THE EUPHORIA IN THE MARKET ABOUT THE DEAL MAY BE SHORT-LIVED: THE EMPLOYMENT REPORT AND THE FED’S DECISION ARE ON THE WAY

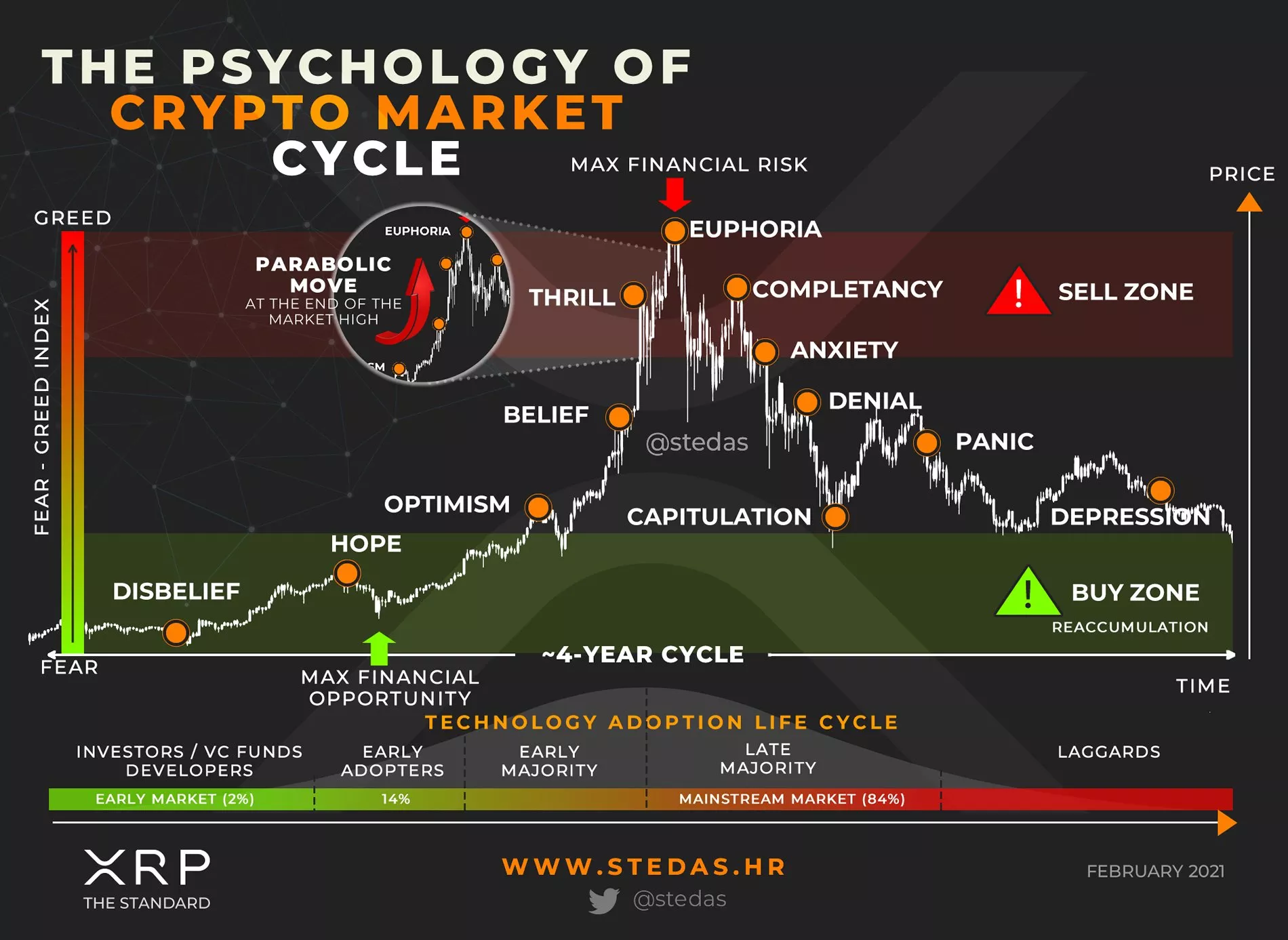

🇺🇸Although everything in Washington points to the conclusion of an agreement on raising the debt ceiling, Wall Street believes that the euphoria from such a deal has already passed or will be short-lived next week.

Similarly, as soon as the euphoria associated with Nvidia’s good forecast of $NVDA for the second quarter and enthusiasm for everything related to AI subsides, investors’ attention will switch to non-agricultural employment data for May, which will be released next Friday (according to Dow Jones estimates, 188,000 new workers are expected places) and the next Fed meeting on June 13-14.

To top it all off, June is usually a bad month for stocks anyway, regardless of what’s going on in Washington and speculation about the Fed’s decision.

“The reason why June is usually weak is that the reporting season is already coming to an end, which means that companies are relatively calm, which means investors depend mainly on political news,” said Jay Hatfield, CEO of Infrastructure Capital Management. “This year, the debt ceiling negotiations, the Fed’s hawkish comments and the banking crisis are looming on the market. It looks like there will be an agreement on the debt ceiling over the weekend, which should help the market stabilize.”

The problem for many on Wall Street is the dynamics of the S&P 500 Tech, which has grown by more than 5% this week; the Nasdaq Composite is ahead by 2.5%, and the S&P 500 is up by 0.3%, which may mask the non-obvious weakness of the market, which is growing only at the expense of certain assets. The S&P 500 indices of consumer goods, materials, healthcare and utilities declined 2.4%-3.2% this week, while the Dow Industrials index declined 1%.

“Although the S&P 500 is up 9.5% in 2023, only a few stocks are performing well. The number of stocks trading above their 200-day moving average has been falling since mid-April,” Liz Yang, head of investment strategy at SoFi, wrote on her blog on Thursday.

“The ‘summer rally’ in most years is the weakest rally of all four seasons,” Stock Trader’s Almanac says.

“Unfortunately, the market background “remains alarming and sets up for further sideways movement and a likely pullback or correction during the weak summer months, especially after mid-July in the worst two months of the year – August and September,” Jeffrey Hirsch, editor-in-chief of Stock Trader’s Almanac, wrote on Thursday. @ESG_Stock_Market