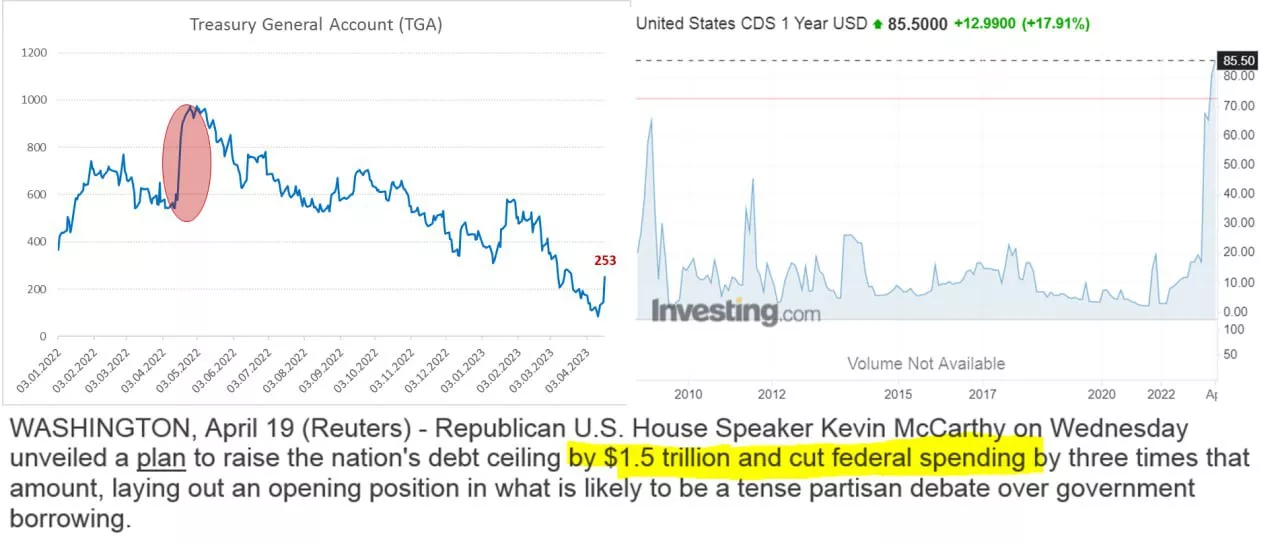

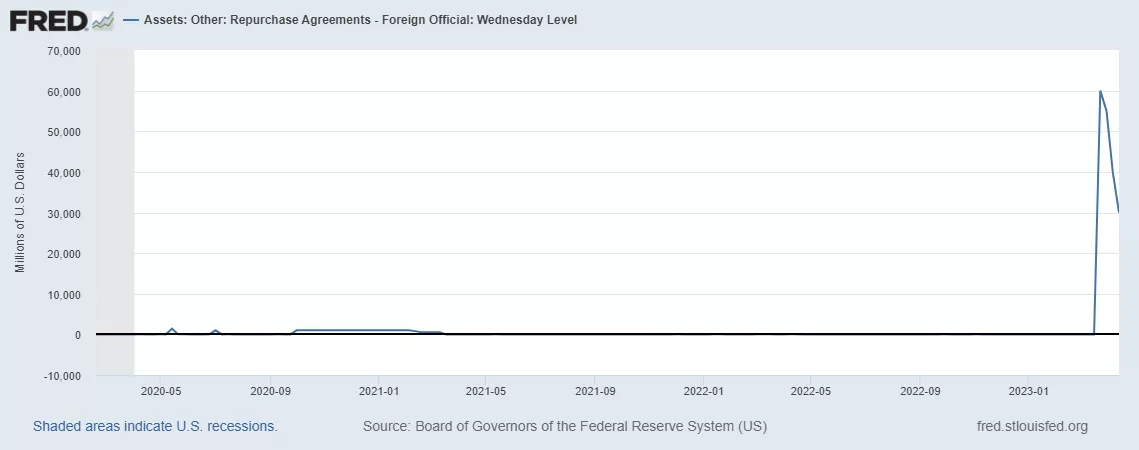

2️⃣ Excess savings remain high, but their “eating through” has accelerated. The volume of deposits and money market funds in households is ~ $3.0 trillion, although it has dropped to 95% of disposable income, but it is much higher than the docklike ~80%. This allows American households to save less and spend more – the savings rate of Americans has increased slightly, but still remains at extremely low levels of 4.4%. Although the banking crisis accelerates the processes in the first quarter, but there is still a long way to normalize here – there is something to spend.

3️⃣ The debt burden is low, but it has become more difficult to borrow. The amount of debt of the population relative to their disposable income of 99% is even slightly lower than in previous quarters. The decrease is due to the slowdown in mortgages (the main part of the debt) against the background of increased rates, the growth of nominal incomes and, of course, the write–off of student loans at the expense of the budget – this played a major role. Americans spent 9.7% of their income on debt servicing, which is very, very little by historical standards. There is still enough stock here, although high mortgage rates limit the possibilities of borrowing, but writing off student debts allows you to borrow several hundred billion extra. Mortgage debt has remained at lows since the 1960s and is 28.8% of the value of real estate in the United States.

4️⃣ Wealth Effect: The value of US household assets remains high. The total asset value of American households remains extremely high at 874% of disposable income. This is still above the docklike levels, but the situation varies for different income groups. The situation in the TOP10 is much better, both due to the increase in the value of financial assets and real estate. At BOTTOM90 – mainly due to the growth in the volume and value of real estate, deposits, pension plans and long-term goods. In general, the situation here is not yet conducive to Americans starting to save.

