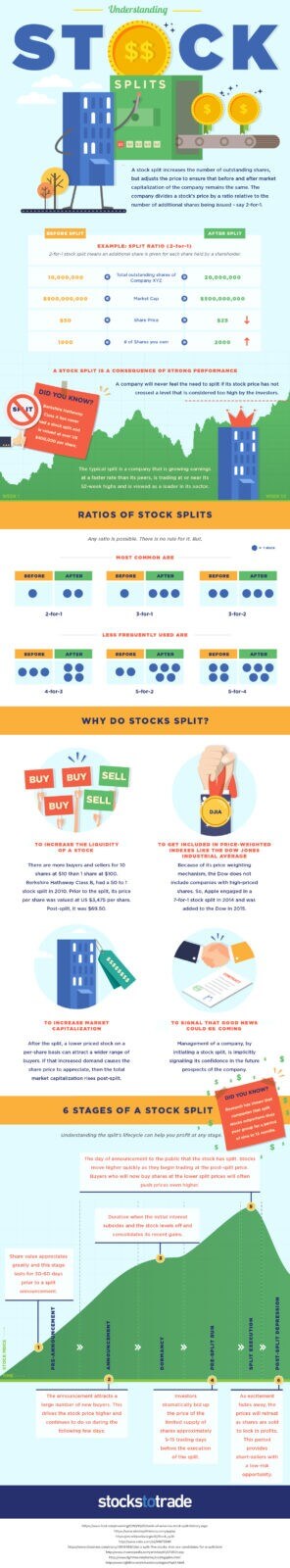

A visual guide to stock splits

Imagine a display case with large pieces of cheese.

If the cost of this cheese increases over time, the price may go beyond what most people are willing to pay. This creates a problem because the store wants to keep selling cheese and people still want to eat it.

The obvious solution is to split the cheese into smaller pieces. That way, more people can again afford to buy it in portions, and those who want more can just buy more smaller pieces.

The total volume of cheese has remained the same, only the portion size has changed. As the StocksToTrade infographic above shows , the same concept applies to stock splits.

Like wheels of cheese, stocks can be split in several ways. Some of the most common splits are 2-for-1, 3-for-1, and 3-for-2. There can also be less common splits, such as when Apple increased its outstanding shares by a ratio of 7-to-1 in 2014.

Why companies conduct stock splits

Of course, stocks are not cheese.

The real world of financial markets, driven by macro trends and buoyancy, is more complex than the items on display.

If companies want their stock price to keep rising, why would they crush it by actually lowering the price? Here are some specific reasons why:

1. liquidity.

As our cheese example shows, stocks can sometimes rise in price to the point where they are no longer available to a wide range of investors. Stock splits (i.e., making an individual stock cheaper) are an effective way to increase the total number of investors who can purchase shares.

2. sending a message.

In many cases, a stock split announcement is a precursor to a company’s prosperity. Nasdaq has found that companies that split their stock have performed better in the market . This is probably due to investor excitement and the fact that companies often split their stock as a growth period approaches.

3. Reduced capital expenditures.

Overpriced stocks have wider spreads than similar stocks. When spreads-the difference between supply and demand-are too wide, they eat into an investor’s income.

4. Index Eligibility

There are certain instances where a company may want to adjust its stock price to meet certain index requirements.

One example is the Dow Jones Industrial Average (DJIA), a well-known benchmark of 30 stocks. The Dow Jones Index is considered a price-weighted index, which means that the higher a company’s stock price, the more weight and influence it has in the index. Shortly after Apple did a 7-to-1 stock split in 2014, dropping its share price from about $650 to $90, the company was added to the DJIA index.

On the other hand, the company may decide to do a reverse stock split. This takes the existing number of shares owned by investors and replaces them with fewer shares at a higher price. In addition to the general stigma associated with a lower stock price, companies need to keep the price above a certain threshold or they can be delisted from the exchange.

Stock splits occur, but are not inevitable

Alphabet will become the latest major company to split its stock in early 2022. The company’s 20-to-1 stock split is aimed at making the share price more affordable for retail investors, dropping the price from about $2,750 to $140 per share.

Conversely, Berkshire Hathaway has never been known to split its stock. As a result, one share of BRK.A is worth more than $470,000. Warren Buffett, the legendary founder of Berkshire Hathaway, believes that stock splits run counter to his “buy and hold” investment philosophy.

@ESG_Stock_Market