Visualizing the state of global debt by country

Since COVID-19 began spreading around the world in 2020, the global economy has been put to the test: the supply chain has been disrupted, commodity prices have become volatile, labor market problems have arisen, and tourism income has declined. The World Bank estimates that the pandemic has pushed nearly 97 million people into extreme poverty.

To help in this difficult situation, world governments have been forced to increase their spending to cope with rising health care costs, unemployment, food insecurity and to help businesses survive. Countries took on new debt obligations to provide financial support for these measures, resulting in the highest level of global debt in half a century.

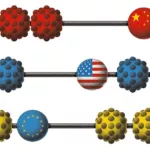

To analyze the extent of global debt, we gathered data on debt-to-GDP ratios by country from the IMF’s latest World Economic Outlook report.

Debt-to-GDP Ratio by Country: The 10 Most Indebted Countries

The debt-to-GDP ratio is a simple metric that compares a country’s public debt to its economic output. By comparing how much a country owes and how much it produces in a year, economists can estimate a country’s theoretical ability to pay its debt.

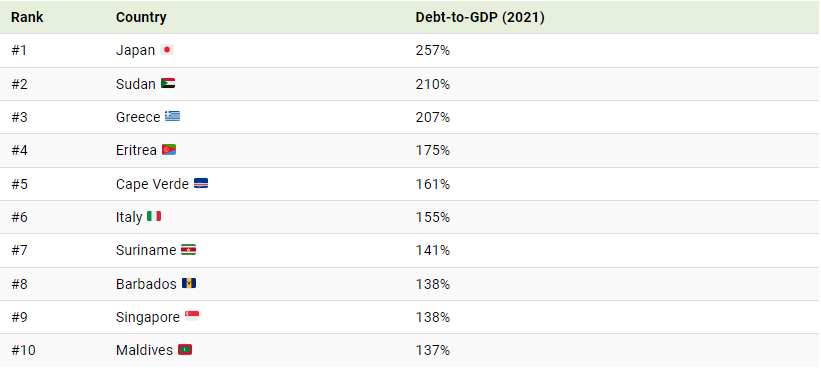

Let’s look at the top 10 countries in terms of debt-to-GDP ratio:

Japan, Sudan and Greece top the list with debt-to-GDP ratios well above 200%, followed by Eritrea (175%), Cape Verde (160%) and Italy (154%).

Japan’s debt level will not come as a surprise to many. In 2010 it became the first country to reach a debt-to-GDP ratio of 200%, and the figure is now 257%. To finance the new debt, the Japanese government issues bonds, which are mainly bought by the Bank of Japan.

By the end of 2020, the Bank of Japan owned 45% of outstanding government debt.

What is the main risk of a high debt-to-GDP ratio?

The rapid increase in government debt is a major cause for concern. As a general rule, the higher a country’s debt-to-GDP ratio, the more likely a country is to default on its debt, causing financial panic in the markets.

The World Bank published a study showing that countries with debt-to-GDP ratios above 77% over a long period of time have experienced economic recession.

COVID-19 exacerbated the debt crisis that has been brewing since the global recession of 2008. A report by the International Monetary Fund (IMF) shows that at least 100 countries will have to cut spending on health care, education and social protection. In addition, 30 countries in the developing world have a high level of debt crisis, which means that they are having great difficulty servicing their debts.

This crisis is hitting poor and middle-income countries harder than rich countries. Rich countries are borrowing to launch fiscal stimulus packages, while low- and middle-income countries cannot afford such measures, potentially leading to even greater global inequality.

IMF warns about interest rates

By the end of 2020, global debt reached $226 trillion, the largest annual increase since World War II.

Borrowing by governments accounted for just over half of the $28 trillion, bringing the world’s public debt ratio to a record 99 percent of GDP. As interest rates rise, IMF officials warn that higher interest rates will reduce the effects of fiscal spending and increase concerns about debt sustainability. “Risks will increase if global interest rates rise faster than expected and growth slows,” the officials write.

“Significant tightening of financial conditions will increase pressure on the most highly indebted governments, households, and companies. If the public and private sectors are forced to cut spending at the same time, growth prospects will suffer.”

#debt #gvp

@ESG_Stock_Market