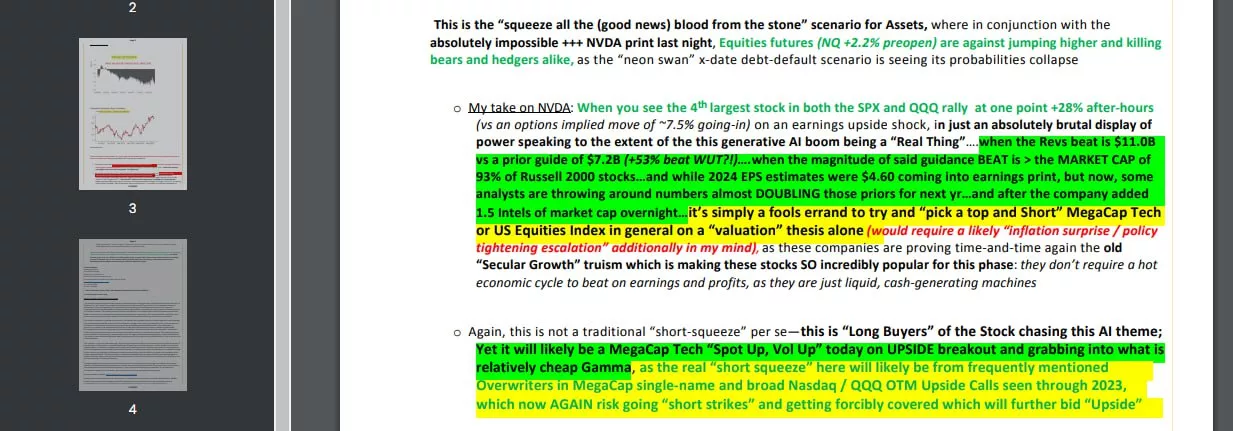

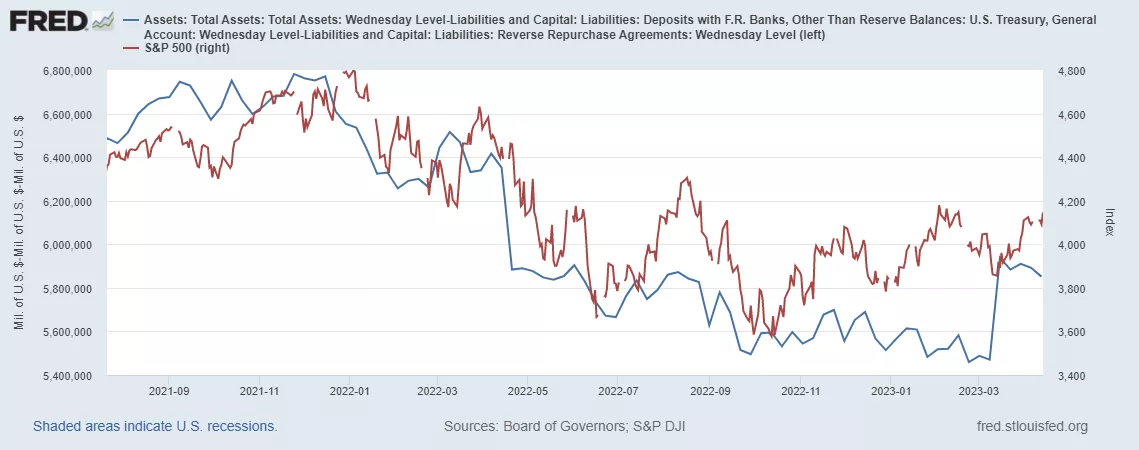

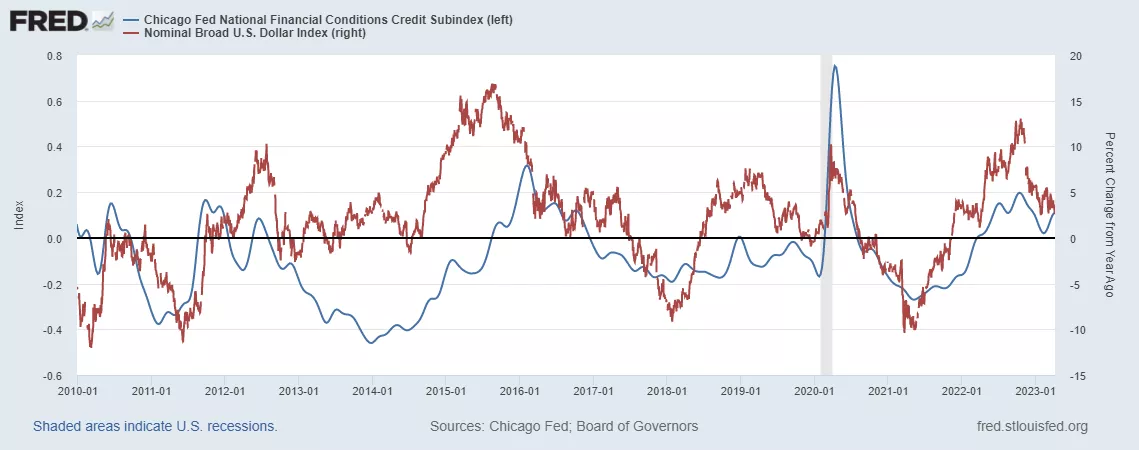

In general, we can say that the growth potential of Americans’ consumer spending remains high 6-8% YoY, which is much higher than what the Fed would like to see. At the same time, the budget incentive has rather increased, both due to the write-off of loans, and due to various kinds of social payments. In general, all this supports a fairly high potential for maintaining the increased growth rates of nominal expenditures, and as a result, inflation. The first “explosions” in the financial market may somewhat accelerate the processes (tightening of financial conditions), but given that history was immediately flooded with money, the impact will be limited.

#USA #inflation #economy #Fed #debt #rates #dollar

Powell ‘s inflation indicator is stability …

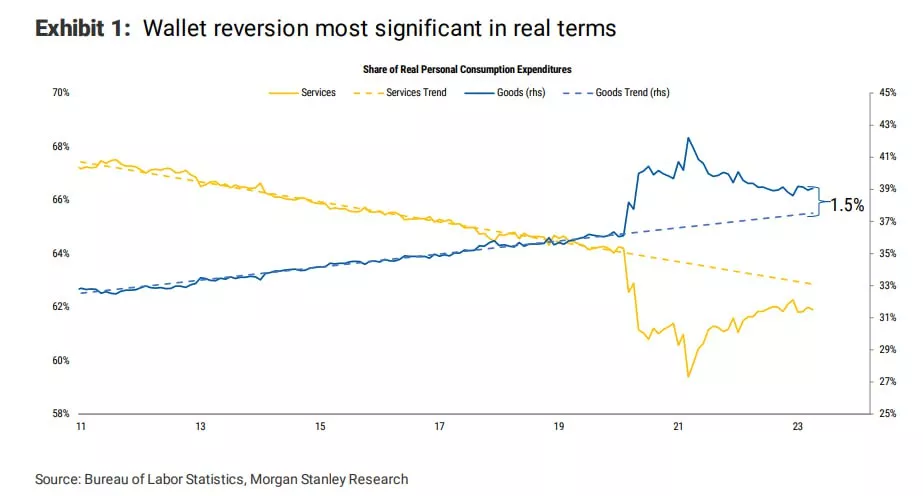

The report on the consumer spending deflator came out slightly better than market expectations, prices rose by 0.3% mom and 5.0% YoY. And even core inflation came out not so bad 0.3% mom and 4.6% YoY – the market was waiting for 4.7% YoY. Commodity inflation against the background of migration of consumption into services is modest and amounted to 0.2% mom and 3.6% YoY. Although the disinflationary effect of prices for used cars continued here (-2.8% mom and -12.3% YoY) – the dynamics is strange, because wholesale prices for them have been rising for several months in a row, and earlier prices were correlated. Prices for short-term goods increased by 0.3% and 5.4% YoY.

The main inflation in services, although not to say that it is huge here, is stable 0.3% mom and 5.7% yoy. Housing is getting more expensive by 0.7% mom and 8.2% yoy, but the Fed is turning a blind eye to it, because there is inertial growth. The most important thing is where J. is looking.Powell and Co. are services inflation excluding housing and energy prices – they added 0.3% mom and 4.7% YoY – stability, in January it was also 4.7% YoY. The increase in these prices for three months amounted to 5.0% in annual terms. In this part of inflation, nothing actually changes, something is accelerating, something is slowing down, but the index has been dead in the range of 4.2-5% annual growth for two years now. With a neutral real rate of about 0.5%, the Fed’s policy is clearly not up to the “restrictive policy” (the real rate is 1-2%)…

#eurozone #inflation #ECB #rates #economy #EUR

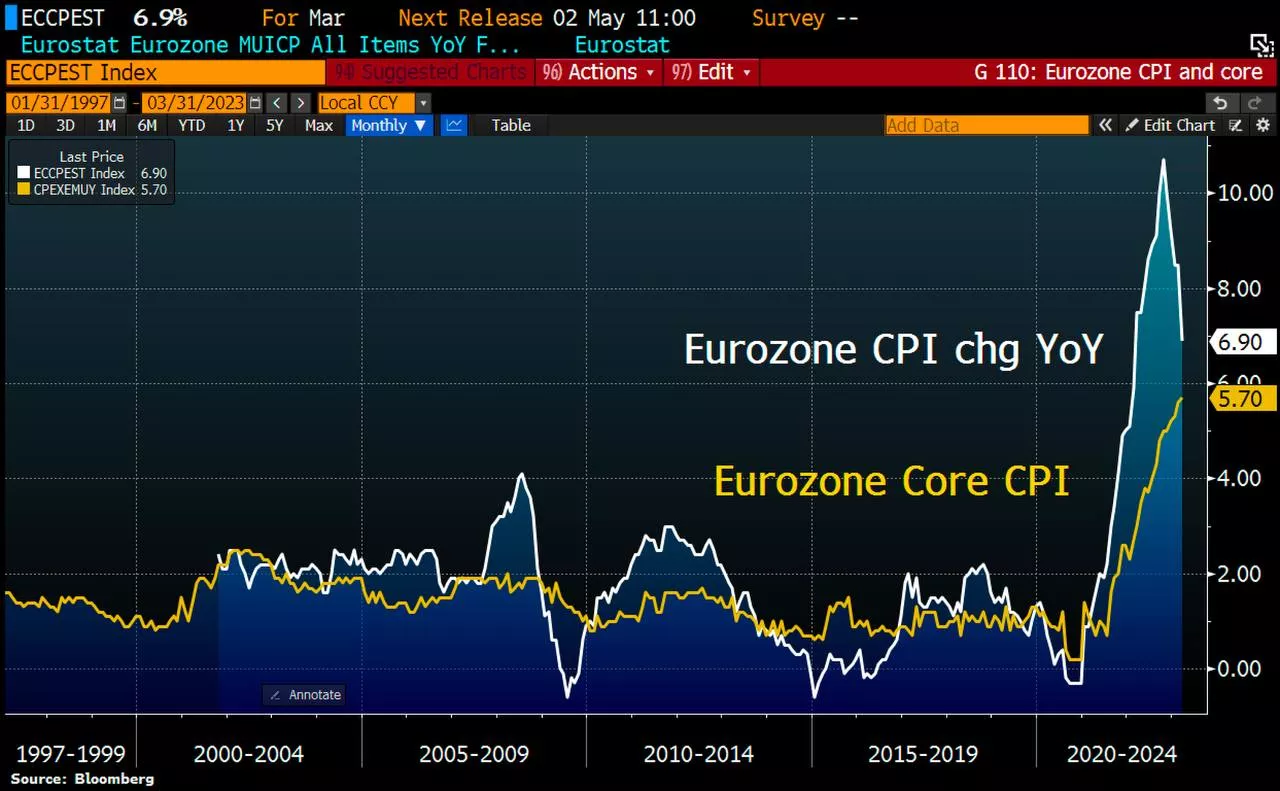

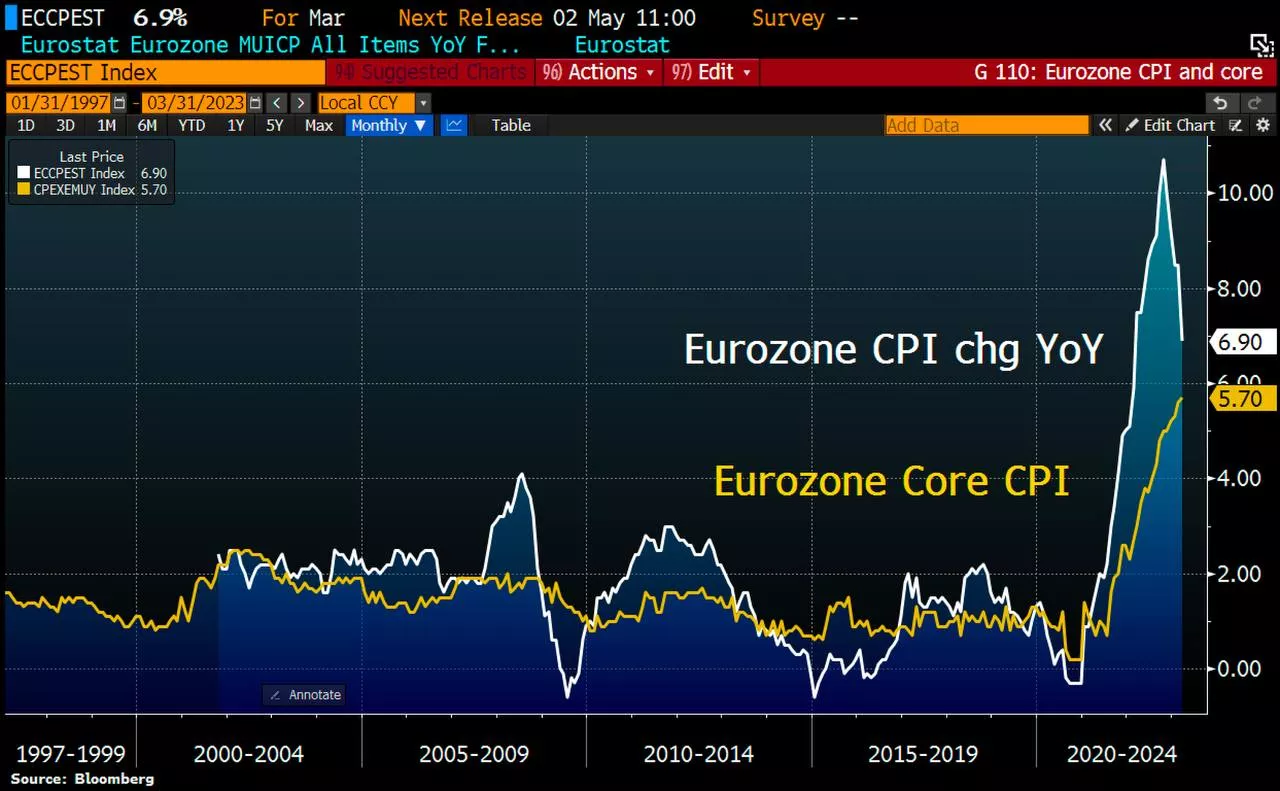

Euroinflation

Inflation in the eurozone in March was 0.9% mom, although annual inflation slowed to 6.9% YoY, this slowdown is mainly due to the high base of last year. The only factor slowing price growth was energy (-2.2% mom and -0.9% YoY), everything else was actively getting more expensive.

Food products produced 1.3% mom and 15.4% YoY. Without energy and food, core inflation is 1.2% mom and a record 5.7% YoY. Although the price growth for goods without energy slowed down a bit (6.6% YoY), but the price growth in services accelerated to 5% YoY. The influence of energy has gone, but inflation has remained.

At the same time, unemployment is at historical lows of 6.6%.

With the economy, everything is not particularly positive – real retail sales in Germany fell by 1.3% mom and collapsed by 7.1% YoY, although nominal sales increased by 2.6% yoy. Real sales were 1.6% lower than three years ago.

Consumption of goods in France fell by 0.8% mom and 4.1% YoY in real terms. First of all, this applies to food (-1.5% mom and -9% yoy). Consumption in France is at the levels of a decade ago, but this is in real terms. Protests against the background of pushing pension reform will add additional negativity to the French economy.

Low unemployment and labor shortage are side by side with a drop in living standards against the background of high inflation – such an entertaining reality. So the real strikes are still ahead here.

#Germany #inflation #Eurozone #economy #rates #Crisis

Inflation in Germany is not retreating

The growth of consumer prices in March, according to preliminary data, amounted to 0.8% mom and 7.4% yoy. Although annual inflation has slowed down, this is only the effect of the base of last year, when prices jumped by 2.4% mom in a month.

According to the Eurostat methodology, consumer prices in Germany are growing by 1.1% mom and 7.8% YoY. The growth of energy prices has slowed down sharply (+3.5% YoY compared to 19.1% yoy in February) – there are a lot of subsidies. But the growth of food prices accelerated even more (+22.3% YoY versus +21.8% in March). The growth of prices in services accelerated to 4.8% YoY, even though rents in Germany continue to rise by a modest 2% (but much is administratively regulated here).

In Spain, it is also interesting, inflation was 0.4% mom and due to the effect of the base collapsed to 3.3% yoy. But core inflation in Spain was 0.7% mom and 7.5% YoY.

So the ECB, as some Eurobankers say, “still has a lot of work to do”, it is unlikely that monthly prints of 0.7-1% mom correspond to the ECB’s goal. The reaction of the markets rather indicates that they continue to believe in the story that rates will rise and everything will be fine… and there will definitely be no SVB in Europe … well , we ‘ll wait )

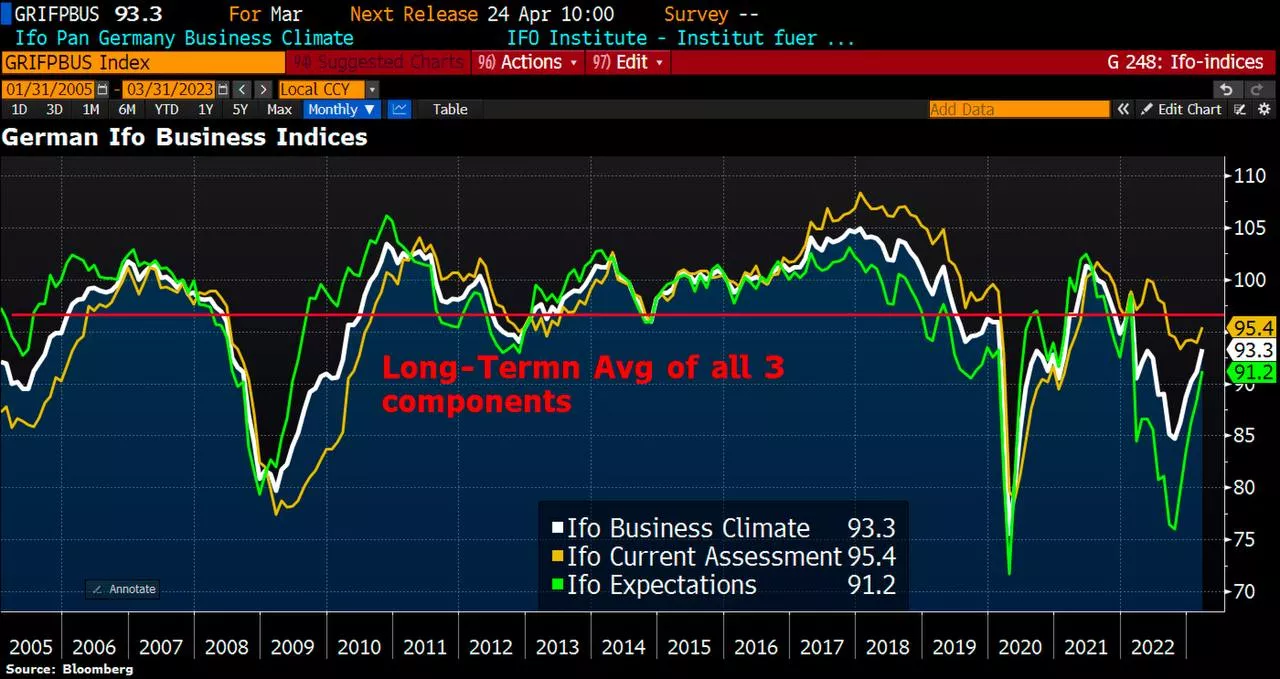

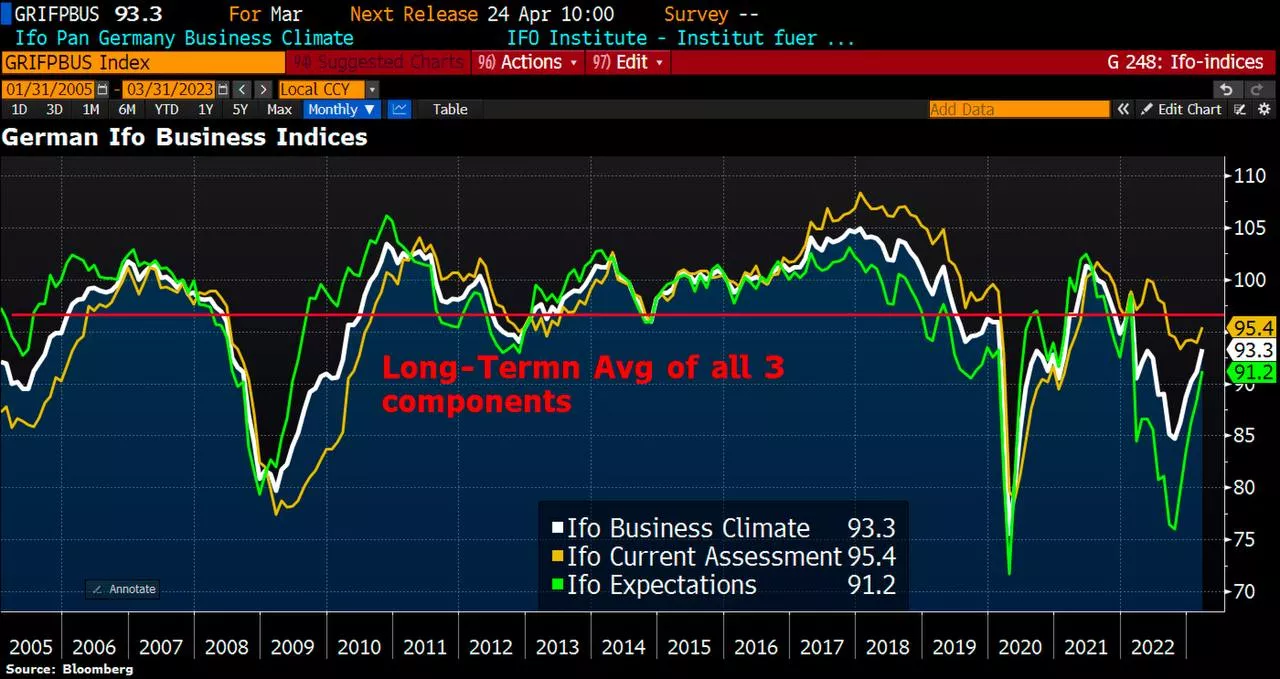

#germany #sentiment #recession #crisis #economy

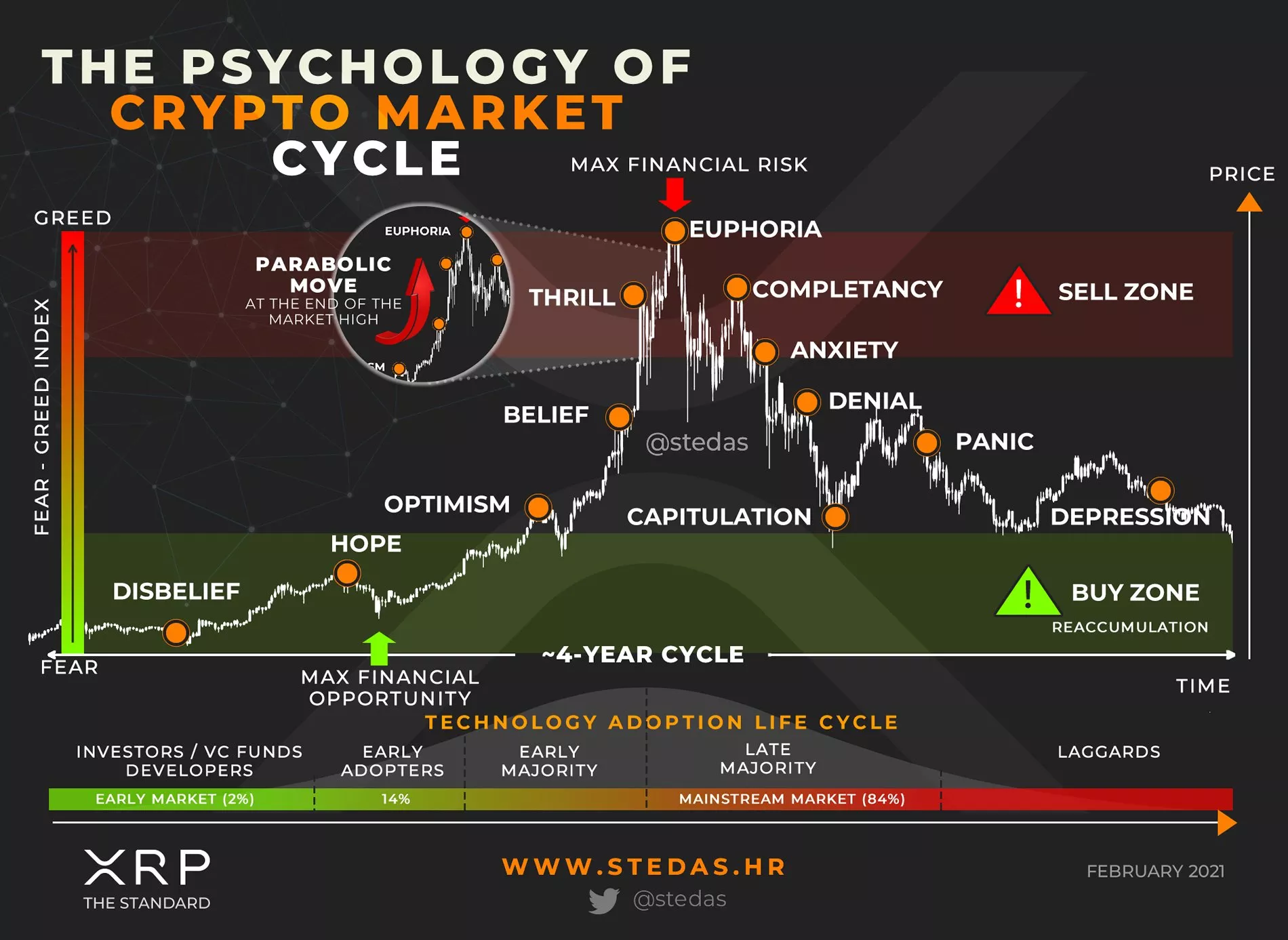

Despite the depressive information background associated with the ECB rate hike, high inflation, the likelihood of a recession and problems in the banking sector, a positive mood prevails in German business circles in March. However, it is worth remembering that the more expectations are inflated, the deeper the disappointments will be

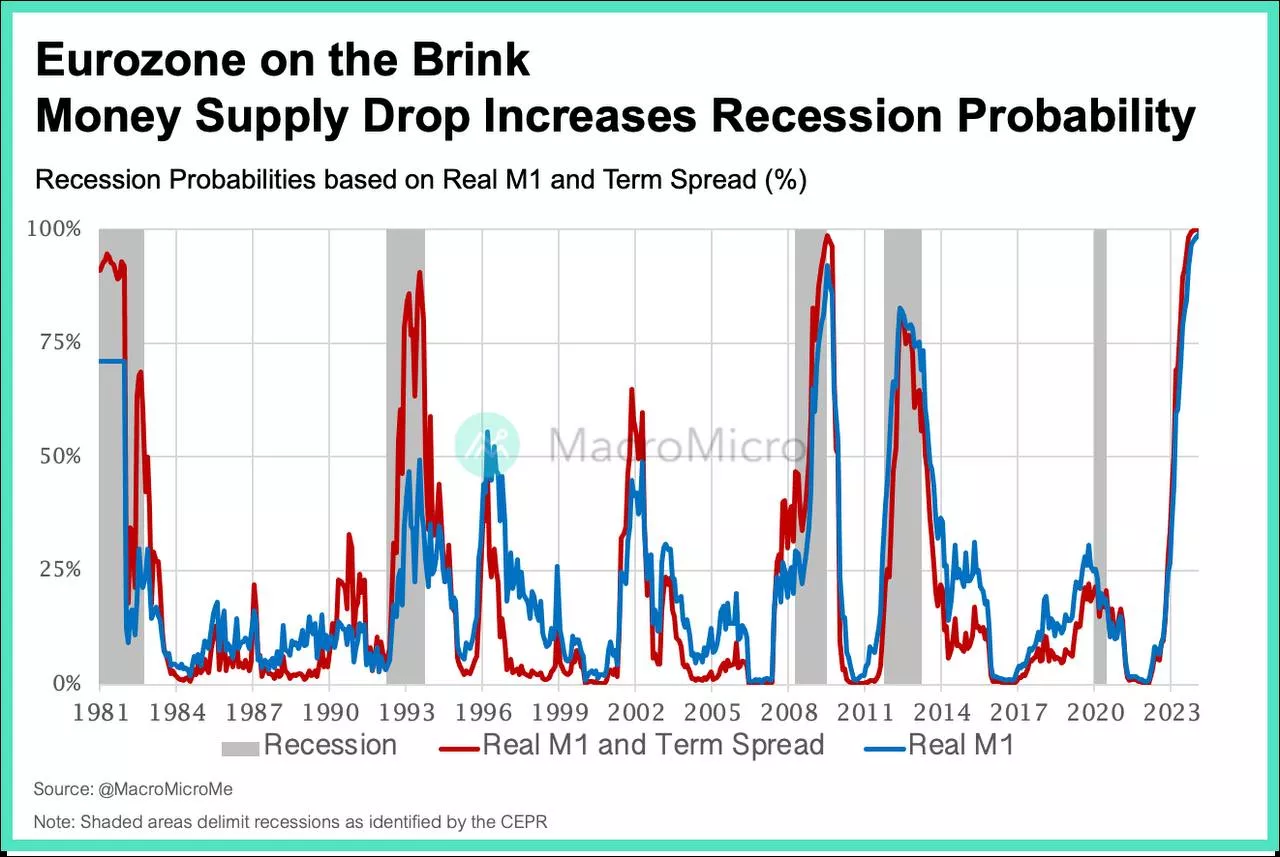

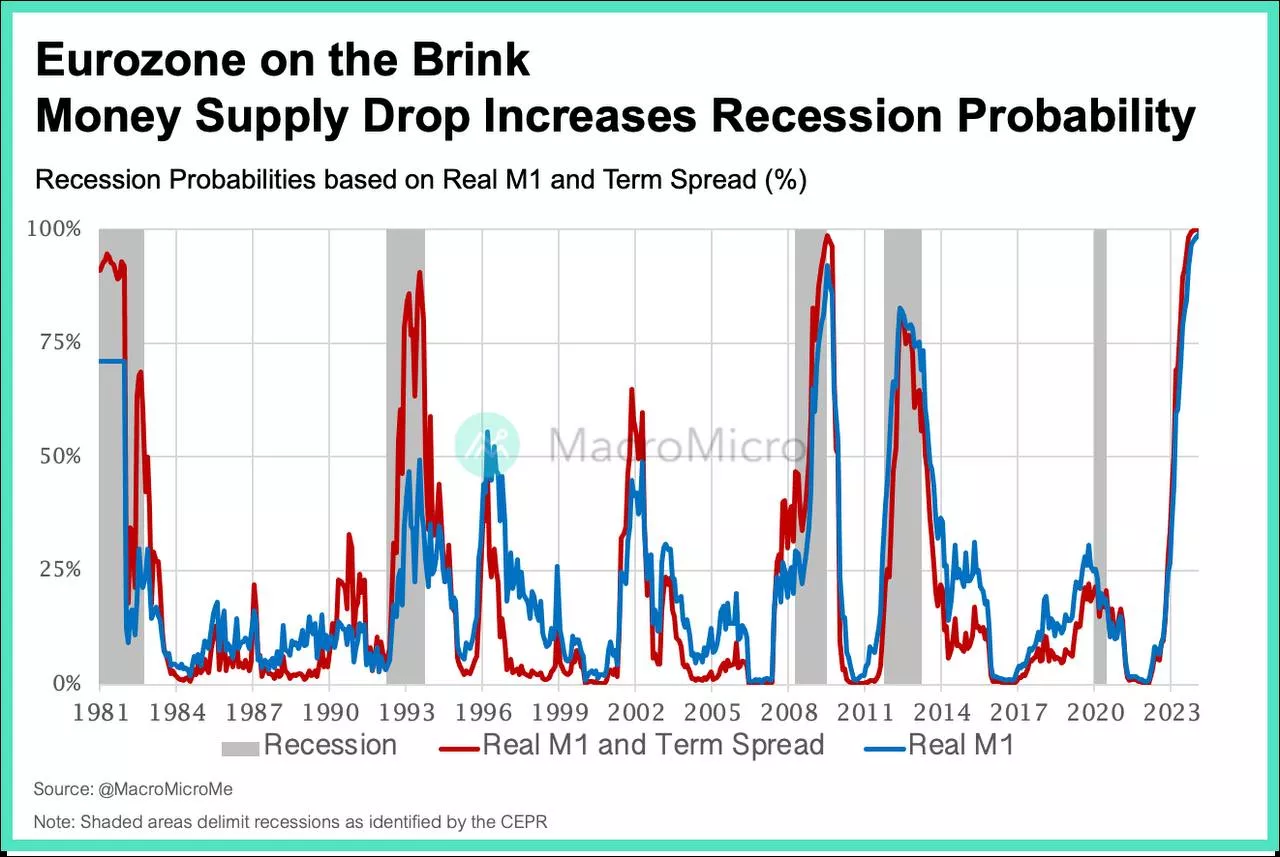

#recession #europe #ecb #rates #economy

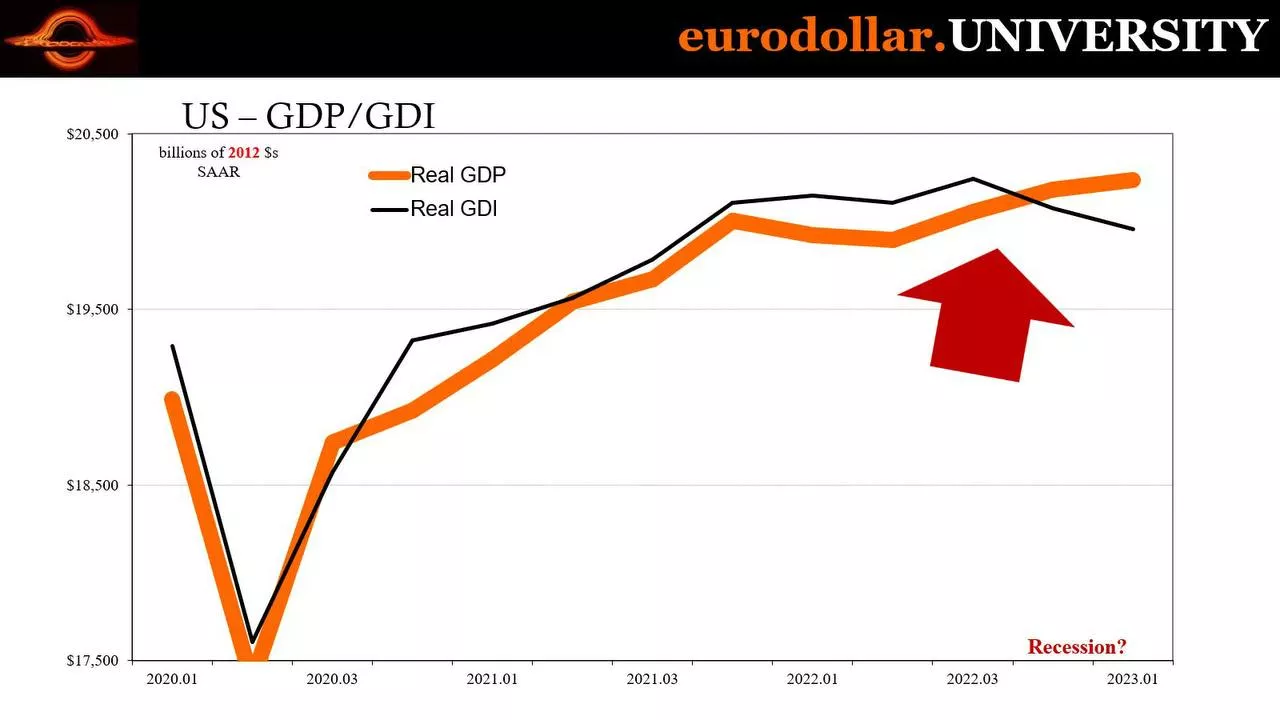

The MacroMicroMe team used the ECB 2019 model to estimate the likelihood of a recession in the EU. This model is based on the real money supply and the state of the yield curve. The results showed that the probability of a recession in Europe has reached 100%, which is an exceptional event over the past 40 years.

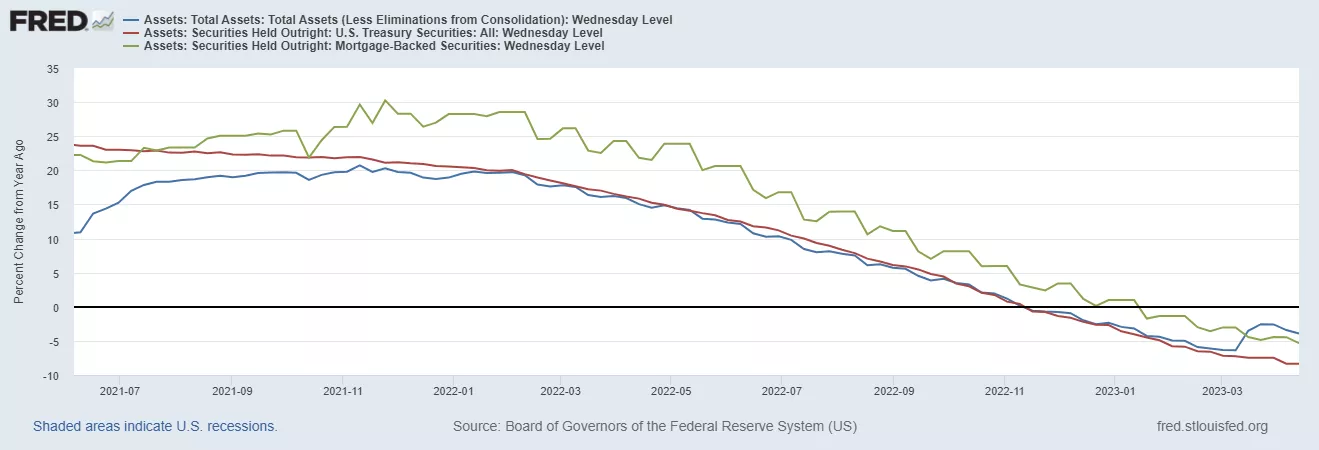

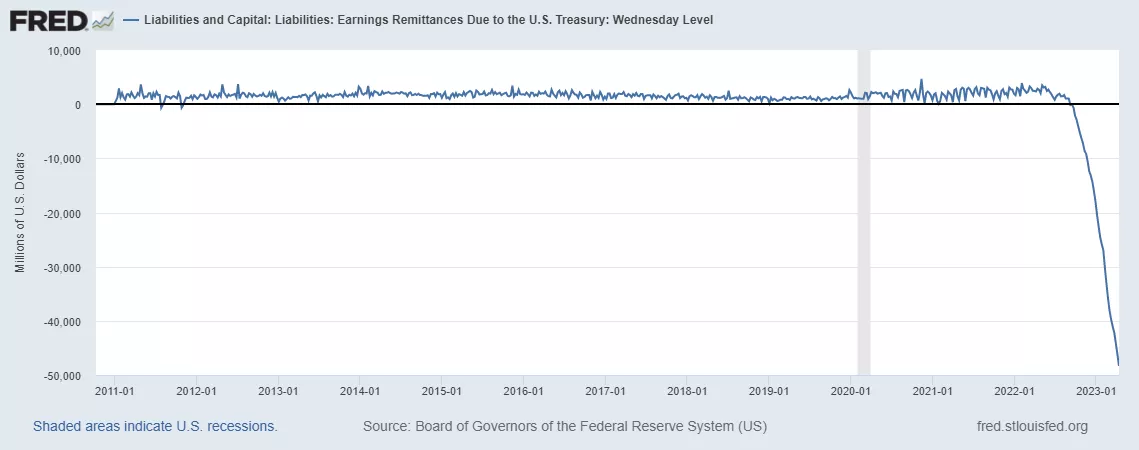

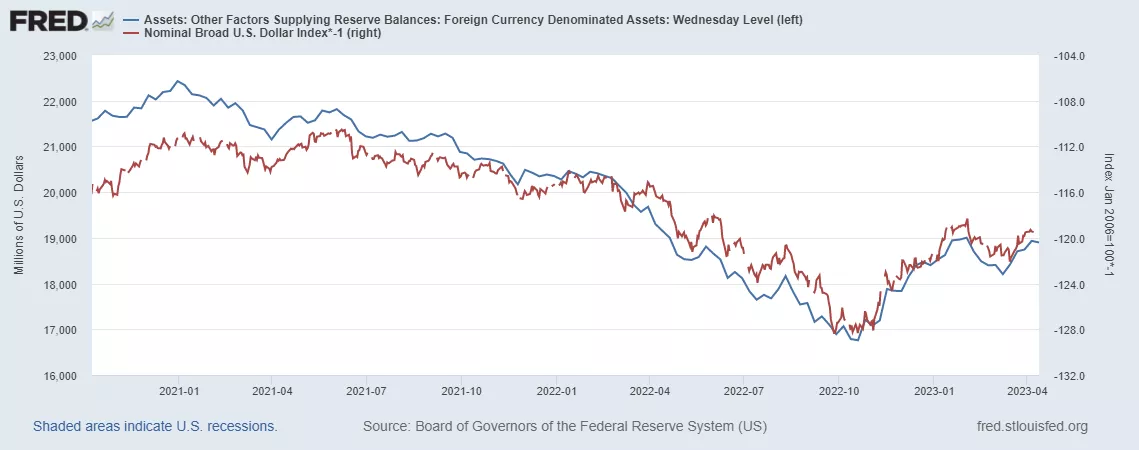

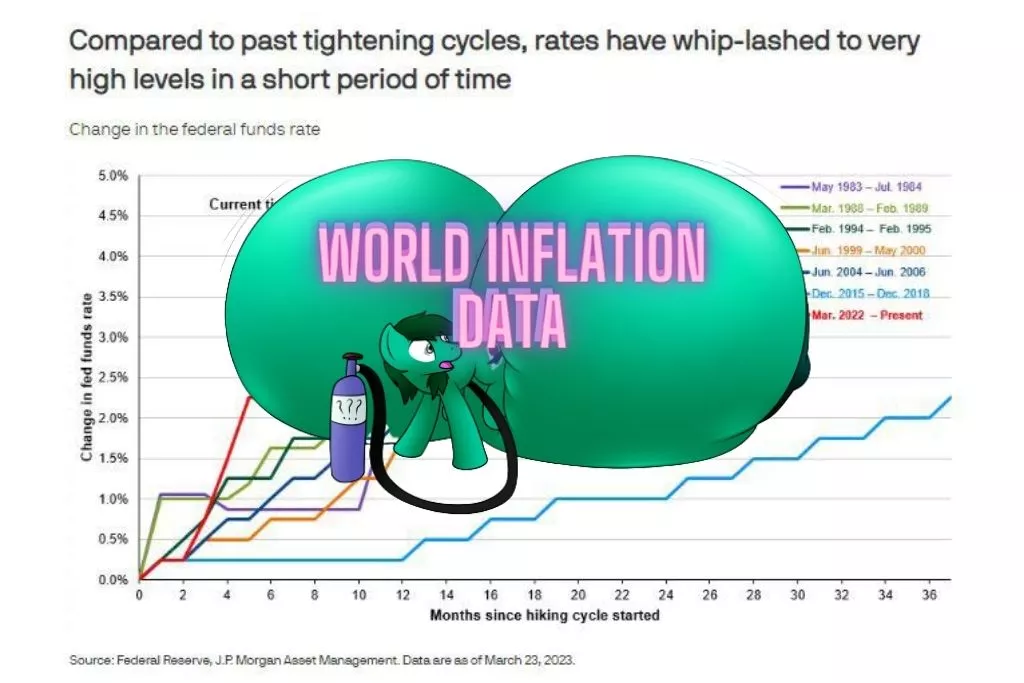

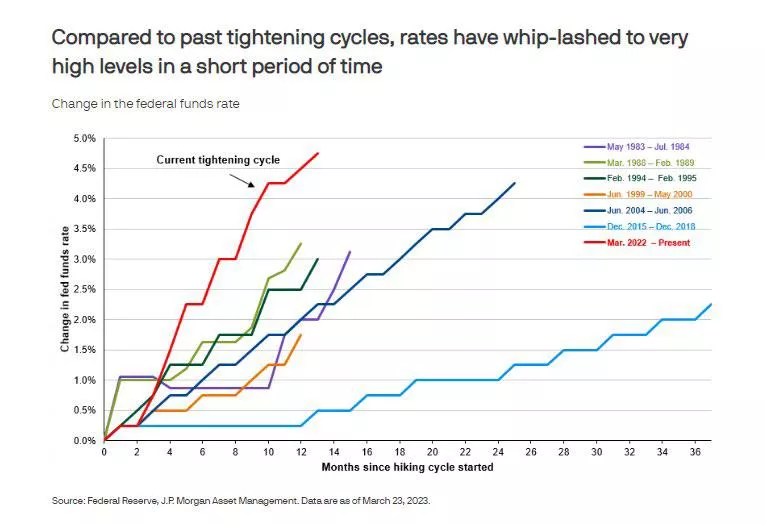

And remember: #Fed #rates #qt #prep #finance #economics

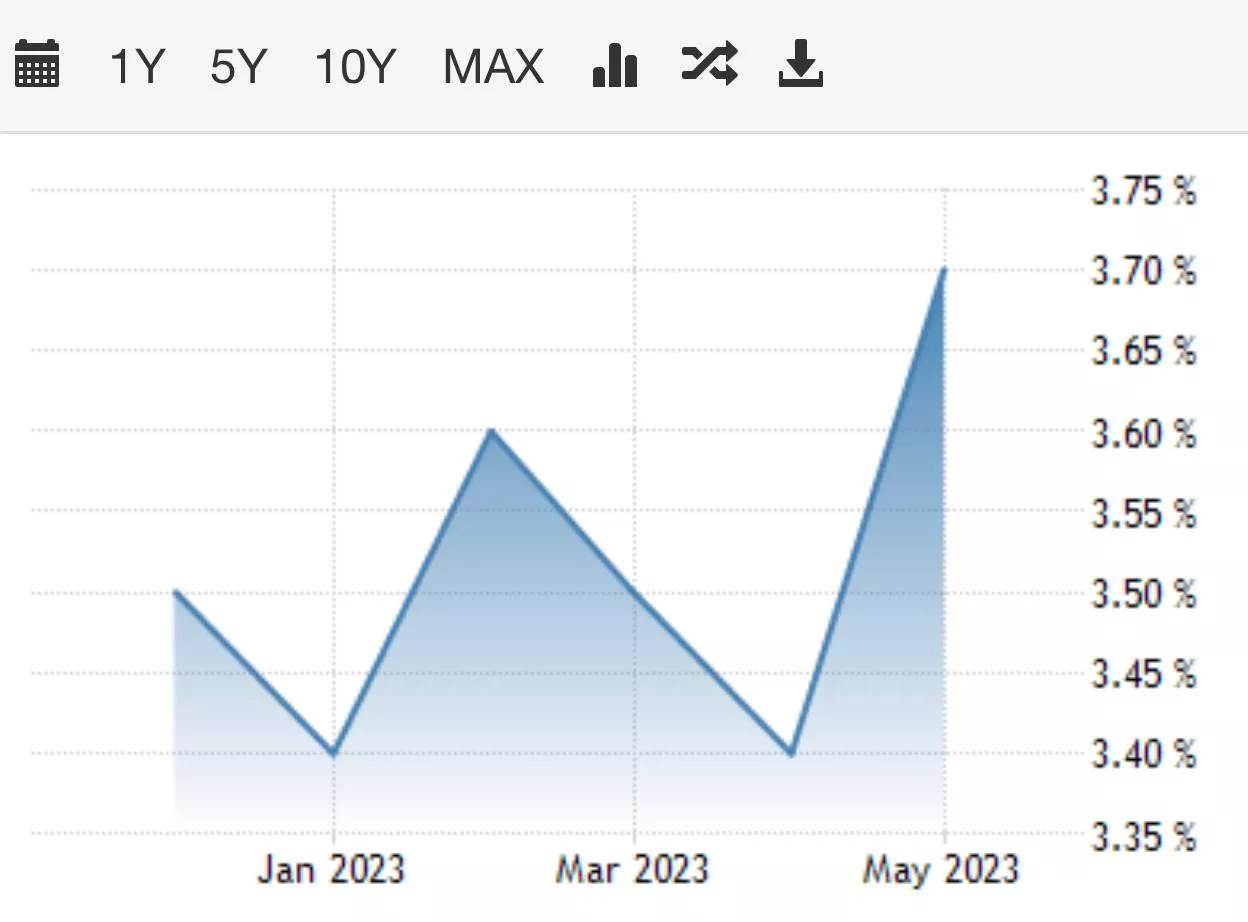

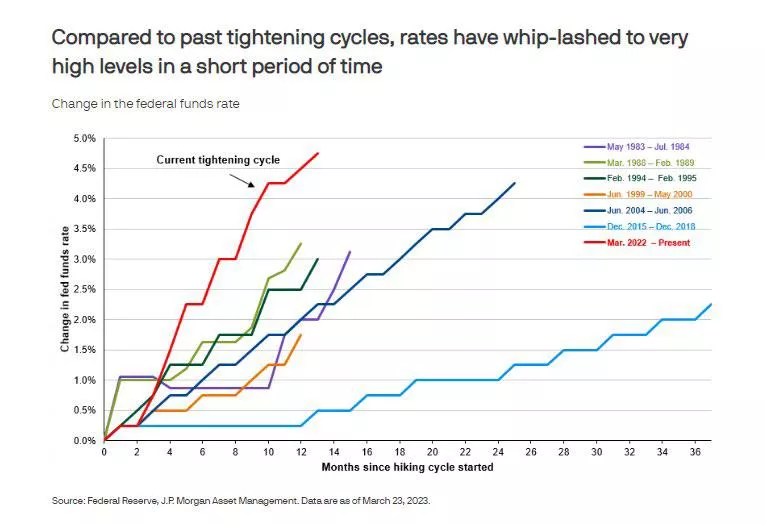

The Fed is in the toughest monetary policy tightening cycle since 1983: rates are rising faster and have reached historically high values, which is reflected in the red line on the chart.

However, the worst thing is that the financial system is already under stress, and inflationary pressure in the US economy remains stable. The monthly increase in core inflation corresponds to the average rate of the 80s of the last century, which indicates that even such a strict policy of the Fed is not able to effectively combat inflation. Moreover, business activity revived in March, which is a signal of sustained inflation. @ESG_Stock_Market